How To Respond to a New Jersey Debt Collection Lawsuit

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you’re sued for a debt in New Jersey, you’ll be notified with a court summons and complaint. These are official forms that tell you you’re being sued and what you’re being sued for. It’s important to respond by filing an Answer form with the court within 35 days. Otherwise, you can lose for not responding, which can lead to wage garnishment. You don’t have to hire a lawyer to successfully fight a debt lawsuit.

Written by Upsolve Team.

Updated August 25, 2025

Table of Contents

How Do Debt Collection Lawsuits in New Jersey Work?

If you haven’t responded to a creditor or debt collector’s attempts to reach you for a debt they think you owe, you may eventually be notified that they’ve brought a debt collection lawsuit against you.

📄 The court document that notifies you of a lawsuit is called a summons. It’s accompanied by another document called a complaint.

🏛️ In New Jersey, debt collection lawsuits are usually heard in a Superior Court, which has different parts (or divisions) for civil cases:

If you’re sued for $5,000 or less, your case will likely be heard as a small claims case (Special Civil Part, Small Claims).

If you’re sued for $5,000 to $20,000, your case will be heard in a Special Civil Part of your local Superior Court.

This matters because the processes discussed below can vary slightly based on the type of court (part) your case is heard in.

Try not to get too hung up on the language and different courts.

The court hearing your case will be listed in the summons, which also usually includes specific instructions on what you need to do next. Always read the information on the court documents and don’t hesitate to contact the court clerk if you need clarification on court forms or processes.

What Is a Summons and Complaint?

A summons is an official court document notifying you of a lawsuit against you. It essentially tells you that you’re being sued. A complaint accompanies the summons and includes a list of claims against you. Essentially, it tells you why you’re being sued.

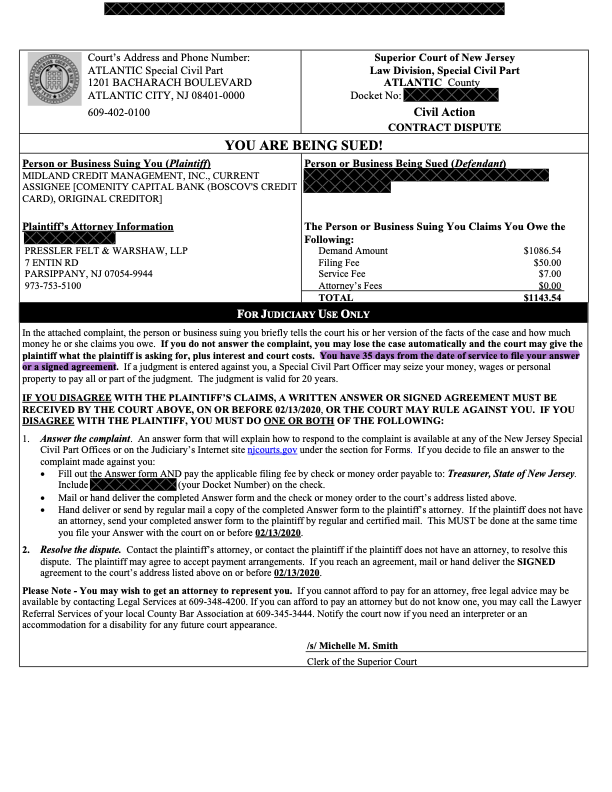

In New Jersey, the summons will include important information, such as:

Who is suing you (and who is representing them, if they have a lawyer)

How much you’re being sued for

The name and address of the court hearing your case

The docket number for the case

Instructions about what to do next

The deadline to respond to the summons

Here’s a redacted version of an actual New Jersey court summons for a recent debt collection lawsuit:

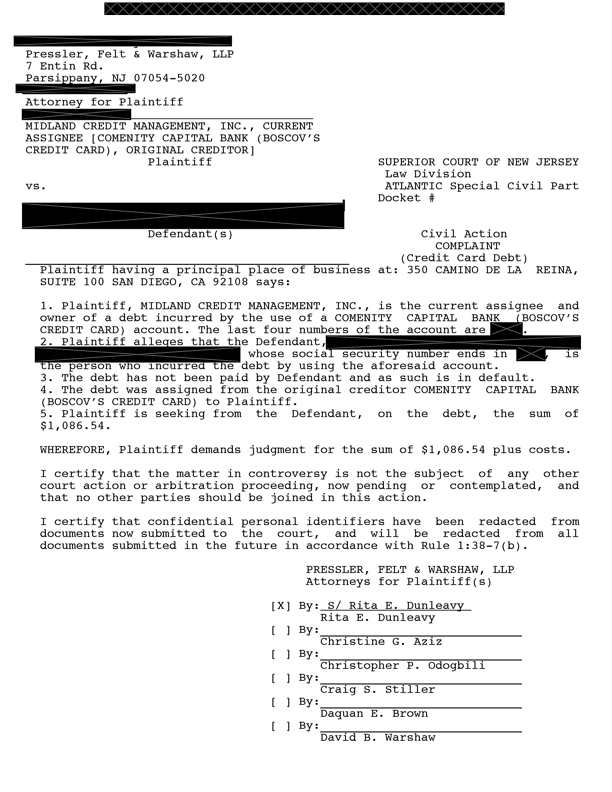

The complaint will explain the plaintiff’s (the person suing you) claims against you in numbered paragraphs. It will also include the amount of debt they say you owe and what they’re requesting from the court. They usually request a court order called a judgment.

