Refinancing a Car Loan With Bad Credit

Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

Favorable auto refinancing terms are often extended to borrowers with good credit. Borrowers with bad credit need to "shop around" carefully to secure decent refinancing rates. If decent rates are extended, refinancing an auto loan can save a borrower thousands of dollars. But, borrowers with bad credit need to understand the terms that they are being offered carefully or the potential savings overall could be minimal.

Written by Lawyer John Coble.

Updated November 30, 2021

Table of Contents

Refinancing a car loan can save you thousands of dollars. Having a good credit score will help you get a better interest rate. But there are ways to save money by refinancing your car even if you have poor credit. This article examines auto loan refinancing, what the pros and cons are, when it’s a good idea to do it, how to do it, and how your credit history will affect the terms you'll be able to get on a new loan.

Refinancing a Car Loan

Think of refinancing your auto loan as trading in your old car loan for a new, better car loan. You still have the same car, but you get a lower interest rate, lower monthly payments, or both. When you refinance your auto loan, the old loan is paid off by the new loan. You'll no longer make monthly payments on the old loan. You'll make loan payments on the new loan.

Pros and Cons of Auto Refinancing

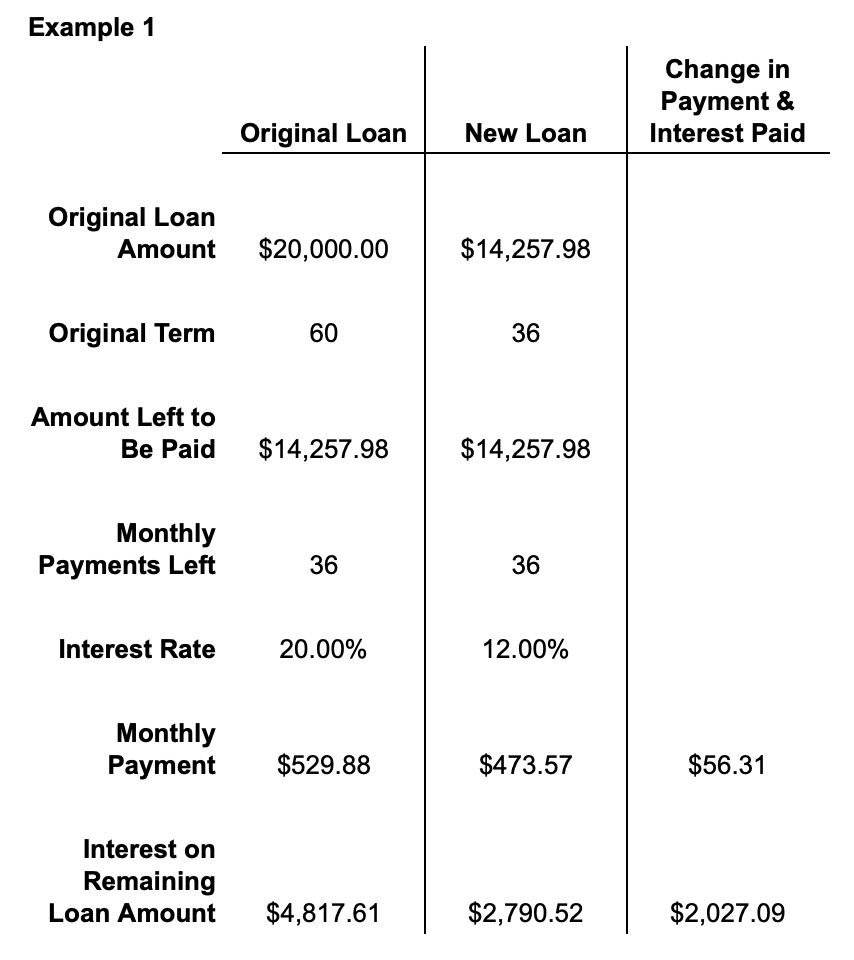

When deciding whether to refinance or not you have to weigh the benefits against the costs. If you can get a new loan with better repayment terms it can make a huge difference in your cash flow and the total cost of the loan. Consider Example 1 below:

In Example 1, you have a 5-year (60 months) $20,000 loan at 20% interest. You refinance that loan after two years at 12% for the remaining amount of $14,257.98. This reduces your monthly payment from $529.88 per month to $473.57 per month. That’s a monthly savings of $56.31. The total interest you'll pay on the remainder of the loan is reduced from $4,817.61 to $2,790.52. That means you’ll save $2,027.09 in interest over the remainder of the loan.

