A Guide to New York State Debt Collection Laws & Regulations

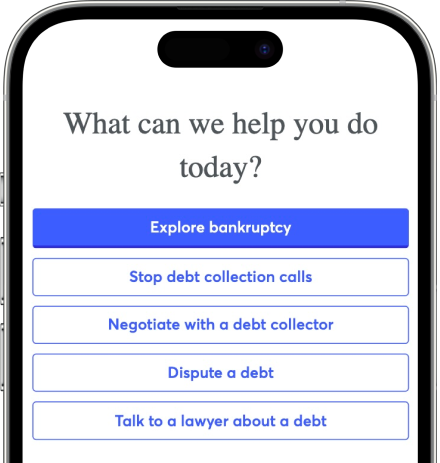

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Federal and state laws protect New Yorkers against illegal and unfair debt collection practices. At the state level, the new Consumer Credit Fairness Act strengthens consumer protections in debt collection lawsuits. Under the law, new notice requirements apply for debt collectors that sue borrowers, and the statute of limitations to bring a lawsuit dropped from six years to three years.

Written by Curtis Lee, JD.

Updated August 21, 2023

Table of Contents

New York State Residents Have Both Federal and State Protection

New Yorkers are better guarded against predatory third-party debt collectors than residents in most other states because in New York, such collectors are subject to both state and federal regulations.

First, there’s the federal Fair Debt Collection Practices Act (FDCPA), which protects consumers from deceptive and unfair debt collection practices. The FDCPA also provides potential legal remedies to consumers who experience FDCPA violations.

Second, there are New York state laws and regulations. Namely, the Consumer Credit Fairness Act (CCFA). This new law provides additional protections to New Yorkers involved with consumer credit transactions.

Some places also have local laws that apply to certain types of debt collection activities. For instance, New York City has regulations that go beyond what’s required by state or federal law.

How Does the FDCPA Protect Consumers?

The FDCPA regulates what debt collectors can and can’t do when they try to collect a debt. If a debt collector does any of the following when trying to collect a debt from you, they may have violated the FDCPA:

Harassing, abusing, or misleading you to trick or coerce you into paying a debt. This includes threatening you with arrest.

Discussing your debt with third parties like family members or friends (with some exceptions).

Calling you at work if you’ve asked them to stop.

Contacting you instead of your attorney, if you have one.

Threatening you with legal action if the statute of limitations for your debt has expired.

The Federal Trade Commission (FTC) enforces the FDCPA. But consumers can also sue the debt collector directly for FDCPA violations.

The FDCPA Doesn't Apply to Original Creditors

The Fair Debt Collection Practices Act (FDCPA) only applies to debt collectors and debt buyers, not the original creditor. The original creditor is the entity that first lent you the money. A debt buyer is someone who buys debt from the original creditor or another debt buyer and tries to collect it.

If the original creditor is trying to collect on the debt, the FDCPA’s requirements generally don’t apply to them. There’s one exception though: If the original creditor uses a different name when trying to recover a debt from you, the FDCPA could apply.

Upsolve Member Experiences

1,940+ Members OnlineWhat Are New York's Debt Collection Laws?

As mentioned previously, New York state has consumer protections that go beyond the FDCPA. These protections typically relate to disclosures that debt collectors must provide the first time they contact you or within five days afterward. Also, if you submit a written during their initial contact request, the debt collector must provide debt verification information within 60 days of your request.

What Information Are Debt Collectors Required To Tell You in New York?

Debt collectors subject to New York’s debt collection laws must give you three main types of information:

Information about your rights as a consumer and exempt income

Information about the debt they’re trying to collect

Information about the statute of limitations on the debt

The first type of information includes notice of your rights under both New York state laws and the FDCPA. They must also give you information concerning the types of income that a debt collector can’t touch, even if they sue you and get a judgment against you.

The second type of information relates to the debt they’re trying to collect from you. A New York debt collector must confirm the name of the original creditor, how much you owe, and how your debt balance was calculated.

Lastly, you’re entitled to information about the debt’s statute of limitations. This is the deadline for any legal action a creditor wants to take against you if they want the court’s help to collect a debt.

If the statute of limitations has already expired or is about to expire, the New York debt collector must:

Let you know that the statute of limitations has expired (if applicable).

Remind you that the FDCPA prohibits a debt collection lawsuit if the time limit from the statute of limitations has expired. Just remember that debt collection attempts (other than a lawsuit) may continue.

Tell you that you don’t have to admit to the debt, promise to pay the debt, or waive your statute of limitation rights.

