What Are My Rights When a Debt Collector Is Threatening To Sue Me?

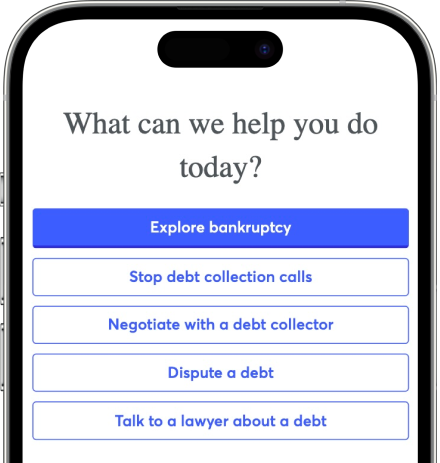

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Being sued by a debt collector can be a scary thing, but you have rights that protect you from harrassment and abusive collection practices. These rights and the rules debt collectors must follow are outlined in the Fair Debt Collection Protections Act. Learn what they mean for you and how to respond to a debt collector that has violated these rules. Also, find out what steps you can take if a debt collector has filed a lawsuit against you.

Written by Curtis Lee, JD.

Updated September 17, 2021

Table of Contents

Debt collectors may threaten to sue you to try to collect a debt. In some cases, they can legally make this threat. But in other situations, making this threat is illegal. The Fair Debt Collection Practices Act governs how debt collectors can use threats to collect debts.

This federal law doesn’t apply to all kinds of debt collectors. But it may offer those with outstanding consumer debts a way to fight back against harassing debt collection phone calls. To take advantage of these rights, it may help to consult with an attorney or other source of legal services, such as a legal aid organization.

This article will cover what to do when a debt collector threatens to serve papers, what rights you have against creditor abuse, and what to do if a creditor sues you.

When A Debt Collector Threatens To Serve Papers

Has a debt collector contacted you and threatened to serve papers? If so, it means they’re trying to collect the money they claim you owe them. It also means they’re willing to go to court to do it. The process of getting served varies by state and county. Someone may actually come to you and hand you documents or a summons or a complaint could be mailed to you.

A debt collector can only threaten to sue you if two conditions exist. First, the threat to sue must be real. In other words, the debt collector must intend to sue you if you refuse to pay them. Second, they must have the legal right to sue you. Many debt collectors and collection agencies try to recover debts where the right to bring a lawsuit no longer exists. This might occur in situations where any lawsuit is time-barred by the statute of limitations. This essentially means they ran out of time.

Assuming the debt collector follows through with the threat and serves you with papers, you need to respond in some way. If you have a valid statute of limitations defense, you need to appear in court and tell the judge your defense. If you don’t, you risk a court entering a default judgment against you even though you have a legal defense that could help you win your case.

Statute Of Limitations

In most legal actions (both civil and criminal), there’s a time limit in which a plaintiff can sue a defendant. These time limits vary by state and by the type of lawsuit, but they often range from three to six years for most debt recovery suits (often brought as a breach of contract action).

If the statute of limitations deadline passes for a particular legal claim, you can’t be sued. In the case of debt collection, if there’s no lawsuit, the debt collector’s recovery options are far more limited. For instance, the debt collection agency can’t garnish your wages because they need a court order to do so.

The amount of time a debt collector has to sue will depend on the type of debt they’re trying to collect. Another variable will be how the state determines when the statute of limitations clock starts. For example, it might start when you fail to make a required debt payment. Or, it could start when you made your most recent payment.

Most states allow debt collection agencies to contact you to recover a debt even though the statute of limitations prevents them from filing a debt collection lawsuit. Sometimes, a sneaky debt collector will try to find a way to convince you to make a payment on the debt or acknowledge in writing that you owe the debt. In some states, either of these actions will be enough to reset the statute of limitations. Then they can sue you to collect the money you owe.

Keep in mind that if the debt collector can’t sue you because of the statute of limitations, the debt may still show up on your credit report and lower your credit score.

Your Rights Against Creditor Abuse

When it comes to legal protections against abusive debt collectors, the Fair Debt Collection Practices Act (FDCPA) is the primary law that will apply. As its name implies, the FDCPA is a federal law that attempts to limit the tactics individuals and companies can use when trying to collect consumer debts, like car loans, student loans, medical bills, mortgages, and credit card debts. The FDCPA doesn’t apply to the recovery of business debts.

Who’s Covered by the FDCPA?

Only third-party debt collectors who are trying to recover a debt for someone else are subject to the FDCPA. If the original creditor or holder of the debt is trying to collect the debt, they aren’t subject to the FDCPA. For example, a hospital trying to collect a medical debt from a patient isn’t a “debt collector” under the FDCPA. Additionally, a debt collection agency may purchase debt from the original creditor and try to collect the debt themselves for a profit. In this case, the debt collector also isn’t subject to the FDCPA.

This might seem like a significant limitation of FDCPA, but the FDCPA isn’t the only consumer protection law concerning debt collection. Many states have comparable laws that provide greater protections. One example is California, which applies its FDCPA-equivalent law to original creditors as well as third-party debt collectors.

