How To Beat CCS Offices

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

CCS Offices is a third-party debt collection agency. If they contact you, they’re probably trying to get you to pay on a collection account they purchased from one of your creditors. Make sure they validate the debt before you pay anything. If the debt is valid but you can’t afford to pay the full amount, try to negotiate a debt settlement. If CCS Offices sues you, you can still try to negotiate a settlement, but it’s important to respond to the lawsuit as well. You can respond by filling out an answer form from the court.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated January 21, 2026

Table of Contents

Why Is CCS Offices Contacting Me?

CCS Offices may have purchased your debt if you failed to pay a credit card, personal loan, utility bill, or medical bill. If CCS Offices bought your original debt, they will reach out to notify you that the debt has been transferred to them and is no longer payable through the original debtor. CCS Offices is also known as Credit Collection Services.

Do I Have To Pay CCS Offices?

It depends! To determine if you need to pay CCS Offices, ask yourself the following three questions:

Did CCS Offices validate the debt, and is all of the validated information (amount owed, account number, and name) correct?

Have you claimed the debt and stated that it is yours and that it belongs to you?

Is this an undisputed debt?

If you can answer yes to any or all of these questions, you probably need to make a plan to repay the debt. But you might not have to pay it all. If you can’t afford the full amount, consider trying to negotiate a debt settlement agreement with CCS. Here’s how.

✨ If settling this debt isn’t realistic because you’re dealing with multiple debts, Chapter 7 bankruptcy may be another option. If your case is simple, you may be eligible to use Upsolve’s free filing tool.

How To Negotiate a Debt Settlement With CCS Offices in 3 Steps

It might surprise you to learn that you can negotiate to pay less than the full amount of your debt. This is possible because debt collectors like CCS Offices usually buy collections accounts for much less than they’re worth. Since they’ll probably still make money even if you pay less, they’re usually open to negotiating the debt to close the account and move on.

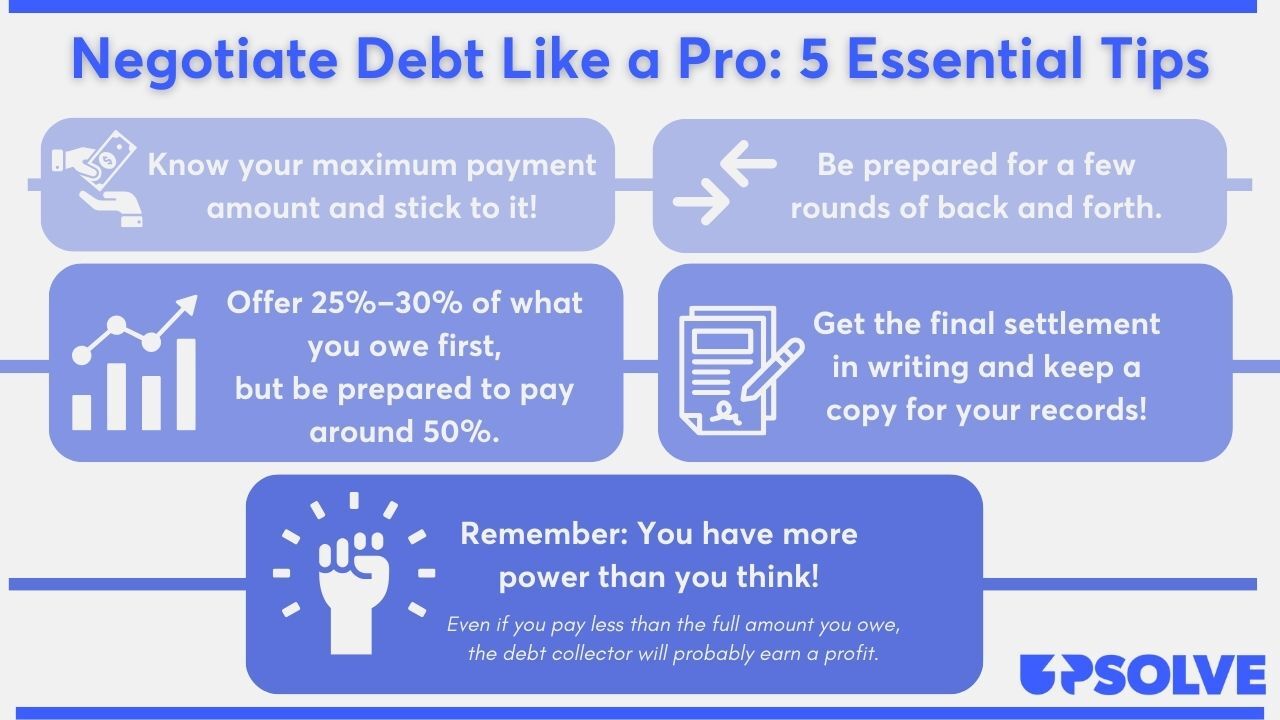

You can expect to settle the debt for around 40%–60% of the total amount. Sometimes debt collectors reach out with a settlement offer, but you take the initiative and start negotiations yourself.

Step 1: Make Sure the Debt Is Valid

The Consumer Financial Protection Bureau (CFPB) requires that debt collectors provide you with a debt validation letter before they first contact you or within five days after first contacting you. If you haven’t received a validation letter, request one.

The debt validation letter should tell you:

The account number

The account holder’s name and information

The name and contact information of the creditor

The amount of the debt, including payments, fees, and interest

If any of this information is incorrect, you can dispute the debt, but you need to do so within 30 days of receiving the letter. You can dispute the debt or request further information using a debt verification letter.

