How To Respond to a Minnesota Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

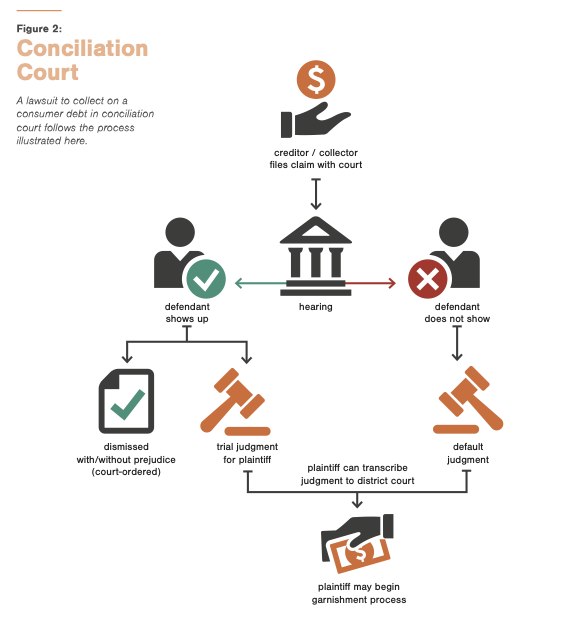

The process to respond to a debt collection lawsuit in Minnesota depends on which court you’re sued in. If you get sued in a small claims court (called conciliation courts in Minnesota), the process is simple and straightforward: You’ll get notification of the lawsuit and hearing and show up to the hearing to state your case.

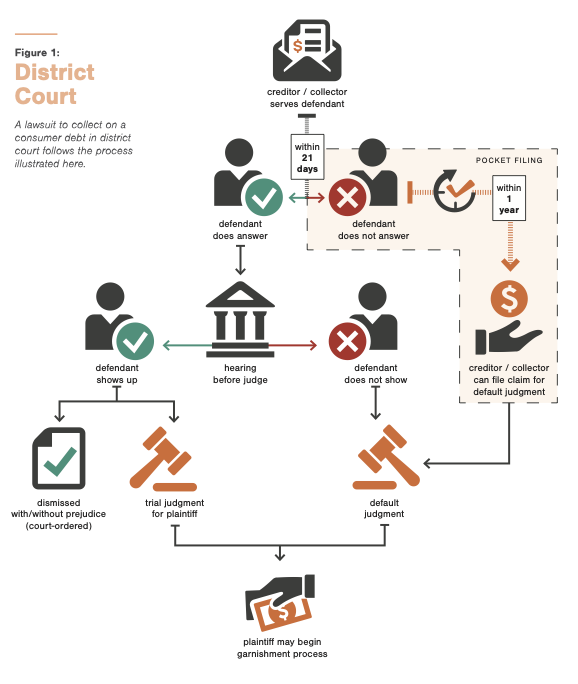

If you’re sued in a district court, the process is more complicated. You’ll receive a summons and complaint from the person suing you. You answer them directly, but you can use a form from the courts. Then you either settle the case or wait for the debt collector to officially file the case in the court.

Written by Upsolve Team.

Updated October 10, 2025

Table of Contents

- How Do Debt Collection Lawsuits in Minnesota Work?

- How Do You Know if You’ve Been Sued for a Debt in Minnesota?

- How Do You Respond to a Small Claims Case in Minnesota?

- How Do You Respond to a Summons in a Minnesota District Court?

- What Happens After You Respond?

- What Happens if You Don’t Respond to the Debt Lawsuit?

- Need Legal Help?

How Do Debt Collection Lawsuits in Minnesota Work?

If a debt collector, original creditor, or debt buyer believes you owe a debt and hasn’t been able to get you to pay it after making phone calls or sending written correspondence, they may eventually bring a debt collection lawsuit against you.

In Minnesota, debt collection lawsuits for $15,000 or less are usually filed in conciliation court (small claims). If the case involves a consumer credit transaction (like a credit card or retail contract), the limit is $4,000. Larger cases are filed in district court.

Conciliation court cases are easier, cheaper, and more straightforward to respond to than cases in district court due to Minnesota’s peculiar rules for district court debt collection cases.