Debt Collection Practices Prohibited by the FDCPA

The FDCPA lays out many of the debt collection actions that are illegal. Here are some of the important aspects of the law:

Unless they have your permission, a debt collection agency working for a lender can’t contact you when it’s inconvenient for you. Unless they have information indicating otherwise, this means they can’t call you before 8 a.m. or after 9 p.m. local time.

If the debt collector knows (or has reason to know) that you’re not allowed to receive debt collection communications at work, they are not allowed to contact you at your place of employment.

They may not contact you instead of your attorney if an attorney is representing you.

They cannot harass you in any manner, including phone calls, emails, text messages, or harassing someone you know. Harassing behavior includes using obscene language, repeatedly calling you, or threatening to hurt you.

They may not continue to contact you if you’ve told them in writing to stop. There are two exceptions to this: First, the debt collector may tell you that they’ll no longer contact you. Second, the debt collector can let you know that they may continue to proceed with lawful debt collection activities like a lawsuit.

They can’t tell any revealing information about the debt to anyone except your spouse or your attorney. One exception is that the debt collector may contact third parties to obtain your contact information or find out where you live or work. But as a general rule, they may only contact them once and can’t reveal that you owe a debt.

They can’t lie about who they are or the amount of money you owe.

States can create their own consumer debt protection laws as well, so there may be other things debt collectors can or can’t do when trying to collect consumer debts in your state.

Remedies for FDCPA Violations

If a debt collector violates the FDCPA, you can sue them in either state or federal court. You’ll have one year from the alleged violation to file your lawsuit. If you win your case, you can recover actual damages, such as lost wages or medical bills.

If you don’t have these damages or can’t prove them, a court may still award you up to $1,000, plus attorney fees and court costs. Besides bringing your own lawsuit, you can also file a complaint against the debt collector.

Lodging a Complaint With the FTC

If you want to report a debt collector, you have three major options:

The Federal Trade Commission (FTC)

The Consumer Financial Protection Bureau (CFPB)

Your state’s attorney general

The FTC has traditionally been the enforcement agency of the FDCPA. But when the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 became law, the CFPB became the primary federal agency tasked with enforcing the FDCPA. Despite this, you can report violations of the FDCPA to the FTC, as well as any other unlawful business practices, such as scams and fraud.

We also recommend filing a complaint with your state’s attorney general office if your state has its own version of the law.

Upsolve Member Experiences

1,341+ Members OnlineHow To Stop Collection Phone Calls From Creditors

If a creditor or debt collector won’t stop calling you, the simplest way to tell them to stop contacting you is by writing a letter to the debt collector. Tell them that you want them to stop contacting you. When you send this letter, keep a copy of it for your records and mail it in a way that you can confirm the debt collection company received it. Sending it via certified mail with a return receipt is a good way to do this.

After the debt collector receives your letter, the only time they can contact you is to confirm that they’ll no longer contact you or to notify you about a legal action like a lawsuit or wage garnishment.

Two other ways to stop collection calls are filing for bankruptcy or hiring a lawyer to provide you with legal advice regarding the debt.

What Happens if a Creditor Sues You?

A debt collector will sue you for nonpayment of debt to try to collect from you. If this happens, you have several ways to respond.

First, you may defend yourself against the lawsuit. If you have a potential defense, it may be worth making that argument in court. Common defenses to debt collection lawsuits include:

The lawsuit is time-barred because of the statute of limitations.

The plaintiff is suing the wrong person.

You’re being sued in the wrong court.

The plaintiff doesn’t have the necessary paperwork to prove that you owe the debt.

Second, after getting served with the summons and complaint, you or your attorney can reach out to the plaintiff and offer to settle the debt. These debt settlements often take the form of a payment plan or a partial lump-sum payment.

If the plaintiff agrees to a payment plan, you’ll make periodic payments until your entire debt is paid in full. However, many plaintiffs in debt collection cases won’t agree to a payment plan because of the risk of another default. That’s why plaintiffs will instead ask for a lump-sum payment that consists of a significant percentage of the debt they claim you owe. In return for getting the money quickly and not having to spend the resources suing you, the plaintiff will agree to accept a partial payment of the debt but consider the debt paid in full.

Third, you can file for bankruptcy. Depending on whether you file Chapter 7 or Chapter 13 bankruptcy, it might be possible to have the debt wiped away through the bankruptcy process. But even if having your debt discharged through bankruptcy isn’t possible, you can still take advantage of the automatic stay. This will immediately stop any pending debt collection lawsuits against you. While the stay is in effect, debt collectors can’t make any attempts to collect your debt.

The one thing you shouldn’t do is ignore the lawsuit. If you do that, the plaintiff can obtain a default judgment against you. Once they have that, they can begin collection activities, which can include garnishing your wages, freezing your bank account, and seizing your property.

Let’s Summarize...

If a debt collector is threatening you with court papers, they are telling you that they’ll sue you if you don’t pay off your debt. Under the FDCPA, they can only make this threat if they intend to follow through with it and if they have the legal right to sue you.

The FDCPA also prohibits debt collection entities from engaging in abusive or harassing behavior when trying to collect the debt. If they violate the FDCPA, you can file a complaint with the FTC, CFPB, or your state’s attorney general. You may also have the right to sue the debt collector in court and recover monetary damages.