How To Answer a Washington Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you’re sued for a debt in the state of Washington, it’s important to respond! And it might be easier than you think. Here are the basic steps: 1. Fill out an answer and appearance form. 2. Complete a certificate of service form. 3. File your forms with the court within 20 days of receiving the summons. 4. Deliver a copy of your answer form to the person suing you.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated November 10, 2025

Table of Contents

How Do Debt Collection Lawsuits in Washington Work?

About a quarter of all Americans have at least one debt in collections. Once your account is in a debt collector’s hands, you’ll receive phone calls and written notices. If you ignore these collection efforts, the creditor or the debt collector may decide to bring a debt collection lawsuit against you.

In Washington state, debt collection cases can be filed in either a district or a superior court. Every county in Washington has both types of courts.

District courts hear claims up to $75,000. The small claims division of district courts is simpler to navigate, and these courts hear claims of up to $5,000.

Many debt collection cases in Washington are filed in a district court, but it isn’t unusual for a superior court case to hear these cases too. Regardless of where your case is heard, read all forms and papers you receive from the court carefully and follow instructions promptly.

What Is a Summons and Complaint?

A summons and complaint are official court documents.

The summons notifies you that a lawsuit has been filed against you. This document will tell you the deadline to respond to the complaint and which court will hear your case.

The complaint outlines the allegations, or claims, that the plaintiff is making against you. The plaintiff is the legal term for the person who’s suing you. In a debt collection lawsuit, the complaint will list claims about your debt, such as how much the collector thinks you owe and why they believe you owe it.

The complaint will also explain what the debt collector wants from the lawsuit. Usually, they are looking for a court-ordered money judgment to collect the debt. The judgment amount could include the debt the collector believes you owe, any interest that has accrued since your last payment, and any other costs the plaintiff thinks you should cover as a part of the lawsuit, such as legal costs.

If you get sued, you should receive the summons and complaint by personal service. This means that either the sheriff’s office or a private process server has to hand-deliver the summons and complaint to you.

You can also be served by certified mail, but only if and after personal service fails. The plaintiff has to file a motion and get a court order if this happens.

How Do You Respond to a Washington Court Summons for Debt Collection?

In Washington state, it’s best practice to fill out and file both an answer form and a notice of appearance form with the court handling the case. Keep in mind that not acknowledging your lawsuit is almost always a surefire way to lose. This can have serious consequences (more on this below).

To respond to the lawsuit, fill out an answer and appearance form. Next, complete the certificate of service form. Then, file your forms with the court within 20 days of receiving the summons. Finally, deliver your completed paperwork to the plaintiff (the person suing you).

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

How Do You Fill Out an Answer & Appearance Form?

The first two forms to fill out are the notice of appearance and a written answer. The notice of appearance tells the court you acknowledge the lawsuit and plan to appear in court. This form does not mean that you agree with anything the plaintiff said in their complaint. The written answer lets you explain your side (or defenses) in the lawsuit.

WashingtonLawHelp.org has excellent resources on its website with instructions and forms you can use to complete and file your answer. The court (listed on your summons) may also have forms and instructions on its website.