This article will give an overview of both processes.

If you're worried about dealing with a debt lawsuit, but you can't afford a lawyer, you can draft an answer letter for a small fee using SoloSuit. They've helped over 300,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

How Do You Know if You’ve Been Sued for a Debt in Minnesota?

No matter which court your case is filed in, you should receive some kind of notice that a court case was filed against you. In small claims cases, this is usually a form titled Statement of Claim and Summons. In district court cases, this is a summons and complaint.

This notice may be delivered to you in person or sent to you in the mail. If you’ve received this notice and are wondering what to do next, you can read on to learn more about the court process for each type of case.

Upsolve Member Experiences

4,642+ Members OnlineHow Do You Respond to a Small Claims Case in Minnesota?

Small claims cases are heard in conciliation courts in Minnesota. Here’s an overview of how this process works:

Image courtesy of the Minnesota State Bar Association.

Step 1: Receive the Statement of Claim and Summons

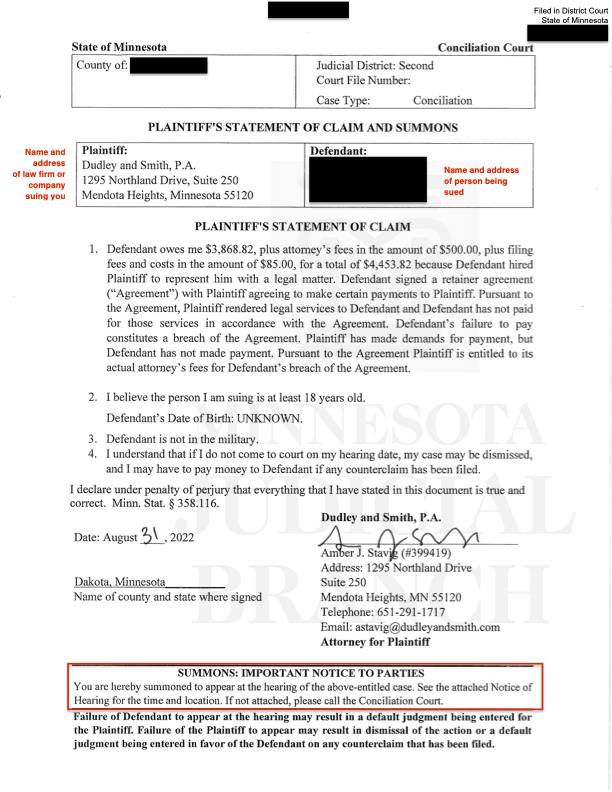

If the case is brought in conciliation court, you’ll receive a Statement of Claim and Summons. Here’s an actual copy of a recent statement filed in Minnesota (with personal details redacted):

As you can see, this document is pretty simple. It includes:

The name and address of the person suing you

The amount (the debt plus attorney and court fees) they allege that you owe

An explanation of why they think you owe the debt.

Read the Notice of Hearing Document

At the bottom of the Statement of Claim and Summons, there is a statement that you are being summoned to appear in a hearing for the case. The date and time of the hearing will be presented on a separate document called a Notice of Hearing.

