Will filing Chapter 7 bankruptcy help you? Consider this...

1 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

Filing bankruptcy allows you to eliminate your debts - credit cards, car loans, bank loans, medical bills etc. While eliminating these payments will inevitably help your household budget, it won’t change the here and now. You’ll still be responsible for rent, utilities, insurance, groceries and really all other living expenses. Remember, filing bankruptcy does not change your income. If you made $0/mo. before filing your case, you’ll still be making $0/mo. afterwards.

Written by Attorney Andrea Wimmer.

Updated July 30, 2020

Filing bankruptcy allows you to eliminate your debts - credit cards, car loans, bank loans, medical bills etc. While eliminating these payments will inevitably help your household budget, it won’t change the here and now.

You’ll still be responsible for rent, utilities, insurance, groceries and really all other living expenses. Remember, filing bankruptcy does not change your income. If you made $0/mo. before filing your case, you’ll still be making $0/mo. afterwards. This means that simply stopping paying your unsecured debt so you can make sure your necessities are taken care of will have the same short-term effect as a bankruptcy filing.

Let's take a look at an example:

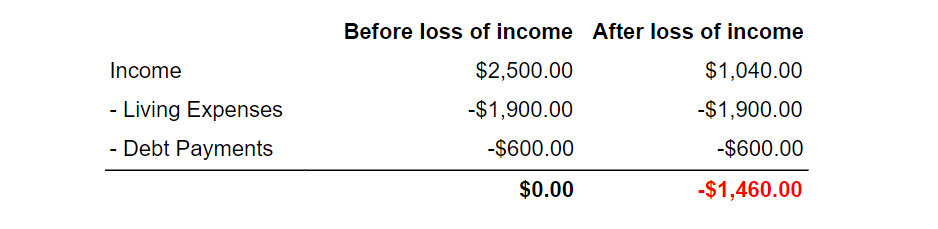

Debbie, a single woman working in the hospitality industry was doing alright, taking home a net income of $2,500/month. She wasn’t putting much into savings on a monthly basis, but her income was enough to pay her bills and living expenses, including the $600/mo. in credit card payments. Last week, Debbie was laid off. Her employer, a small catering and event planning company, had lost pretty much all of its business and was forced to shut down. No one really knows whether they’ll be able to open their doors again once this all blows over.

Debbie was able to apply for and start receiving unemployment income of $240 per week or $1,040 per month. Her monthly budget changed as follows:

Debbie knows she can’t make her credit card payments anymore - she is barely able to figure out a new budget that allows her to keep up with rent, utilities and food. She is considering filing Chapter 7 bankruptcy to help deal with this shortfall.

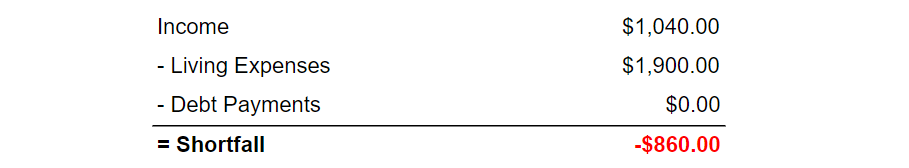

Option 1: Debbie holds off on filing bankruptcy for now, but stops all credit card payments.

Option 2: Debbie decides to file for Chapter 7 bankruptcy and, as a result, stops all credit card payments.

Regardless of which option Debbie chooses, her new monthly budget will look like this:

Her monthly expenses exceed her income by $860/mo. Filing Chapter 7 bankruptcy will not increase her income. It will not help her deal with the $860/mo. shortfall. In fact, it won’t change her current situation at all. Since filing a Chapter 7 will provide Debbie neither immediate relief from financial distress nor a fresh start, it’s probably premature for Debbie to file Chapter 7 bankruptcy now.