If everything looks correct with the debt validation letter, proceed to the next step.

Step 2: Figure Out What You Can Pay

Once you’ve validated that the debt is yours and all the information is accurate, it’s time to figure out how much you can pay. Consider your budget and any upcoming major life events that may affect your finances.

Understandably, looking at your itemized finances can feel overwhelming, but you don't have to go at it alone. If you need additional help creating your budget, use the CFPB’s budget and debt worksheets or set up a free consultation with an accredited nonprofit credit counselor. A credit counselor can help you understand all your debt-relief options, which can be really helpful if you’re struggling to repay several accounts.

Lump Sum vs. Payment Plan: Which Is Better?

After you've come up with a dollar amount you can pay, consider whether a lump sum or monthly payment is right for you. You may be able to significantly reduce the amount that you owe if you pay via a one-time lump sum payment.

You can also negotiate to make monthly payments at a lower amount. However, you want to ensure you can commit to paying an amount you can comfortably make for the set time frame you agree with.

Step 3: Make a Settlement Offer to CCS Offices

Many debt collectors are willing to settle for 40% to 60% of the original amount owed. Start the negotiations with a lower offer than you can afford. Many debt collectors have a minimum threshold they are willing to accept. You won’t know that number if you start off with a high debt settlement number.

When you’re negotiating, you want to ensure you get everything in writing. Once you agree to a settlement amount, ask the debt collector to send you a copy of the agreement in writing.

Don’t Just Negotiate the Amount… Negotiate Everything!

You can also work with CCS Offices to make your payments on a day of the month that works best for you. For example, if you pay most of your bills during the first week of the month, it may be more financially convenient to set your monthly debt payment sometime mid-month.

You can also negotiate how the debt collector reports your repayment with the credit bureaus. They can report the account as paid in full, partial payment, or settled. Ask part of the negotiation, ask if they’d be willing to report the account as “paid in full.” If they agree, this can help boost your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Yes, you can usually still enter into a debt settlement agreement if you’ve been notified via a complaint and summons that CCS Offices has initiated a lawsuit.

However, do not ignore a complaint and summons. You have a set amount of time to file your response before the courts grant a default judgment, which lets CCS Offices take more aggressive collection action. It is often easier than you think to file an answer according to the court's instructions.

Tips for a Successful Debt Settlement

With the right information, you can empower yourself as you negotiate with CCS Offices. Taking action and exercising your consumer rights puts you in the driver's seat to negotiate an offer and remove a weight from your shoulders.

For even more tips and info, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat CCS Offices in a Debt Lawsuit

If you get sued for a debt, try not to panic or shut down. With the right information and a timely response, you can save yourself from additional trouble like having your paycheck garnished.

Thankfully, responding to the complaint and summons is easier than most people think. It’s usually a matter of filling out some paperwork called an answer form.

Many courts provide packets that fully explain how to fill out your answer form, when and how to file it, the cost of the filing fees (if there are fees), and the process for attaining a fee waiver if you qualify.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 340,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: Read the Summons and Complaint Carefully

A summons is a legal court document notifying you that the plaintiff — in this case, CCS Offices — has filed a lawsuit against you. The summons usually includes the following information:

The court name and address

The case number

The time you have to file your answer — this varies by court so make sure you read the summons carefully and file your answer well before the deadline

The parties to the case, including the plaintiff (CCS Offices) and the defendant, which is the person being sued (you)

A complaint accompanies the summons and outlines the accusations or claims the plaintiff is asserting against you. This document also outlines what the plaintiff wants to receive, usually referred to as damages.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Once you understand the claims against you, it's time to respond to the lawsuit. This is called your answer.

Do an internet search of the court's name and “answer form.” You may be able to easily access the answer forms online. The answer form for each court and state varies so avoid using a generic form that may not be accepted.

You could also look for the court clerk’s contact information and call to ask about where to find the form. While they can’t give you legal advice, the clerk can let you know how much the filing fees are and the process for filing your answer.

How To Use Defenses the Your Answer Form

You can also raise defenses or affirmative defenses in your answer form. This is your chance to fight back legally.

An affirmative defense is a legal reason why the plaintiff, CCS Offices, should not win the case. Here is a list of common defenses:

You were not served properly.

You filed for bankruptcy.

You’ve already paid off the debt.

You were a victim of identity theft.

You do not actually owe CCS Offices, and they’ve named the wrong person or entity in the summons and complaint.

To learn more about defenses and what to do if a debt collector sues you, read Upsolve’s 3-Step Guide to Responding to a Debt Collection Lawsuit.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

The exact process for filing an answer varies by court, so follow the instructions for the specific court listed on the summons. If you still have questions, feel free to call the court clerk in the civil division for answers to your filing questions.

Regardless of the court's specific instructions for filing the answer, you will most likely be responsible for delivering or “serving” a copy of your filed answer to the plaintiff. This is usually done by mail, but again, the court clerk can help you understand the process.

Let’s Summarize…

Receiving a summons and complaint in the mail may shock you, but you can take steps to win your case against CCS Offices and even settle your debt. Unfortunately, many Americans lose their debt collection cases for failure to respond, mainly due to fear or not knowing what to do. It may be easier to file on your own behalf. You’ve already taken a major step by informing yourself. Keep loading your tool belt with the knowledge to help you beat CCS Offices and reduce your debt via negotiation.