How To Answer a Texas Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you have a debt collection lawsuit filed against you in Texas, you will be notified with a summons and complaint. After receiving those notices, you need to file your response (answer) to the summons within 14 days if you are served through the justice courts. Most debt collection lawsuits in Texas are filed in a justice court.

File this paperwork at the court listed in the summons, deliver a copy to the plaintiff (the debt collector suing you), and exchange information with the plaintiff.

Written by Upsolve Team.

Updated January 16, 2026

Table of Contents

How Do Debt Collection Lawsuits in Texas Work?

Debt can come at you fast. If you fall behind on your payments, your debt may end up in collections. If you ignore those collection efforts, the debt collector may decide to bring a debt collection lawsuit against you.

You will be notified that a debt collection lawsuit has been filed against you when you receive a summons and complaint.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped over 340,000 respond to debt lawsuits and settle debts for less.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

What Is a Summons and Complaint?

If a debt collector files a lawsuit against you, you will receive a summons and complaint. The summons is a document issued by the court that tells you a lawsuit has been filed against you. The summons will include the deadline to respond to the complaint, and it will list the court overseeing your case.

The complaint details the allegations, or claims, that the plaintiff (the person suing you) is making against you. In a debt collection lawsuit, this usually means claims about your debt, when the last payment was made, and how much the debt collector believes you currently owe.

The complaint will also say what the debt collector wants from the court to resolve the issue. Usually, this is a court order called a money judgment. The judgment will be a total of the debt they believe you owe, plus any interest that has accrued, legal fees, or other costs the plaintiff believes you should cover.

How Do You Respond to a Texas Court Summons for Debt Collection?

If a debt collector sues you in the state of Texas, you need to take action. First, fill out and file your answer form — this is your response to the lawsuit. Then, provide a copy of the filed (stamped) forms to the plaintiff (the debt collector) and keep a copy for your own records.

There are many different kinds of courts in Texas. Justice courts are the typical venue for most debt collection lawsuits. This article primarily addresses the rules and procedures for lawsuits in justice court. Rarely, a lawsuit may be heard in a district or county court. You can always verify which court is hearing your case by looking at the official court summons you receive.

Upsolve Member Experiences

4,642+ Members OnlineHow Do You Fill Out an Answer Form?

You can generate your answer form without a lawyer in two ways:

Use E-File Texas, answer questions online, and have your forms generated for free.

Use a template from Texas Law Help and fill in your responses on the computer, or print the form and fill it out by hand.