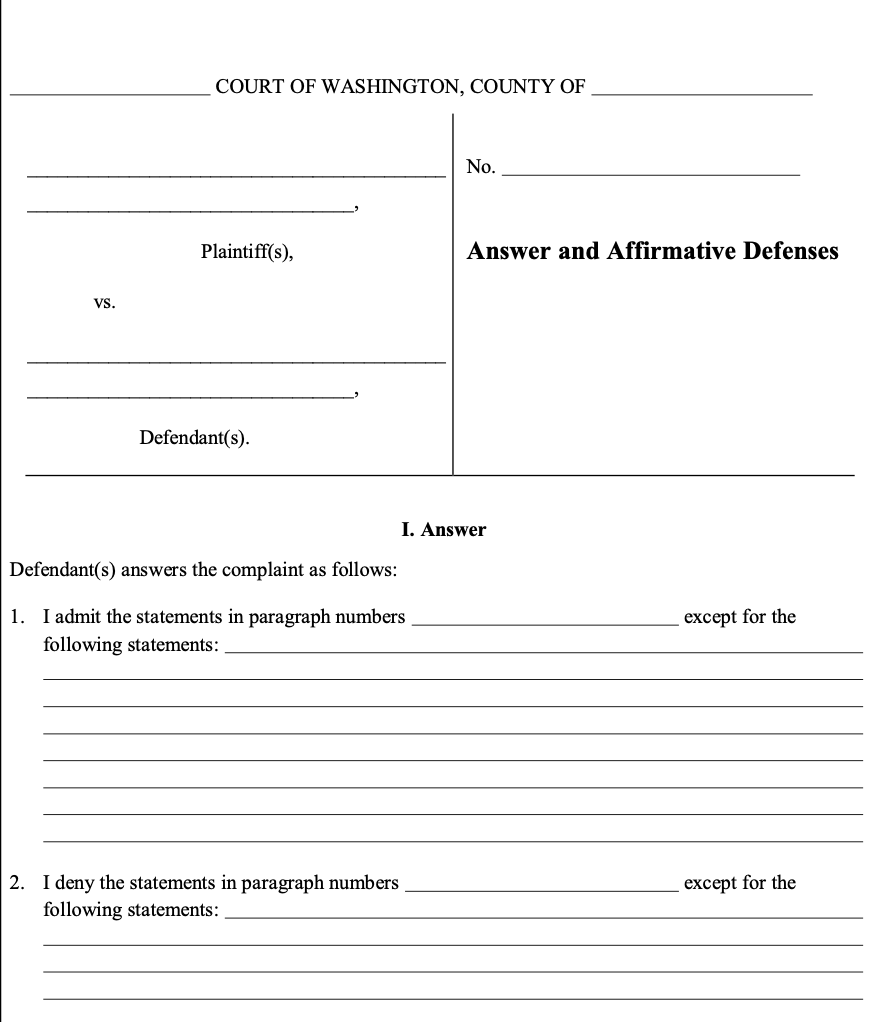

Here’s what the first page of the answer form looks like:

Step 1: Address Each Complaint/Allegation on the Answer Form

Complaints are the plaintiff’s allegations or claims against you, presented in numbered paragraphs. When you fill out your answer form, be sure to address each of these allegations by number. You can respond by either:

Admitting, which means you agree with the statement

Denying, which means you disagree with the statement

Claiming a lack of knowledge, which means you don’t know if the statement is true or not or you need more information

In Washington state’s answer form, you group your responses by answer type. All of your admissions will be laid out in the first section, all of your denials in the second section, and all of your “lack of knowledge” responses in the last section. Make sure your responses address and match up with the numbered paragraphs on the complaint.

Step 2: Raise Your Defenses and Counterclaims on the Answer Form

After you address each statement in the complaint, you have the opportunity to raise any affirmative defenses you have. An affirmative defense is a reason you shouldn’t have to pay the debt. These defenses are usually based on information that the plaintiff didn’t include in their complaint.

WashingtonLawHelp.org outlines some examples of common affirmative defenses, including:

You already paid the debt.

The debt was discharged in bankruptcy.

The statute of limitation has expired.

Your debt was from medical bills and you’re eligible for Charity Care.

If you’re not sure how to navigate the process, the Northwest Justice Project may be able to help. They offer free legal assistance and help connect individuals to other legal aid providers throughout Washington as well.