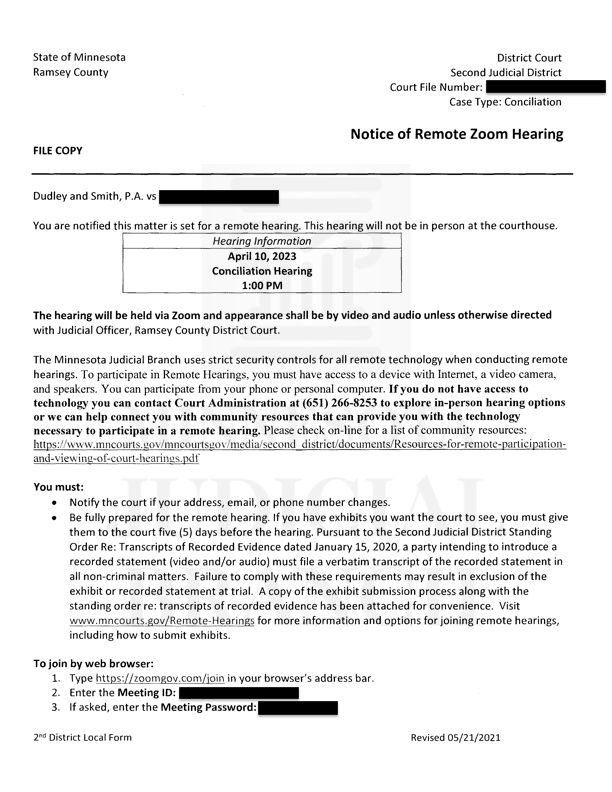

Many hearings are being held remotely, so the notice may say Notice of Remote Hearing. The notice looks like this:

Be sure to read the notice carefully. It includes information about how to join the remote hearing and other important instructions.

Want To File a Counterclaim?

If you believe that the person suing you owes you money, you can file a counterclaim by filling out a Statement of Counterclaim and Summons and submitting it to the court along with the required filing fee.

Filing a counterclaim can make things more complicated, so you may want to get legal advice if you plan to do this.

Step 2: Prepare Your Defenses

You do not have to file a written response to the Statement of Claim and Summons, but it’s a good idea to prepare for the hearing, especially if you have defenses to the claim.

Affirmative defenses are reasons the plaintiff shouldn’t win. They’re usually based on information that wasn’t included in the claim form. Here are some common defenses in debt collection lawsuits:

The debt is past the statute of limitations. In Minnesota, the statute of limitations for credit card debts and medical debts is six years.

The debt doesn’t belong to you (you were a victim of identity theft or fraud).

You already paid off the debt.

The lawsuit was filed by a third-party debt collector who violated the federal Fair Debt Collection Practices Act (FDCPA) by engaging in deceptive or unfair practices. If the debt collector violates this law, not only can you use this as an affirmative defense, but you may also be able to file a counterclaim for damages.

You’ll also need to gather proof to back up your claims.

Send Proof of Your Defenses to the Court

If you plan to bring up a defense during the hearing, you need to provide the court with copies of documentation that backs up your claim. In legal terms, these are called exhibits. You must send exhibits to the court at least five days before the scheduled hearing.

Proof might include but isn’t limited to:

Bank or credit card statements

Loan or credit agreements

Payment records (receipts, canceled checks, bank statements)

Documentations showing you’ve reported identity theft

Letters, emails, or other communications with the creditor or debt collector

Step 3: Attend the Hearing and State Your Case

Finally, you’ll attend the hearing at the place, date, and time listed on the hearing notice. Many hearings are being held virtually. If your hearing is virtual, be sure you know how to log in for the hearings and test the program on your device in advance.

If your hearing is in person, show up to the court early and come prepared with any documents that support your case.

Small claims courts were designed for ordinary people who don’t know the ins and outs of the judicial system. They are less formal than trial courts. Still, it helps to be prepared by practicing what you want to say to the judge. The person suing you will make their case first, and then you get to respond.

The judge may try to facilitate an agreement, make a ruling at the end of the hearing, or wait to make a ruling until after the hearing.

The Minnesota courts have put together a video and handbook on what to expect at a conciliation court hearing.

How Do You Respond to a Summons in a Minnesota District Court?

If a debt collector sues you or plans to sue you in a district court in Minnesota, this is what the process will look like:

Image courtesy of the Minnesota State Bar Association.