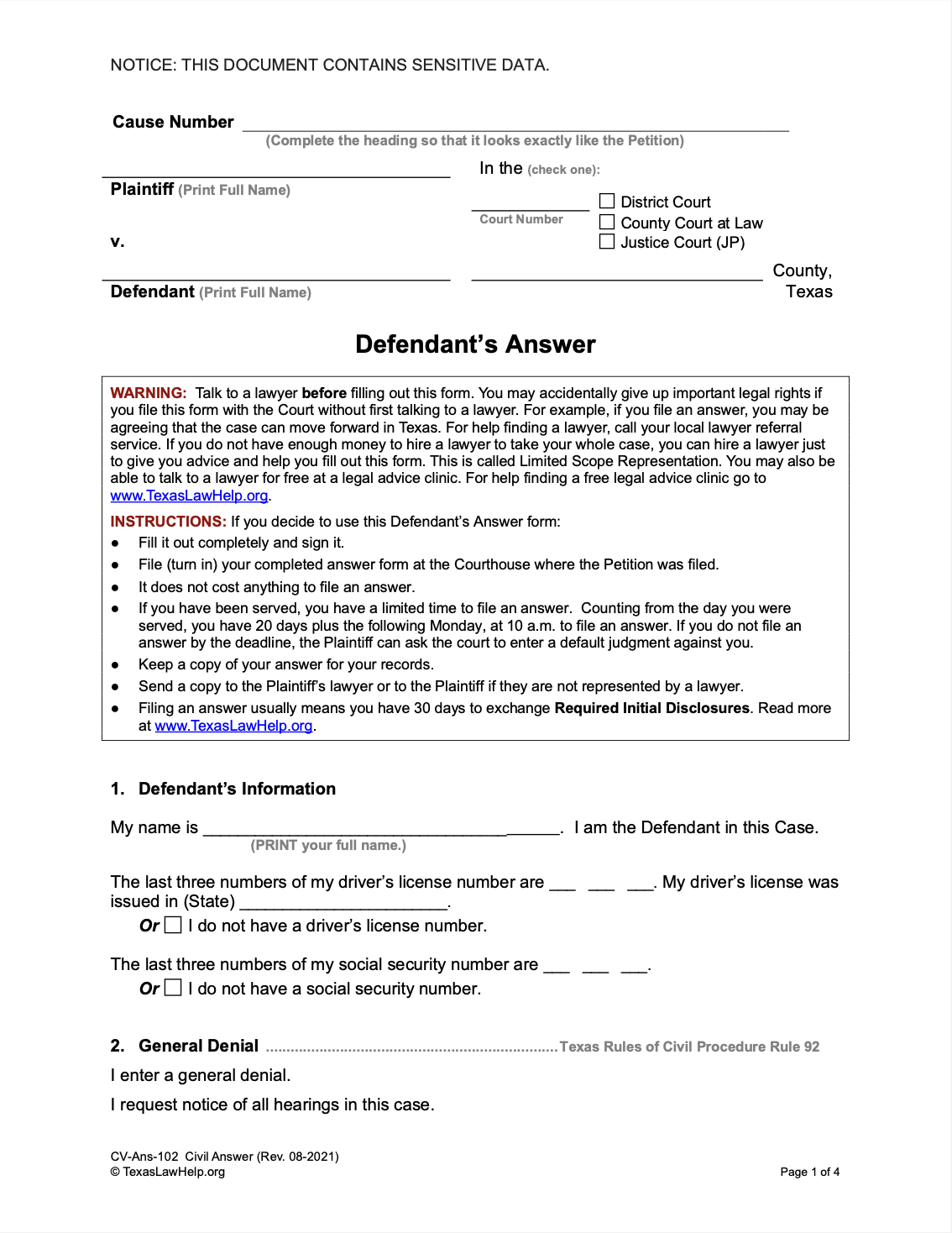

Here’s what the first page of the answer form from Texas Law Help looks like:

Step 1: Deny or Verify the Pleas From the Complaint

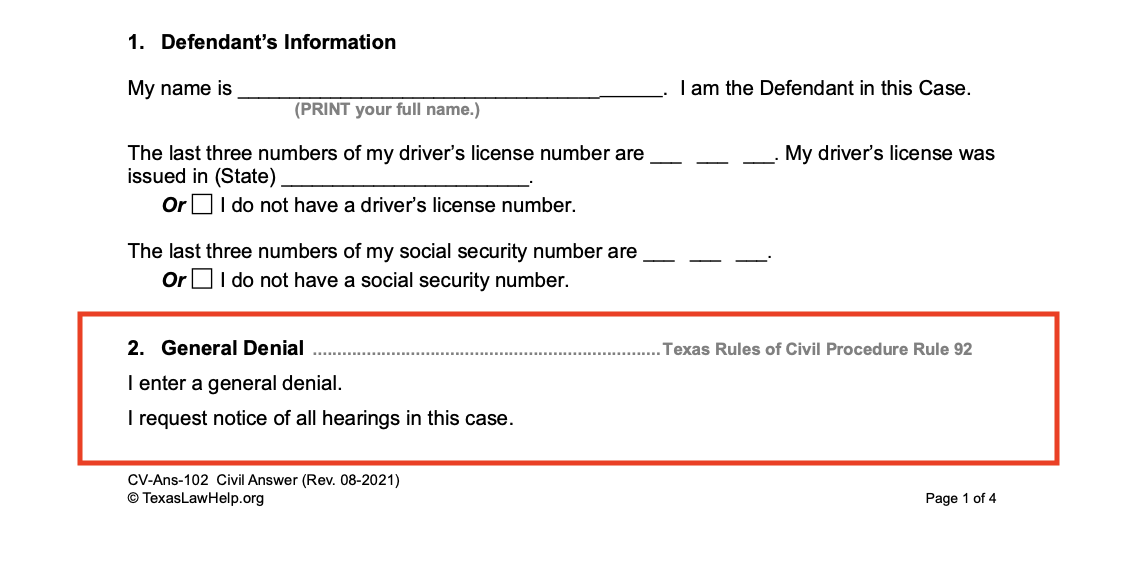

Texas allows for general denial in Texas State Court cases. If you select “I enter a general denial” on your answer form, you deny (or disagree) with the entire case brought against you. This means you disagree with every claim that was listed on the complaint.

