How To Win Against Unifin

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If Unifin contacts you to try to collect a debt, know your rights and fight back. Start by making sure they can validate the debt and its details. Then, decide what to do next. If you don’t owe the debt, dispute it. If you do owe it, negotiate a settlement for less than the full amount. If you get sued by Unifin, respond to the lawsuit using the information provided in this article.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated October 13, 2025

Table of Contents

Why Is Unifin Contacting Me?

Unifin is a debt collection company. If you get a phone call or letter from Unifin, they’re probably trying to settle an unpaid account. The original creditor or lender usually tries to collect a debt for several months before they sell your account to a third-party collection agency like Unifin. If you defaulted on a credit card, student loan, or other account, the original creditor may have sold your debt to Unifin.

For more information, please read our guide, How to Deal with Unifin.

Do I Have To Pay Unifin?

If Unifin can validate the debt they say you owe, and you don’t dispute the debt, you usually need to pay it. If you don’t pay, you might face serious consequences, ranging from your credit score taking a hit to your paycheck being garnished. That said, many people successfully negotiate a debt settlement and pay less than the full amount they owe.

How To Negotiate a Debt Settlement With Unifin in 3 Steps

While it may seem strange, debt collection is a profitable business for many third-party collection agencies, such as Unifin. These companies make money by buying your debt from the original creditor (or another debt buyer) for pennies on the dollar.

Buying and selling debt may seem shady, but it’s legal. And it has a silver lining for you: It gives you power to try to negotiate your debt amount. Depending on your situation, you may be able to settle the debt and pay just 40%–60% of the total amount you owe.

Sometimes debt collectors like Unifin will reach out with a settlement offer, but being proactive and initiating the settlement yourself shows Unifin that you know your rights.

Step 1: Make Sure the Debt Is Valid

According to a Consumer Financial Protection Bureau (CFPB) debt collection rule, third-party debt collectors must send you a validation letter and give you 30 days to dispute the debt. If Unifin has sent you a debt validation letter, the first step is to verify the details of the debt and make sure the account details look correct. If you haven’t received a debt validation notice from Unifin, send them a debt verification letter requesting details of the debt. You can also use this letter to dispute the debt if you don’t agree that you owe it.

When validating a debt, you want to make sure that:

The debt actually belongs to you — it may not if you experienced identity theft or were misidentified as the account holder.

Unifin actually owns the debt.

The debt amount is correct.

If you’re certain that the debt is valid, you can move on to the next step.

Step 2: Figure Out What You Can Pay

If you can’t pay the full debt but think you can pay part of it, figure out how much. It’s important not to promise to pay more than you can afford or to divert funds you need for essentials like housing and food.

To figure out how much you can pay, add together all your income sources and subtract your expenses and existing debt payments. Then, look at what’s left.

The CFPB has a helpful budget worksheet and debt worksheet that simplify this process. If it still feels overwhelming, schedule a free consultation with an accredited nonprofit credit counselor to get help.

Can You Use a Payment Plan if You Settle a Debt?

Unifin and other collection agencies are often more likely to accept lump-sum payments than payment plans. Once they get the lump-sum payment, their work is done, and there’s no risk of you defaulting on a payment plan.

If a payment plan is your only viable option, explore ways to increase the chances of Unifin accepting your proposal. For instance, some companies may agree to multiple payments if you allow direct withdrawal from your bank account.

Sometimes, you may be able to use a windfall to settle a debt in one lump sum. For example, if you’re expecting a tax return or work bonus, consider putting it aside to use as a lump-sum settlement payment.

Step 3: Make a Settlement Offer to Unifin

Now that you know how much you can afford to pay, make an offer. Start lower than where you hope to end up! This is a negotiation, after all. Also, expect a few rounds of back and forth. This is normal.

It’s best to make your offer in writing. In fact, you should always communicate with debt collectors like Unifin in writing so you have a record.

Don’t Just Negotiate the Amount… Negotiate Everything!

You can negotiate several important aspects of the debt account, including how you repay the debt — one lump sum versus a payment plan — the timeline of the payment plan, and the payment amount. If you propose a monthly payment amount and timeline, make sure you feel confident you can stick with it.

Finally, negotiate how Unifin reports the account to credit bureaus. Debt collectors may choose to report the debt as “paid in full,” “partial payment,” or “settled.” Ask them to report it as paid in full. This can help boost your credit score.

You don’t have to do all this alone. Use Upsolve’s Debt Settlement Letter template to help you draft your offer letter.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Usually, yes! And it’s often wise to do so.

Here’s a note of caution, though: If you’re working on a settlement agreement with the debt collector while there’s an ongoing court case against you, don’t stop responding to court notices or fail to appear when required!

Assume the legal matter is still valid and ongoing unless and until the case is closed or dismissed. To learn more, read Can I Settle a Debt After a Lawsuit Has Been Filed?