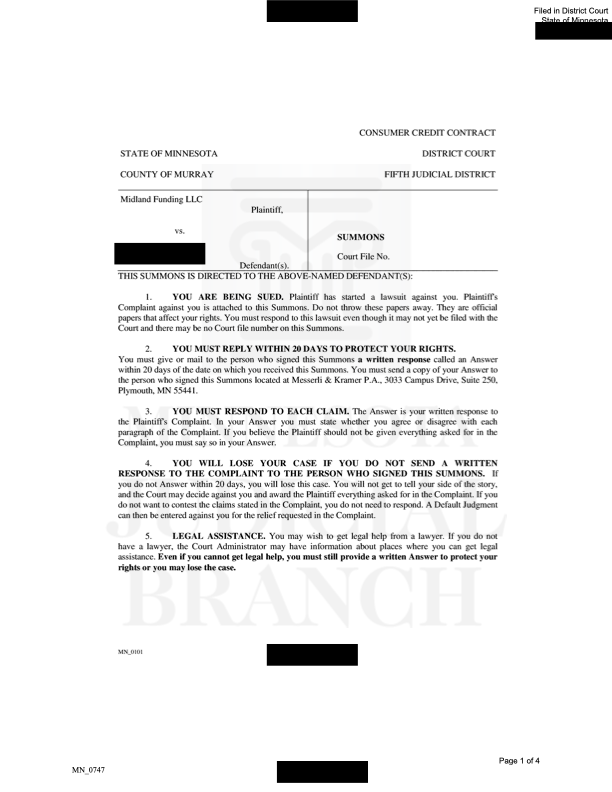

Step 1: Receive the Summons and Complaint

Debt collection cases in district courts are a bit more complicated and formal than cases brought in small claims courts.

In Minnesota, the person suing you starts the lawsuit by serving you with a summons and complaint. This is unique to this state. In most other states, the person suing you (the plaintiff) starts the lawsuit by filing a complaint with the court first, then you’re served with a summons and complaint. In Minnesota, the plaintiff has a one-year grace period to file the case with the court after serving you a summons.

This understandably leads to some confusion for people who receive a summons for a debt collection lawsuit in Minnesota. If you are being sued in a district court, there may not be a docket or court file number listed on the summons you receive, and the court may not yet be aware of the case when you receive the summons. Most cases are filed with the court within three months of sending a summons.

What’s in a Court Summons?

A court summons notifies you that you’re being sued and how long you have to respond to the lawsuit. In Minnesota, you have 21 days to respond to a summons if you were served in person, or 60 days if you were served by mail and filled out a Waiver of Service form.

Here’s an actual recent summons for a debt collection case in Minnesota (with personal information redacted):

In addition to notifying you that you’re being sued, the summons tells you how long you have to reply to the person suing you. It also provides instructions about what must be included in your response and how to get legal assistance.

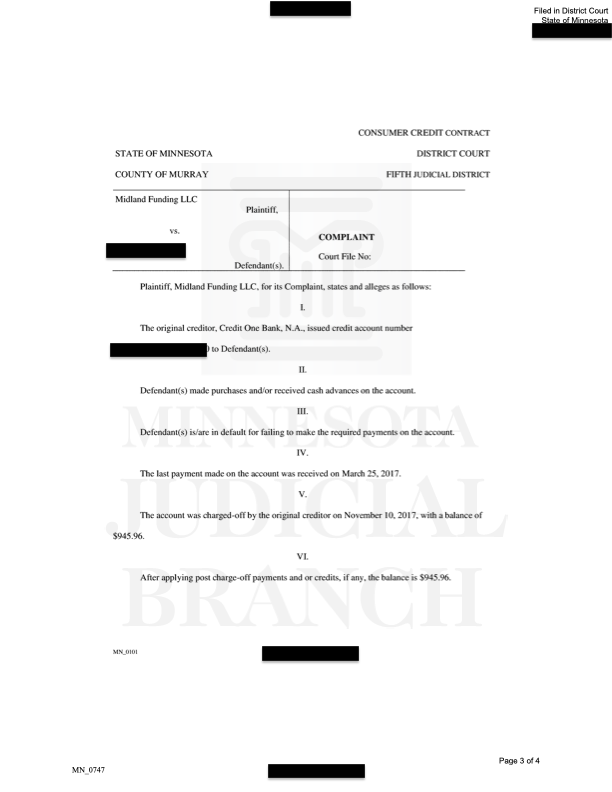

What’s in a Complaint?