Here’s what an actual (redacted) complaint from a recent case looks like:

How Do You Respond to a New Jersey Court Summons for Debt Collection?

As mentioned earlier, the way you need to respond to the court summons you receive should be outlined in the summons itself. What follows are general instructions for responding to a debt collection lawsuit in New Jersey.

This should help you get a sense of how the process usually works and will point you to further resources that can help you figure out what you need to do for your specific situation.

The New Jersey Courts site has excellent information about how to defend yourself in a small claims lawsuit. In New Jersey, you have 35 days to file your answer with the court.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft an answer letter for a small fee using SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

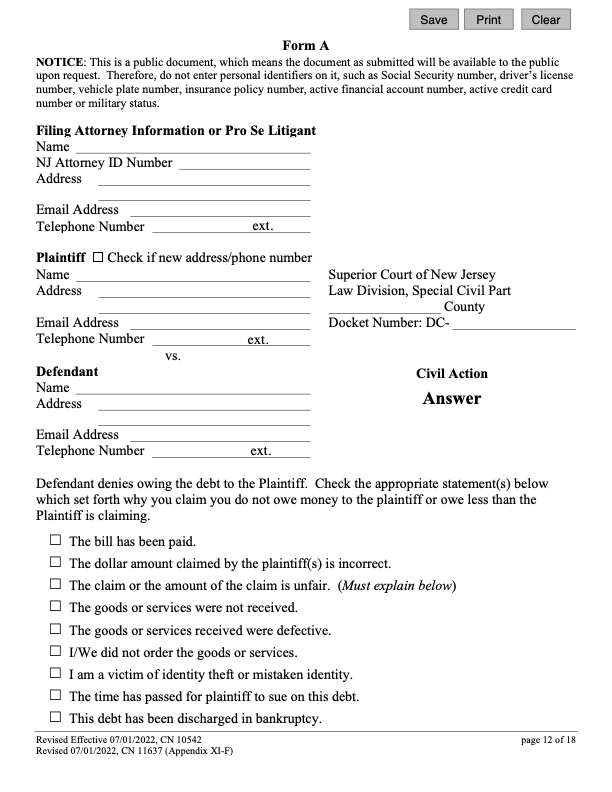

Step 1: Fill Out an Answer Form

New Jersey has done an excellent job of providing informational packets to guide people who are responding to a debt collection lawsuit on their own without a lawyer. The court’s How To Answer a Civil Complaint packet is thorough, easy to read, and includes a template for the forms you need to file your response.

The form you need is called an Answer form. Here’s what the first page of the New Jersey Answer form for a debt collection suit looks like:

As you can see, the form requires you to list the name and contact information for the filing attorney or pro se litigant, the plaintiff, and the defendant.

Filing attorney or pro se litigant: If you are representing yourself, you are considered a “pro se litigant,” so you’d like your name and contact information here. If you hire an attorney, they’ll fill out this form for you.

Plaintiff: This is the agency or person who owns the debt. They should also be listed on the summons or complaint.

Defendant: This is the person being sued. In this case, you.

You should also fill in the name of the county and docket number for your case. This can be found on the summons you received.

You can download and print a copy of the answer form. It starts on pg. 12 of the court's packet.

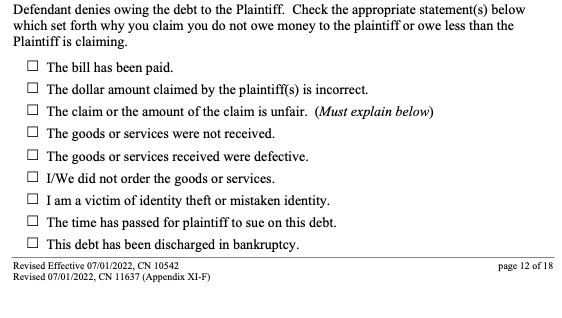

Step 2: Check the Box(es) Relevant to Your Defense

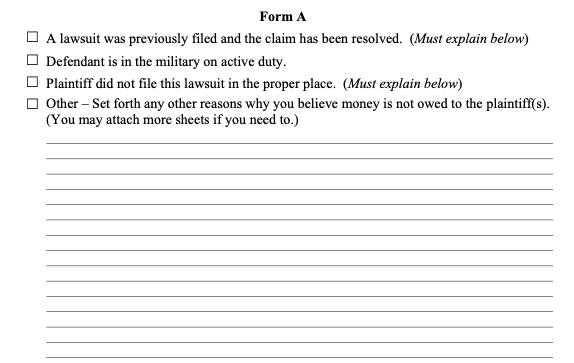

The next thing on the answer form is a list of statements that may explain why you don’t think you owe the debt. You may hear these referred to as affirmative defenses.