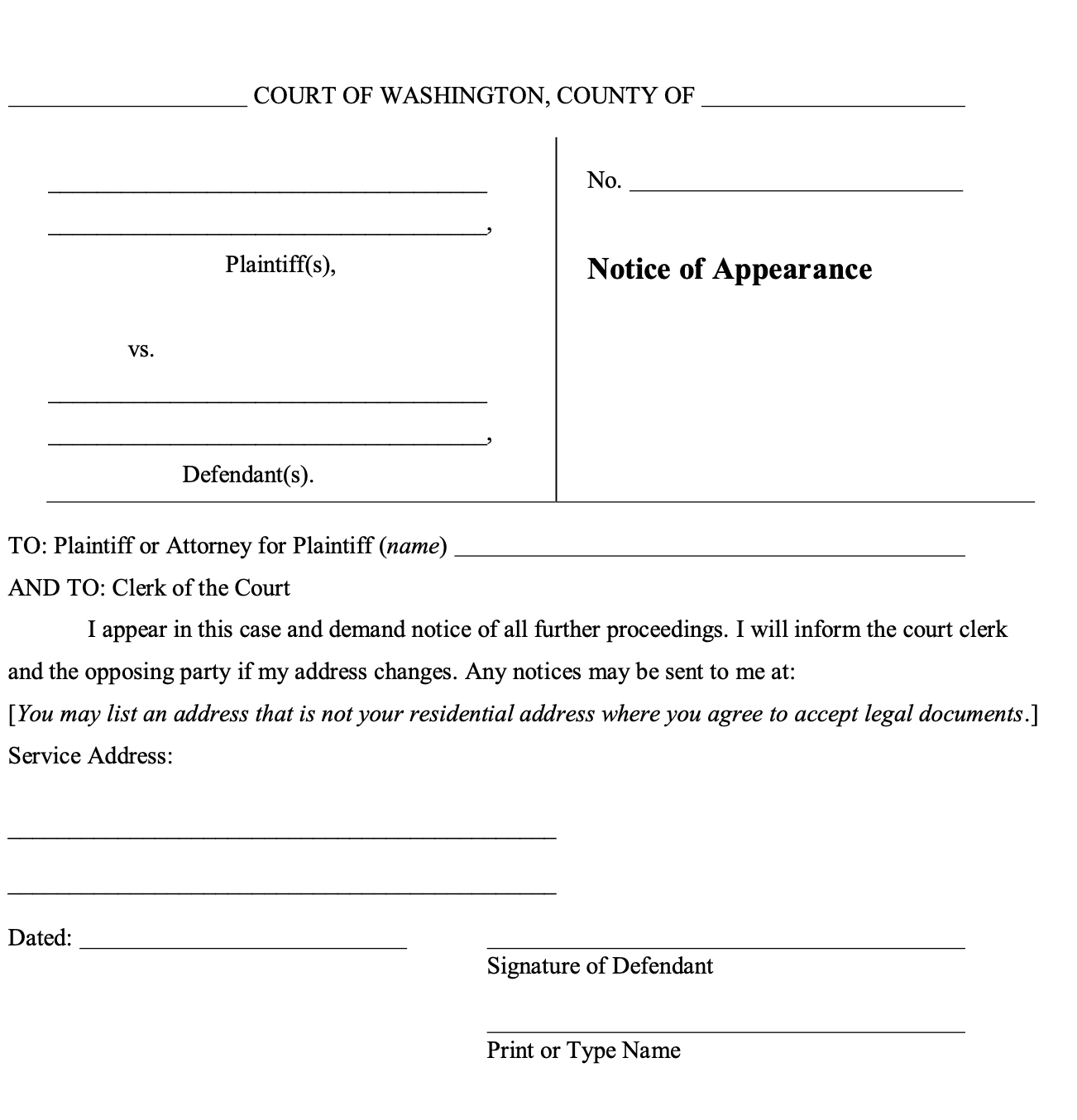

Step 3: Fill Out the Notice of Appearance

While you can file the notice of appearance form on its own, it makes the most sense to fill it out and file it alongside the answer. The best way is to follow WashigntonLawHelp.org’s template.

The notice of appearance does exactly what it sounds like: notifies the court that you will appear in the lawsuit.

Here is what the notice looks like:

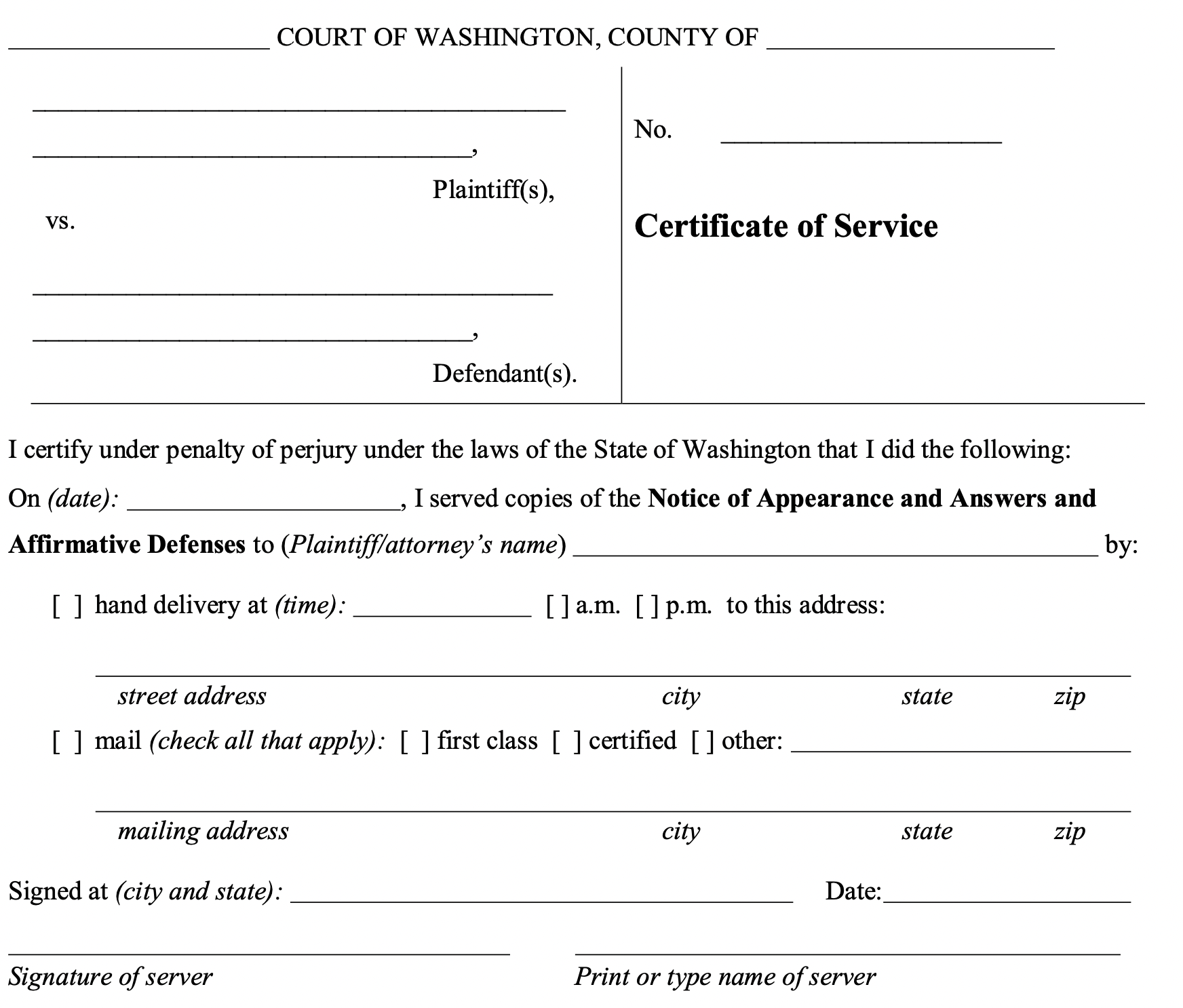

Step 4: Complete the Certificate of Service

You are required to send a copy of both your answer form and your notice of appearance to the plaintiff (the person/company suing you). This lets them know that you're responding to (and potentially contesting) their claims.

In the certificate of service form, you will indicate the method of delivery. You can either hand-deliver the copy to the plaintiff (or their lawyer if they have one) or send it through first-class mail. You can find the plaintiff’s name and address on the summons you received.

You will then serve the plaintiff (or their lawyer). To “serve” means to deliver in legal terms. You’re required to serve your answer form (and counterclaims) on the plaintiff at the address listed on the court summons. Often, but not always, this will be an attorney representing the creditor or debt collector.

In Washington, you can either hand-deliver the copy or mail using first-class mail.

Here is what a certificate of service form looks like:

Step 5: File Your Forms With the Court Clerk Within 20 Days

After you fill out the answer and appearance forms, you’ll make two copies of your forms. In total, you’ll have three forms:

File the original with the court clerk.

Serve (deliver) one copy on the plaintiff.

Keep a copy for your records.

You have to file your answer, appearance, and certificate of service forms with the court within 20 days of receiving the summons. File your forms in the court named at the top of your summons.

What Happens After You Respond to the Lawsuit?

Generally, after you file your notice of appearance with the court, the judge will set a hearing date and send you notice of it. This notice may be delivered by mail, electronically, or both — depending on the court and county.

If you don’t file at least a notice of appearance within 20 days of receiving the summons, the court can enter a default judgment against you with or without a hearing. This basically means you lose the case. (More on default judgments below.)

You must appear in court on your hearing date. The trial may happen on that day, or the court may review the claims and defenses and set the case for trial at a later date. You should be ready to defend your case and explain your side of the story on the first hearing date, just in case.

How To Prepare for Court Appearances

It’s normal to feel intimidated or overwhelmed when dealing with the court system. But many people find their confidence increases by spending a little time preparing and following some simple best practices, such as:

Arrive early for your hearing.

Speak respectfully to the judge and other people in the courtroom.

Dress professionally.

Be organized and bring copies of relevant documents to support your defenses.

Upsolve’s article on What Happens In Small Claims Court has other helpful tips.

What Happens if You Don’t Respond to the Lawsuit?

The most important thing you can do in a debt lawsuit is acknowledge it and take action. If you ignore the lawsuit, it won’t just go away. Instead, you’re likely to lose the case and have a default judgment issued against you.

This allows the person or company suing you to request a court order for wage garnishment, a bank account levy, or a property lien.

Debt collectors count on you not showing up to court or responding to the lawsuit. If you take action and respond to the lawsuit, you give yourself a fighting chance to win the debt collection lawsuit.

What Do I Do if the Court Already Issued a Default Judgment Against Me?

If a default judgment has already been ordered against you, you can file a motion to vacate the judgment. To vacate means to cancel the judgment ordered.

WashingtonLawHelp.org has helpful forms and instructions on their website.

Need Legal Help?

WashingtonLawHelp.org has self-help guides and resources online and a comprehensive legal aid directory with links to local and statewide resources.

King County Bar Association provides free legal clinic aid to low-income King County residents.

Washington State Bar Association has an online hub with links to local and statewide legal aid resources.

Northwest Justice Project provides legal assistance to low-income residents statewide.

Washington Pro Bono Council connects residents to legal aid resources and providers in their area.