The summons will be accompanied by a complaint, which sets out the claims of the person suing you in numbered paragraphs. Here’s an example of a page from a recent complaint:

Generally speaking, the complaint should tell you:

The amount the person suing you alleges that you owe

Information about the debt account or contract

The plaintiff’s name and address

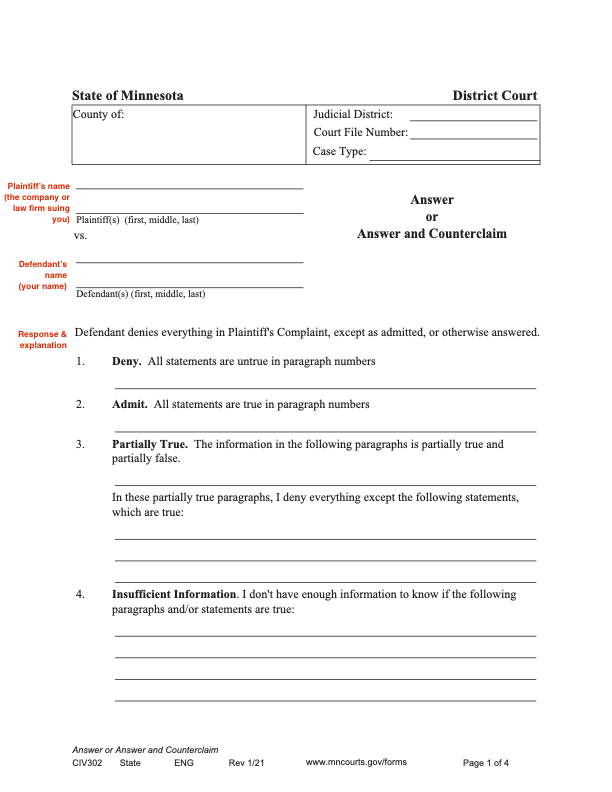

Step 2: Get an Answer Form

You need to respond to the summons and complaint within 21 days if you were served in person or 60 days if you were served by mail. You can do this by downloading and filling out a templated answer form provided by the court. Alternatively, you can use the court's fillable smart form to type your responses in.

Here’s what the first page of the answer form looks like:

The full form is four pages long, but it’s relatively simple to fill out, and not all sections will apply to all cases. The Minnesota court provides thorough instructions online about how to fill out an answer form.

Step 3: Address Each Complaint/Allegation

The complaint form lists claims in numbered paragraphs. On your answer form, make sure you respond to every claim in the complaint.

Your choices on the answer form are:

Deny: List the paragraph numbers of any claims you believe are untrue here.

Admit: If there are claims you want to admit to, you can list those by their paragraph numbers here.

Partially True: Sometimes, a claim will include some information you agree with and some you disagree with. In that case, you can explain which specific statements you believe to be true while denying the rest of the information in a certain claim.

Insufficient Information: If you don’t feel like you have enough information to deny or admit a claim, you can list it here.

Some attorneys advise their clients to use the insufficient information response on all claims in a complaint. This forces the person suing you to prove all the information they included in their complaint.

If you deny a claim as untrue, you don’t need a defense. But you may have an affirmative defense that introduces new information that wasn’t in the complaint.

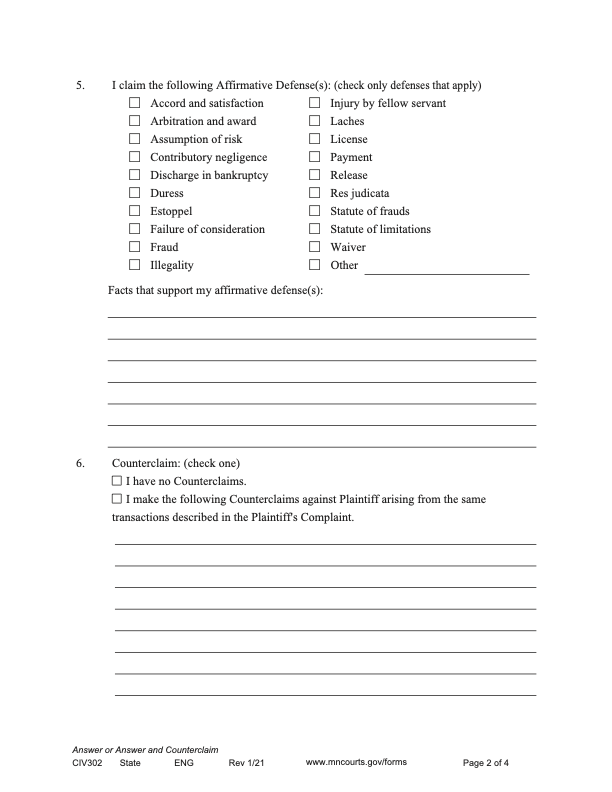

Step 4: Raise Your Defenses and Counterclaims

An affirmative defense is a reason the person suing you shouldn’t win even if some or all of the information in their complaint is true. To raise an affirmative defense, you’ll bring new information to light that the plaintiff didn’t mention in their complaint.