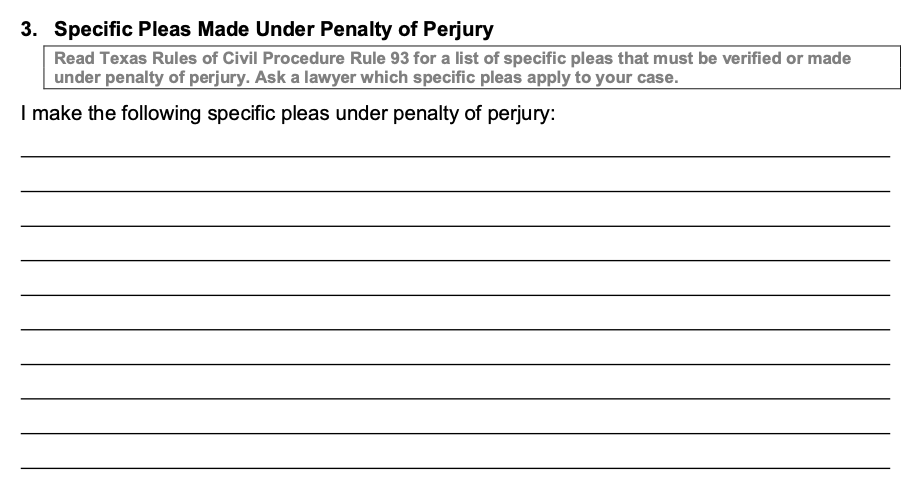

You will then move on to the Specific Pleas section. This is where you respond to the specific claims outlined in the complaint. You will either agree, disagree, or claim “no knowledge” in response to each item on the complaint.

Remember, when you sign your form, you are confirming all information — including your specific pleas — is true under “penalty of perjury.” This means you cannot knowingly lie or you may face legal consequences.

Step 2: Raise Your Defenses and Counterclaims

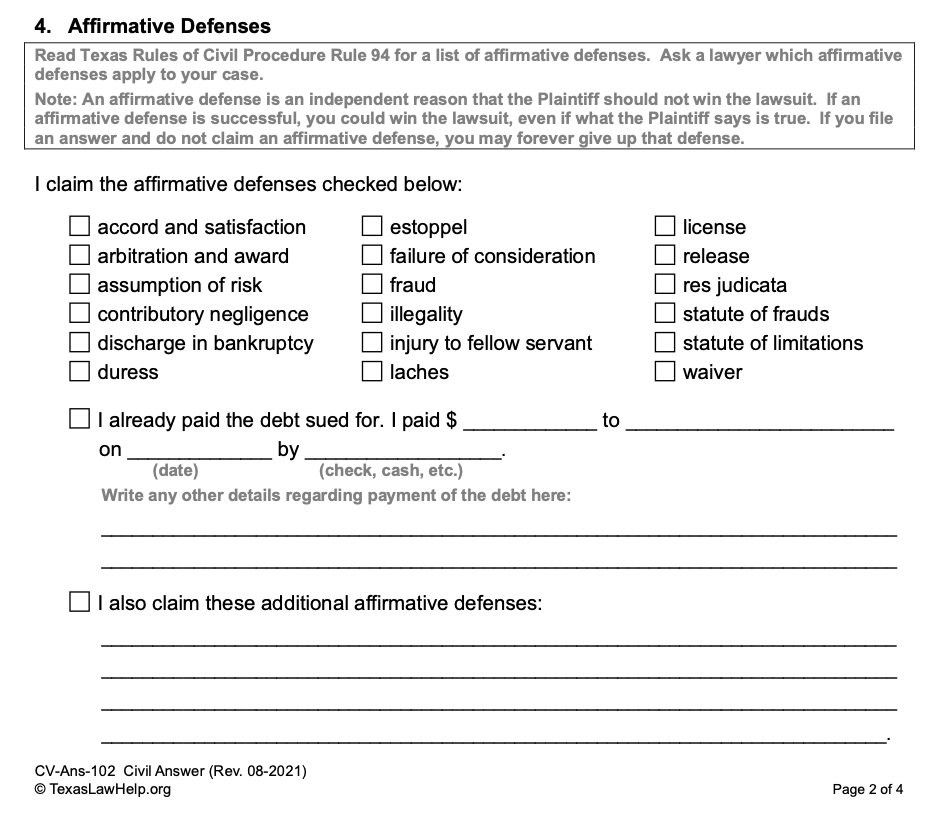

You will then have the opportunity to raise any defenses you have in the “Affirmative Defenses” section. An affirmative defense is any reason(s) that the plaintiff (the collector suing you) should lose the case.