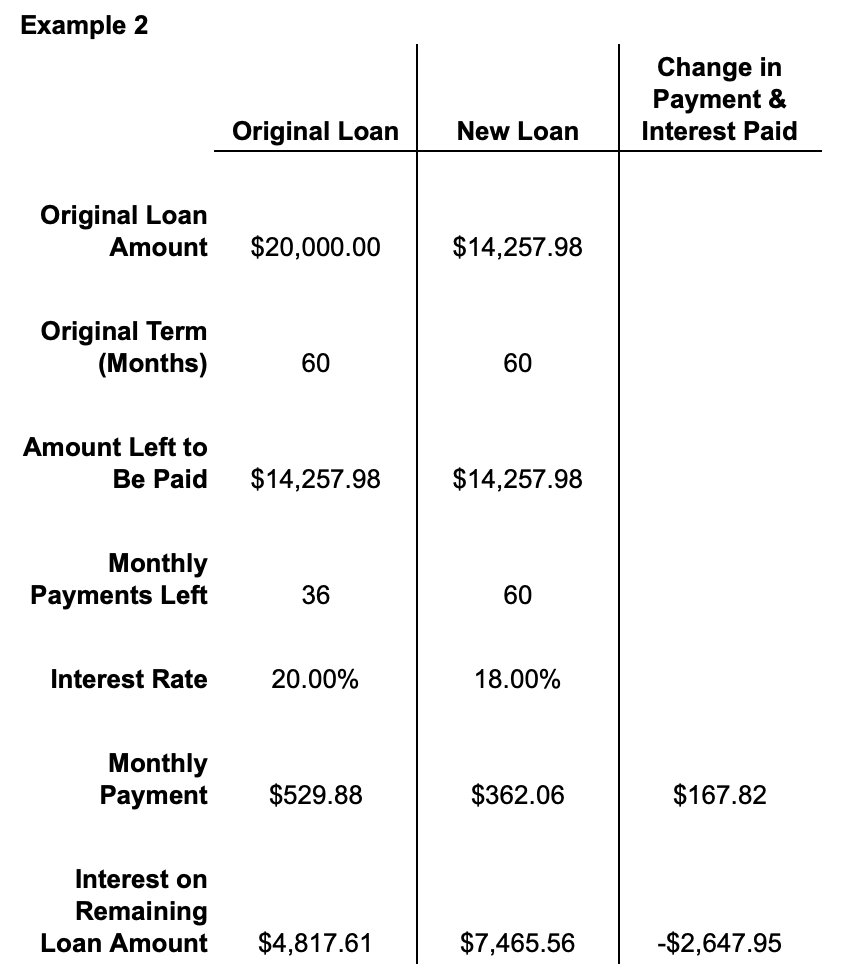

In Example 2, you have the same original loan as in Example 1. But, the interest rate on the new loan is only 2% lower and the repayment term is extended from three years remaining to five years. Because of the longer term, the monthly payment decreases by even more than Example 1. The monthly payment is $167.82 less than it was under the old loan. But, the longer term also means there's more time for interest to accrue. This means your remaining interest payments will be higher even though the interest rate is two points lower. You'll end up paying $2,647.95 more in interest for the longer term with lower monthly payments.