Page 2 of the court’s answer packet addresses both of these. It looks like this:

You can check the box that best describes your affirmative defense or check “Other” and write in a short explanation. Many of these affirmative defenses are legal terms and may not be familiar to you.

Any could be relevant to a debt collection lawsuit, but some of the more common ones are:

Discharge in bankruptcy, if you’ve included the debt in a bankruptcy case

Fraud, if the debt collector violated state or federal laws

Statute of limitations, if the debt is too old to collect under Minnesota law

How Do You Raise a Counterclaim?

The bottom half of the second page is where you list any counterclaims you wish to bring against the person suing you. If you believe the plaintiff has wronged you and owes you compensation, it’s your right to file a counterclaim. But you may want to seek legal advice.

While filling out and sending an answer form is relatively straightforward, filing a counterclaim gets more complicated. It helps to have some legal know-how to effectively prove a counterclaim.

Step 5: Send a Copy of the Answer to the Plaintiff

After you fill out the answer form, make at least one copy. Send a copy to the plaintiff at the address listed on the summons or complaint. This will often be a law office.

Step 6: Complete an Affidavit of Service Form (and File With the Court if Necessary)

You also need to fill out an affidavit of service form. There are templates on the Minnesota court website — the form varies based on whether you served (delivered) the form in person or via mail.

Again, make at least one copy of this form. You only need to submit it to the court — along with your original answer form — if you receive a Notice of Judicial Assignment, a document from the court explaining that the person suing you filed their case with the court. Remember, this often happens several months after you receive the summons and can happen up to one year after receiving the summons.

If you file an answer and affidavit of service with the court, you’ll have to pay a filing fee or submit a request for a fee waiver or reduction. Filing fees vary by county.

What Happens After You Respond?

After the person suing you sends you a summons and complaint, they have a one-year grace period to file their case with the district court. Recent data shows that most plaintiffs file these cases within three months, but at least 10% wait up to eight months to file with the court.

This can leave you with the sense that an impending lawsuit is hanging over your head — you aren’t sure when or if it’ll actually happen. This is a frustrating reality for Minnesotans who are sued by debt collectors in district court. The best thing you can do is send your answer within the 21-day timeframe and wait to hear what happens next.

In Minnesota, it’s common for debt collectors to reach out during this time to try to settle the debt. According to the court, most of these cases are settled outside the courtroom. Read Upsolve’s article 6 Tips for Settling Credit Card Debt to learn how to negotiate a settlement that benefits you.

If you don’t come to an agreement, you will eventually receive information from the court about mediation or a hearing. If you don’t show up to a scheduled court appearance, you can lose the case by default.

What Happens if You Don’t Respond to the Debt Lawsuit?

If you don’t follow the steps listed above to reply to a small claims case or lawsuit in district court, the most likely outcome is that you’ll lose the case. If so, the court will issue a default judgment in the plaintiff’s favor. This allows them to get a court order for a wage garnishment or bank account levy. In other words, they can get a court order to take money directly from your bank check or bank account.

While it might feel impossible, with some preparation you can win the debt collection lawsuit or negotiate to settle the debt for far less than you owe.

If the court has already entered a default judgment against you, you may be able to file a motion to vacate (cancel) the judgment or otherwise reopen the case.

To learn more, speak to the court clerk, tell them your situation, and ask about your options. They can’t give legal advice, but they should be able to tell you if there’s a process in place to contest the judgment.

Need Legal Help?

If you need further information or want assistance with your case, you can:

Draft and send your answer form for a small fee using SoloSuit.

Get a legal referral or search the online directory of LawHelpMN

Look at the Minnesota Court resources page

Look at lower-cost legal assistance options from the MN Unbundled Law Project

Get a legal referral from the Minnesota State Law Library