Debt Collectors Must Verify Debts Upon Request

If you’re contacted about a debt you don’t think you owe or you disagree with the claimed amount due, you can request debt verification from the debt collector. You must make this request in writing, and the debt collector has 60 days to comply with your request.

When responding to your request, they must give you the following information:

The contract or application you signed relating to the debt. If this isn’t available, then the debt collector will give you a copy of a document from the original creditor showing you owe the debt.

A statement from the original creditor showing its intent to charge off the debt and send it to a debt collector. This typically occurs by selling your debt to a debt buyer.

A statement explaining how the current debt collector obtained the debt from the original creditor.

If applicable, any information concerning an earlier debt settlement.

In some situations, you and the creditor may reach a payment agreement or debt settlement. In either situation, the debt collector must give you written confirmation of your agreement within five days afterward.

Then, while you’re paying off the debt, they must give you a statement reflecting your payments at least every three months. When you finally pay off the debt, the debt collector must confirm the debt has been paid off within 20 days.

What Are the New York City Debt Collection Regulations?

Debt collection regulations are even stricter in New York City than in New York state. In addition to what’s required under the FDCPA and state law, New York City debt collectors must also:

Be licensed by the NYC Department of Consumer and Worker Protection (formerly known as the NYC Department of Consumer Affairs)

Limit their debt collection phone calls to just twice per week

Some other municipalities in New York have local laws concerning debt collection as well. For example, Buffalo also requires consumer debt collectors to be licensed.

The CCFA Further Strengthened Consumer Protection

On Nov. 8, 2021, New York enacted the Consumer Credit Fairness Act (CCFA). The CCFA modified the New York Civil Practice Law and Rules (CPLR) and expanded consumer protections.

Key Provisions in the CCFA

Like the FDCPA, CCFA covers debt collection activities. But the CCFA provides further regulations for debt collection lawsuits in the state of New York.

Key provisions include:

The statute of limitations for most debt collection actions involving consumer debts was reduced from six to three years.

A consumer who makes a payment on a debt doesn’t automatically reset or revive the statute of limitations deadline if the time limit has already expired.

The debt collector must give the consumer notice about the lawsuit. They must also provide information about defending against a debt collection lawsuit. This notice must explain what could happen if the consumer doesn’t respond to a pending debt collection lawsuit and list available resources to defend against the lawsuit.

A creditor or debt collector who sues an individual can’t get a default judgment if notice about the debt collection lawsuit is undeliverable.

The legal complaint must include a copy of the original agreement or contract giving rise to the consumer’s obligation to pay the debt. If the legal action is to collect an unpaid credit card debt, then the legal complaint must include a copy of the charge-off statement.

When starting a debt collection lawsuit, the debt collector must provide several key pieces of information. These include the identity of the original creditor, the last four digits of the account number of the debt, when the last payment was made, the amount of the last payment on the debt, and a breakdown of the components of the total amount of the debt (such as fees and interest).

If the plaintiff isn’t the original creditor, it can only get a default judgment against the consumer-defendant if it provides an affidavit (a sworn statement) from the original creditor. This affidavit will serve as partial validation that the plaintiff suing the consumer has the right to collect the debt even though it originated with someone else.

This affidavit from the original creditor must contain information about the debt the plaintiff is now trying to collect. Specifically, the affidavit should include:

When and how the defendant defaulted on the debt.

Details about the sale or transfer of the debt from the original creditor to a third party.

How much the debt was when it was transferred or sold.

An affidavit of sale by any entity selling the debt.

An affidavit from the plaintiff confirming all parties who’ve owned the debt and how the debt worked its way from the original creditor to the current debt collector

Let's Summarize...

If you’re a resident of New York, you enjoy a variety of legal protections against unfair and illegal debt collection agency tactics. These rights come from federal and state law, and in some areas, local law as well.

At the federal level, there’s the Fair Debt Collection Practices Act. At the state level, there’s the Consumer Credit Fairness Act, which goes beyond the FDCPA. This state law gives consumers more rights during debt collection lawsuits. Some municipalities also have their own regulations for debt collection. NYC’s are particularly strong.

If you think a debt collector or creditor has violated any debt collection law, you can file a complaint with the New York Bureau of Consumer Frauds & Protection, the Federal Trade Commission, or the Consumer Financial Protection Bureau (CFPB). If you’d rather take legal action against the creditor or debt collector, you can contact a lawyer. They can offer you legal advice and might agree to take your case and file a lawsuit on your behalf.