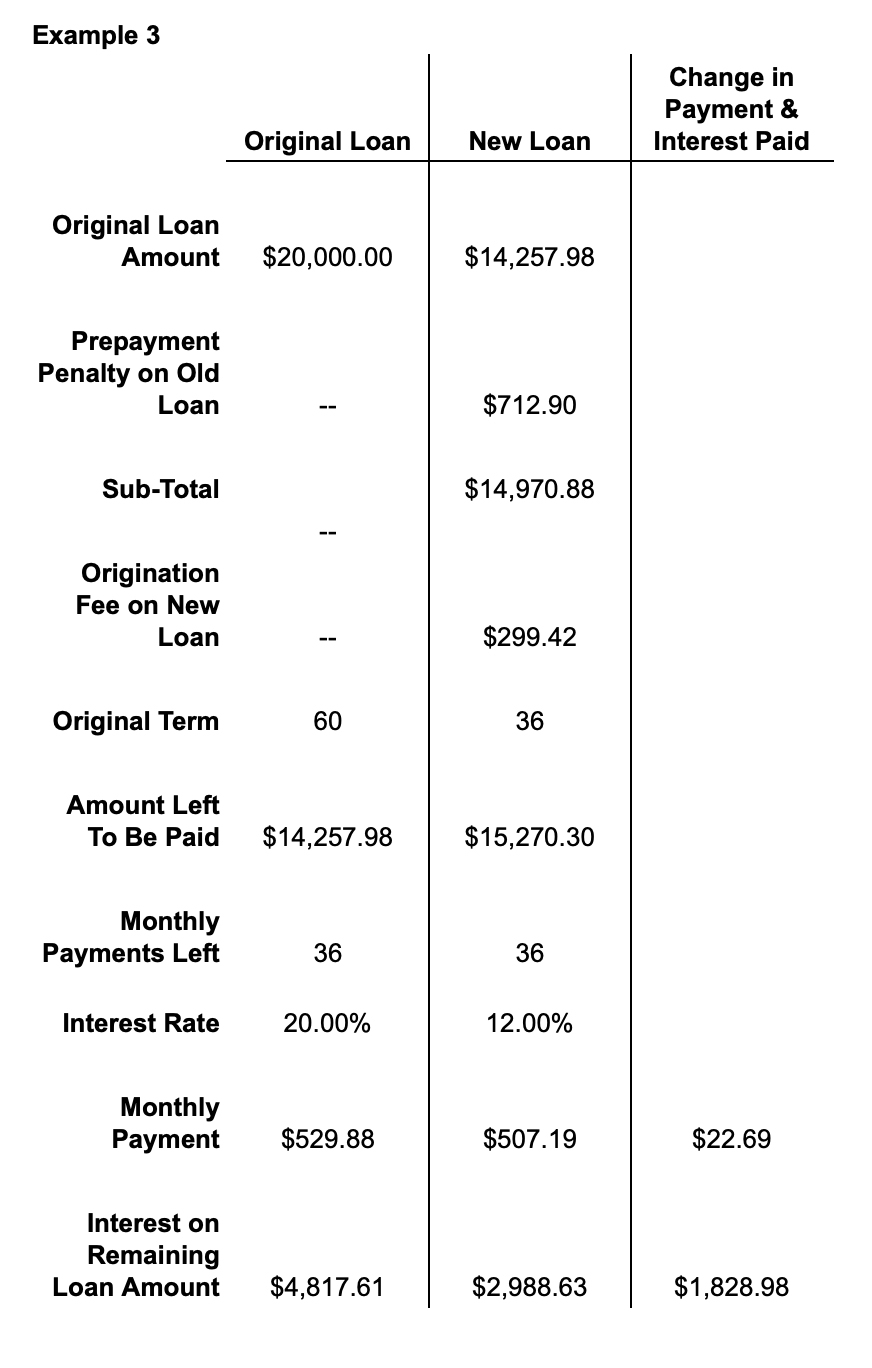

While these refinancing examples illustrate how the interest rate and loan term affect how much you’ll pay on your loan, there are also other issues to consider, including:

Origination fees for the new loan.

A potential prepayment penalty on the old loan.

Where you are in the life of the loan.

Consider Example 3 where there's a 2% origination fee for the new loan and a prepayment penalty that amounts to 5% of the remaining balance for the old loan. Everything else is the same as Example 1.

As you can see, prepayment penalties and origination fees cut out over half your savings on your monthly payment when compared to Example 1. Though there’s only a small addition to your total interest on the new loan due to these fees.

Upsolve Member Experiences

1,940+ Members OnlineWhen Is It a Good Idea To Refinance a Car Loan?

It might be a good time for an auto loan refinance if...

The average interest rate has improved. You can track interest rates at the Federal Reserve Economic Database (FRED).

You had bad credit but your credit score has improved.

You still have a lot of payments to go on your loan.

You can’t afford your current car payment.

It's not a good time to refinance your car loan if you're unable to get favorable terms that outweigh any extra fees you may have to pay. These fees could be prepayment penalties, origination fees, or other fees. Also keep in mind that if you refinance with a new loan that has a longer term, you increase your chance that your car will be worth less than what you owe on it at some point. If your car is already worth less than what you owe on your loan, it’s not a good idea to refinance. The same is true if you’re behind on your current auto loan payments.