One common example is that the debt is too old because the statute of limitations has run out. You can learn more about affirmative defenses from Texas Law Help. This resource explains each of the affirmative defenses listed in the form below.

If you have a defense and you’re not sure if it’s one of the listed defenses, you can write it in your own words and include an explanation in the space below. For example, you could say that the debt collector has identified you as owning the debt but that you aren’t the debt owner.

It’s important to raise any affirmative defenses in your answer. If you don’t, you can’t bring them up later. If you don’t feel confident doing this yourself, you can look for free or low-cost legal help in your area. Check the resources at the bottom of the article to learn more.

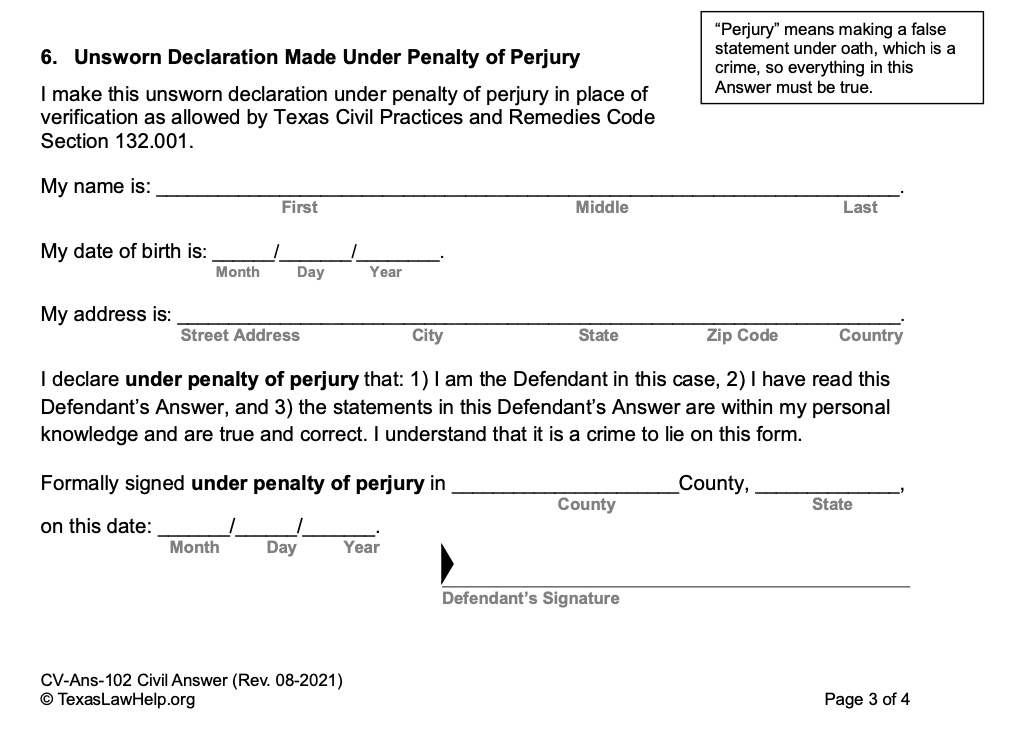

Step 3: Sign the Unsworn Declaration

When you sign in the “Unsworn Declaration” section, you are promising that everything in your answer form is true and accurate. When signing the declaration, you are under penalty of perjury, meaning if you sign the declaration knowing any information is false or misleading, you are breaking the law and can face legal consequences.