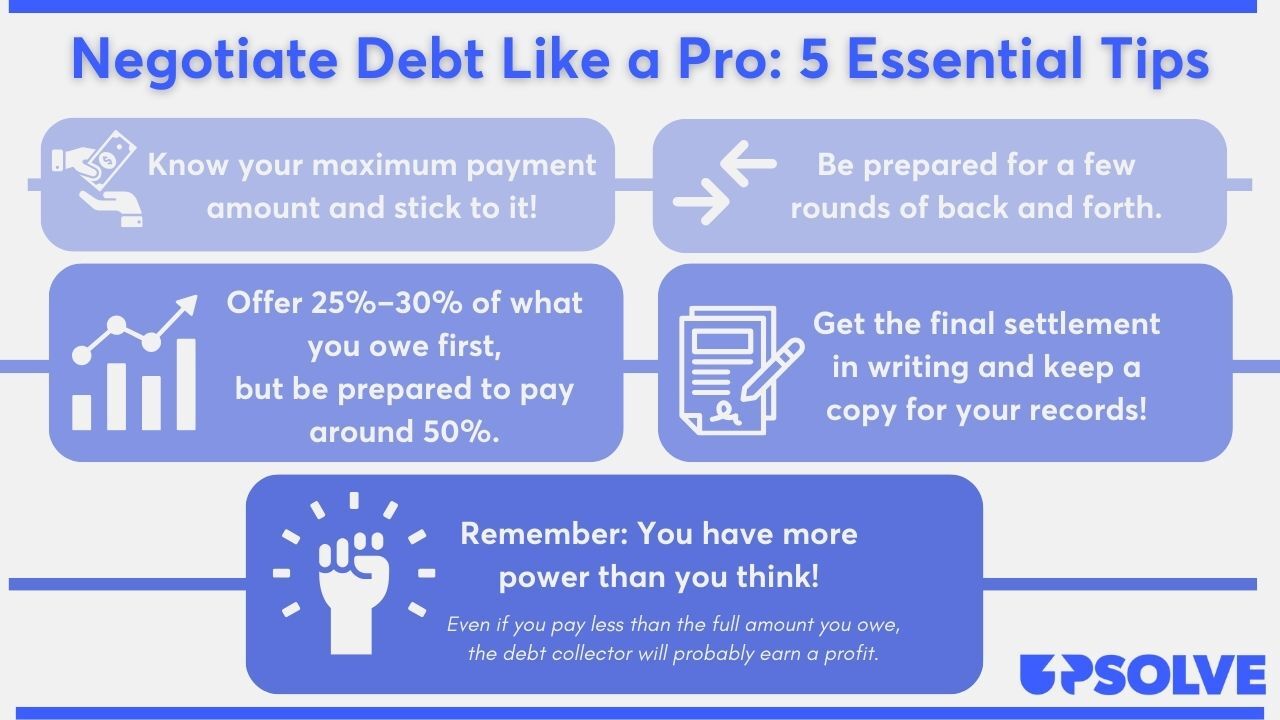

Tips for a Successful Debt Settlement

Negotiating can be an intimidating process. Follow these tips to boost your confidence and increase your chances of settling successfully:

For even more tips and info, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Unifin in a Debt Lawsuit

If you have an outstanding debt with Unifin, and they haven’t been successful in getting you to pay it, they may eventually decide to sue you. It can be hard to tell if notices you receive are official documents or not. If you are being sued, you will receive an official notice from the court. This usually comes in the form of two documents: a summons and a complaint.

It’s critical to respond to the summons (you can usually do this on your own without hiring a lawyer). If you don’t, you may find your paycheck or bank account being garnished. (Though Unifin has to get a court order before they can do this.)

Responding to the lawsuit is easier than you might believe. Let’s get into the simple three-step process.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped over 280,000 people respond to debt lawsuits and settle debt, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document notifying you that you’re being sued. It usually also tells you:

The court name and address

The name and address of the parties involved

The case number

The nature of the lawsuit

Additionally, there’s frequently a disclaimer about the legal consequences of not responding to the lawsuit. There may also be instructions to the defendant. If you’re the one being sued, you’re the defendant. The person suing you is called the plaintiff.

Finally, there should be a deadline to respond to the lawsuit. Sometimes this comes in the form of a specific date; other times, it will tell you how many days you have to respond.

The complaint accompanies the summons and tells you the claims being brought against you. These are usually laid out in numbered paragraphs.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Many courts provide templated answer forms you can use to respond to a debt lawsuit. This makes it much easier to reply to the lawsuit, but you still have to do some work.

To see if your court has an answer form you can use, simply google the court name on the summons plus “answer form” or “court forms,” and see if one comes up. You can also call or visit the court clerk to ask if they have an answer form you can use. Clerks can’t give legal advice, but their job is to help you understand court processes, resources, and documents.

If your court does have a templated answer form, it’ll usually contain a page of instructions as well. Follow the instructions to fill out the form.

This is often your chance to raise any affirmative defenses you have, too. An affirmative defense is any information the debt collector left out of their complaint that could lead to them losing the case. To learn more and read a list of common affirmative defenses in debt lawsuits, read Upsolve’s article: 3 Steps To Take if a Debt Collector Sues You.

Some courts may require you to submit additional forms, such as a certificate of service (though often this is included in the answer form). Again, this varies by court, so check your court’s website or ask the court clerk.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

Once you’ve filled out the answer form and all other required forms, you’ll need to file the papers with the court and serve (deliver) a copy to the plaintiff.

This process, too, often varies by court. You can almost always do it in person, but if that’s not convenient for you, look on the court’s website to see if they allow e-filing or mailing in the response. Sometimes the summons will tell you your filing options. Again, you can always ask the court clerk.

Finally, you’ll usually be required to send a copy of your answer form to the person suing you (the plaintiff). This process is called “service.” Often you can serve the answer form by simply mailing it to the plaintiff (or their lawyer) at the address listed on the summons. Some courts allow you to email the answer form, too.

Let’s Summarize…

If Unifin has contacted you about a debt, always start by making sure the debt is valid. Then, it’s time to fight back. Dispute the debt if it isn’t valid. If it is valid, figure out how much you can pay and negotiate a settlement. If you’re being sued, it’s not too late to settle the debt, but it’s crucial that you also answer (respond to) the lawsuit. This process varies by court, so check with the court listed on your summons to learn more.