How To Refinance a Car Loan

Before trying to refinance a car loan, you'll want to check your credit report and credit score. You'll also want to review your current loan contract to see if you'll have to pay a prepayment penalty. Check the current average interest rates compared to when you first took out your current loan. If they're lower now, there's a better chance you'll get a lower rate. If your car is worth more than you owe now, you'll want to calculate if a longer loan term might cause this to change. Looking at car value books such as Kelly Bluebook or NADA may help with your calculations.

If You’re Upside Down on Your Auto Loan

Being upside-down or underwater means that the amount you owe on the loan is greater than what your car is worth. Consider the following disadvantages of being upside-down on your car loan:

If your car is totaled in an accident and you're upside-down on your loan, the insurance proceeds won't be enough to pay off your car loan since the insurance company is only going to pay you up to the current value of the car. This means even though you don’t have a car, you’ll still owe on the loan for the amount you had been upside-down.

It's more difficult to trade in for a different car if you're upside-down. You may have to make a larger down payment on the trade-in or you may have to add the amount you’re underwater on your old loan to your new car loan. This will cause you to spend much more in interest. And it might put you underwater on your next car loan.

Auto Refinancing and Your Credit Score

As a borrower, your credit score is an important factor in loan financing and refinancing. So before you refinance, check your credit report and credit score. If your score hasn’t improved since you got the original auto loan, you may not yet qualify for a lower interest rate. Some lenders may work with you even if you have bad credit, but it’s worth working to improve your score before refinancing to get the best terms. One easy way to improve your credit and raise your score is to correct any errors on your credit report.

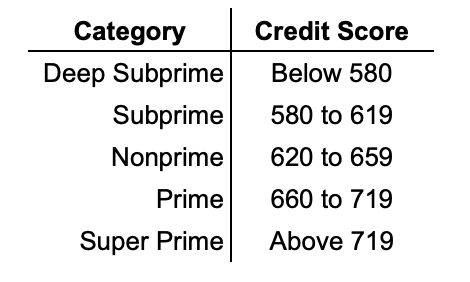

Here’s Experian's breakdown of auto loan categories:

In 2020, used car interest rates ranged from 20.45% for deep subprime loans to 4.29% for super-prime loans. Deep subprime loans are for people with the worst cases of bad credit. Super-prime loans are for people with extremely good credit. Having a better credit score means you’ll have a lower monthly payment and pay less in interest over the term of the loan.

The process of applying for loans can actually hurt your credit. When you apply, lenders will do a hard credit inquiry, which will lower your credit score and stay on your credit report for two years. If you’re shopping around for different loans, you can minimize this effect by applying for all the loans in a short period. Though several lenders will do hard inquiries on your credit, these will be combined and treated as one hard inquiry, which will be less harmful to your credit.

How do you make sure you'll only have one hard inquiry on your credit report? Different credit bureaus have different ways of calculating your credit score. FICO treats all hard inquiries within a 45-day period as one inquiry. But VantageScore only gives you a 14-day period.

Other Factors To Consider

It's important to contact your current lender when shopping for a refinance. Your lender may refinance the loan for you if you've been making your payments on time. They may even offer you a lower interest rate to keep you as a customer. You should also ask about prepayment penalties or any other fees involved in paying off the loan. Your current lender may be willing to waive your prepayment penalty if you refinance with them.

But don't stop with your current lender. It's a good idea to shop around for the best auto loan, and another lender may have a better deal. Before applying for loans look at the internet reviews and the Better Business Bureau to see the experiences others have had with the different lenders you're interested in.

Also, when shopping for loans, look at all the loan terms and fees. Having a lower monthly payment may seem ideal, but you’ll want to think twice if it means you'll pay more in interest over the loan term. Of course, one way you can get a much better loan and greatly reduce your monthly car payment is to have a co-signer who has excellent credit.

Let’s Summarize…

If interest rates decrease or your credit score increases, you may want to consider refinancing your car loan to save money. It's important to look out for prepayment penalties and other fees that can cut into the savings you'll get by refinancing. If your bad credit hasn't improved, you may still be able to get a better loan by shopping around. Just be sure to do your shopping within a two-week period so all the hard inquiries on your credit report will only count as one inquiry.

Even if you can't qualify for a better rate you may be able to get a longer loan term. This can help your monthly cash flow by lowering your car payment. Understand that with a longer-term, you'll pay more interest even if it's at the same annual percentage rate as your existing auto loan. Also, consider the risks that come with being upside-down on a loan. The longer the payment term, the more likely you'll be upside-down.