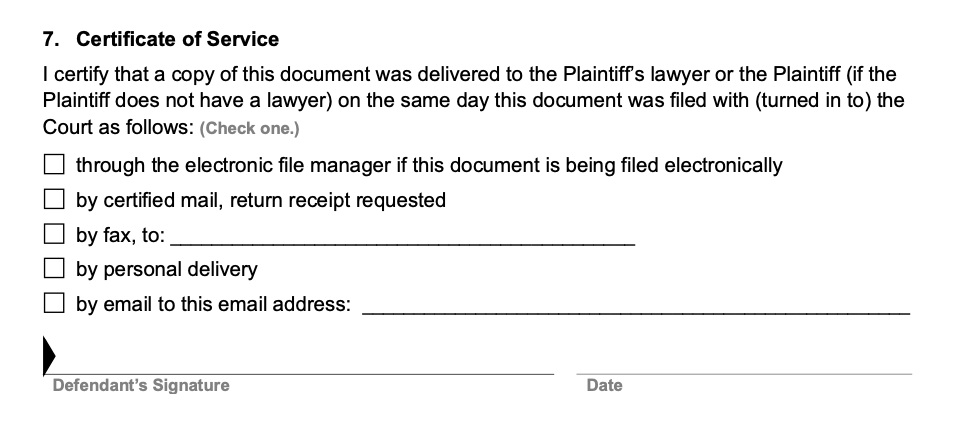

Step 4: Fill Out the Certificate of Service

Lastly, you will fill out the “Certificate of Service” section of the answer form. This is where you state (or certify) that you will deliver a court-stamped copy of the answer form to the plaintiff (debt collector) or their lawyer if they have one.

As you can see below, you can deliver the answer form in a few ways, including filing it electronically, sending it via certified mail, faxing it, delivering it in person, or emailing it to the plaintiff or their lawyer.

Step 5: File Your Forms With the Justice Court Clerk Within 14 Days

In Texas, if your case is being handled by the Justice Court, you need to respond within 14 days. Most debt collection cases are heard in Justice Court. If your case is heard in a district or county court, you have 20 days plus the following Monday at 10 a.m. to answer your court summons.

You will want to bring at least three copies — one for you, one for the court, and one for the plaintiff.

If you e-filed, simply follow the online instructions after completing the online answer form. For more guidance, Texas Law Help has a helpful How to E-File Guide.

If you are filing in person, you will file with the same district clerk’s office you were served from. It’s a good idea to ask the clerk about any local rules or procedures you should know about.

The clerk will stamp your forms, deeming your answer officially filed. You will then serve a copy of the stamped forms to the plaintiff.

Step 6: Serve a Copy of the Answer on the Plaintiff

After getting your forms filed and stamped, you will need to “serve” the plaintiff or their lawyer if they have one. “Serving” them simply means you give them a copy of the official stamped answer form.

In Texas, you can serve them in person, by email, by mail (or by commercial delivery service), or by fax. If you e-filed your answer form, the plaintiff will be served electronically using the electronic filing manager.

What Happens After You Respond to the Lawsuit?

After you respond to the lawsuit, keep an eye out for notices from the court and be sure to follow any instructions you receive. This includes showing up to any scheduled hearings or appearances.

How To Prepare for Court Appearances

Going to court can be intimidating, but preparing yourself ahead of time can ease your stress.

According to Texas Law Help, the best ways to prepare for court in Texas are:

Preparing and organizing your documents and records beforehand

Arriving early to the courthouse (to give time for security and parking)

Treating it like a job interview (dressing and acting appropriately)

You can learn more about what to expect at the courthouse and how to prepare for your appearance in Texas Law Help’s Tips for the Courtroom article.

What Happens if You Don’t Respond to the Lawsuit?

Responding to a lawsuit is the most important thing you can do. If you choose to ignore a lawsuit, there is a good chance you will lose the case by default, leading to the judge issuing a default judgment against you.

A default judgment is a court order that allows the person or company suing you to request orders such as a wage garnishment, a bank account levy, or a property lien.

Debt collectors count on you not showing up to court or not responding to the lawsuit. They want an easy win. If you don’t take action, you hand them that opportunity. By simply responding to the lawsuit, you give yourself a fighting chance to win the debt collection lawsuit.

If you’ve already had a default judgment ordered against you, you can file a motion to vacate the judgment. To vacate the judgment means to cancel the judgment. You can do so by submitting an official request with the court you were served from. This process can be difficult to navigate, so seek legal help as needed.

✨ If a creditor has a judgment against you, you might still be able to get rid of that debt through bankruptcy. Upsolve’s free tool is designed to help people with simple Chapter 7 cases file without a lawyer. It just takes two minutes to see if you're eligible.

Need Legal Help?

The Texas State Law Library Debt Collection Guide details your rights under Texas state law when dealing with debt collectors.

Texas Law Help provides free legal information including “How To Guides,” like their How to File an Answer Guide.

Texas Judicial Branch has a list of legal aid resources for Texans, such as their Lawyer Referral Service and their general legal services referral directory.

SoloSuit is an online service that can help you respond to a debt lawsuit in about 15 minutes. They charge a small fee but have a money-back guarantee.