The list of defenses begins at the end of the first page of Form A (Answer form) and continues on the second page. Read each statement carefully and check any statements that apply to you in your case.

Some statements require further explanation, and there is a space provided for your explanation. You can also attach additional sheets or information to support your claim.

You can also check the “Other” box if you have a defense that isn’t listed. Note that simply being unable to pay the debt is not a defense.

Affirmative defenses may be related to violations of the federal Fair Debt Collection Practices Act (FDCPA) or state laws like the statute of limitations. Read our Guide to New Jersey Debt Collection Laws to learn more.

What if You Want To Bring a Counterclaim?

If you want to bring a counterclaim against the person suing you, you have the right to do so. But you can’t use the forms presented above to file a counterclaim.

If you want to bring a countersuit, it’s best to seek legal help, as the process is more complicated than simply answering the lawsuit and defending yourself.

Step 4: File and Serve Your Answer Within 35 Days

Make at least three copies of your answer form. You’ll need one to serve on (deliver to) the plaintiff, one to file with the court clerk, and one for your records.

How To Deliver Your Answer on the Plaintiff

New Jersey has simple rules for service. Service is the legal term for properly delivering court documents to the other party in the court case.

To properly serve a copy of your answer on the plaintiff, all you need to do is mail them a copy. You can mail the form using certified mail if you want to have proof that you sent the form. If the plaintiff doesn't have a lawyer, the court requires you serve the plaintiff by certified and regular mail.

How To File Your Answer With the Court

You can file your answer with the court in a few ways:

Upload the form electronically using the court’s Judiciary Electronic Document Submission (JED). (This does not work on mobile devices; must use a computer or laptop.)

Mail the form using certified mail to the address listed on the summons

Take the form in person to the courthouse and file them with the court clerk

In New Jersey, there is a $30 filing fee to file your answer form with the court. If you can’t afford to pay the fee, you can file a fee waiver form. It’s important to file this form at the same time you file your Answer. Otherwise, the court may mark your forms as received but not filed, which can delay your case.

Upsolve Member Experiences

4,642+ Members OnlineWhat Happens After You Respond to the Lawsuit?

After you file your Answer, you should get a notice from the court that has a trial date. If you can’t attend on the date listed, it’s important to contact the court as soon as possible to let them know.

If you don’t show up for court, the judge is likely to enter a default judgment against you. This means you lose because you didn’t show up to tell your side of the story.

At some point, the plaintiff (the person suing you) might also send you a list of questions. This is called interrogatories. You need to answer the questions within 30 days and send your response back to the plaintiff.

How To Prepare for Court Appearances

The New Jersey Courts site has helpful information on preparing for trial.

Here are a few things to know. Before the trial, gather any documents you have that support what you wrote in your Answer. This could include receipts, bank statements, credit card statements, canceled checks, phone logs detailing phone calls with debt collectors, contracts, written correspondence, or any other documents that help you prove your case. You need to submit a copy of these documents to the court prior to the trial. You can upload them electronically or send them via mail.

Be prepared to attend a settlement conference prior to your trial. This is a meeting facilitated by a trained third-party mediator to try to come to an agreement without going to trial. If you can’t come to an agreement during the settlement conference, your case will proceed — usually the same day — to trial.

What Happens if You Don’t Respond to the Lawsuit?

As the New Jersey Courts website says, “Do not ignore the summons. Even if you do not have a lawyer, it is better to try to defend yourself in court than to ignore the summons.”

That’s because if you ignore the lawsuit, you are likely to lose by default. This can clear the way for the debt collector to get a court order for wage garnishment, a bank levy, or a property lien.

Many people don’t fight debt lawsuits because they can’t afford to hire a lawyer. Don’t let that stop you! Believe it or not, you can win the debt collection lawsuit on your own. If you work quickly, you may be able to settle the debt for less than you owe before the court case moves forward or as part of the settlement conference.

The vast majority of debt collection lawsuits go unanswered, so debt collectors are used to getting an easy win. Responding to the case shows the debt collector you’re serious and gives you the chance to defend yourself.

What if There’s Already a Default Judgment Against You?

If the judge has already entered a default judgment against you, you can file a motion to vacate (cancel) the judgment if you have a good reason to do so. A motion is a formal request you make (usually via a form) to the court.

Read the court’s How to File a Motion in the Special Civil Part packet to learn more.

Need Legal Help?

If you don’t feel comfortable representing yourself and filing an answer on your own, seek legal help! There are some low-cost or free legal services available across the state.

Find a legal service office in your area.

Use the New Jersey Bar Association’s directory to get a legal referral.

Contact Volunteer Lawyers for Justice to see if you qualify for free legal help.

Use SoloSuit's service to draft an answer form for a small fee in less than 15 minutes.