How To Respond to a Pennsylvania Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

In Pennsylvania, if a debt collection lawsuit has been filed against you, the first thing you need to do is file a Notice of Intention to Defend. You can do this by either calling your court or going in person. If you disagree with the claims against you, you can explain your defenses in your notice. Then, follow any instructions from the court you receive via court notices or ask the court clerk about next steps.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated October 12, 2025

Table of Contents

How Do Debt Collection Lawsuits in Pennsylvania Work?

Debt can happen quickly. If you get behind on your bills, you can fall into debt before you know it. And failing to pay off your debt or respond to debt collection efforts may even result in a debt collection lawsuit.

In Pennsylvania, most debt collection cases are filed in a Magisterial District Court in your county. This is essentially Pennsylvania's small claims court. Some debt collection cases may be filed in your county’s Court of Common Pleas.

One important exception is Philadelphia. In the city of Philadelphia, debt collection cases up to $12,000 will be heard in Municipal Court instead of a Magisterial District Court.

Local rules and forms vary among courts, so it’s always a good idea to reach out to your court for assistance if needed. The Unified Judicial System of Pennsylvania has a Magisterial District Judge directory and a Philadelphia Municipal Court Judge directory that can connect you to a judge's office in your county.

If you get sued for unpaid debt, you will receive a summons and complaint notifying you of the lawsuit.

What Is a Summons and Complaint?

A summons and a complaint are official court documents.

The summons notifies you that a lawsuit has been filed against you. It will tell you the deadline to respond to the lawsuit and which court will hear your case. It will also list the name of the plaintiff (the person suing you) and their lawyer if they hired one to represent them. (This is common.) The summons should include information about what you need to do next, what happens if you don’t respond to the lawsuit, and what your deadline for responding is.

The complaint outlines the plaintiff’s claims against you. For example, the complaint will list how much the debt collector thinks you owe and other details about the debt, like when you made your last payment.

The complaint will also explain what the debt collector wants. Usually, they are looking for a court-ordered judgment to collect the debt. The judgment amount may be higher than the debt amount. That’s because it could also include any interest that has accrued since your last payment and other costs the plaintiff thinks you should cover as a part of the lawsuit, such as legal fees.

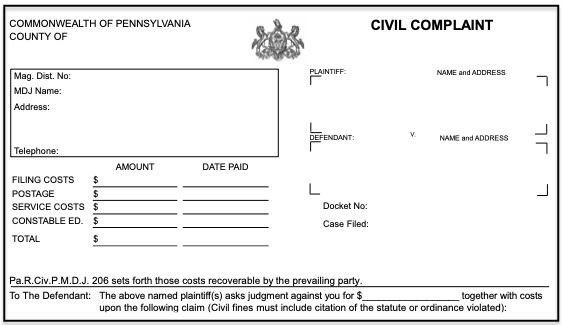

Here is an example of what a complaint in the state of Pennsylvania looks like:

How Will the Summons Be Delivered?

The person suing you must deliver the summons and complaint according to court rules. If they don’t, you can use this as a defense and potentially get the case thrown out. In legal terms, formally delivering documents is called service or being served.

The plaintiff can arrange to deliver the documents by personal service or by certified mail with return receipt. Personal service must be performed by a sheriff or constable. They can directly serve you or leave the documents with an adult member of your family, apartment manager, or another adult in charge of your business if they come to serve you when you’re not present.

How Do You Respond to a Pennsylvania Court Summons for Debt Collection?

Your summons will include a court date and other instructions for how to proceed with your lawsuit. Most small claims courts (Magisterial District Courts) don’t require you to file a written answer. But local rules and procedures vary among small claims courts, so be sure to read the complaint carefully and contact the court if you have any questions.

Generally, for Pennsylvania Magisterial District Courts, you’ll call the court listed on the complaint and tell them you would like to file a Notice of Intention to Defend.

Since this process varies by county, it's important to contact the court listed on the summons as soon as possible to clarify your options. Even if your court doesn’t require a written answer, it’s always a good idea to at least write down your responses and defenses to the claims in the outline to take with you to court.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: File a Notice of Intention to Defend

Each Pennsylvania county has its own rules and procedures, but typically you need to file a Notice of Intention to Defend as soon as possible after being served with a complaint and summons.

You file a Notice of Intention to Defend by either calling your court or going in person and telling the clerk you want to respond to the lawsuit. It's a good idea to file at least five days before the date set for the hearing. The hearing date will be written on your complaint.

Step 2: Prepare Your Defenses

If you disagree with the claims against you, you can include and explain your defenses in your Notice of Intention to Defend. A general defense is like saying, “What the debt collector said isn’t true.” You can also raise affirmative defenses. These are basically reasons why the plaintiff (the debt collector suing you) shouldn’t win the case even if what the debt collector said in the complaint is true.

Common affirmative defenses include:

The debt isn’t yours due to a case of identity theft or mistaken identity.

The statute of limitations has run out.

You don’t owe the debt because you already paid it.

You’ll need to bring any evidence you have that may support your defenses, including copies of contracts, account statements, purchase receipts, and other documents.

Step 3: File a Counterclaim/Cross-Complaint if the Plaintiff Is in the Wrong (Optional)

If you believe the plaintiff (debt collector) actually owes you money or that they violated your rights or caused harm, you can file a cross-complaint in response to their complaint. Just like with the Notice of Intention to Defend, you need to file this at least five days before the date set for the hearing.

You can file the Notice of Intention to Defend on your own without a lawyer. But a countersuit is more difficult to navigate, so contacting a lawyer may be the best move.

What Happens After You Respond to the Lawsuit?

Typically, after you file your Notice of Intention to Defend, the court will notify the plaintiff (the person suing you) that you intend to defend yourself.

After you file your defense(s), the court will likely set a trial date. Don’t confuse this with the hearing date from the complaint that you received. You may still need to show up to that hearing.

If you get information about a trial date before your hearing date arrives, clarify with your local court whether or not you need to attend the hearing as well. Remember, in Pennsylvania, court procedures vary by county, so it’s important to verify your next steps with the court listed on the complaint and/or follow instructions on any court notices you receive.

What Happens at the Trial or in Mediation?

At the trial, the plaintiff will present their case first. Then, you’ll have a chance to present your side. Bring any evidence or supporting documents you have with you. Remember, the burden of proof falls on the plaintiff. This means it’s their job to prove to the judge that you owe the debt.

Depending on the court, you may also have the chance to settle your case prior to the trial via mediation. In mediation, a trained, neutral mediator works with both sides to help them try to reach an agreement.

You can also contact the creditor or debt collector directly to try to settle the debt outside of court. If you do this, it’s important that you still respond to all court notices and follow court procedures unless and until a debt settlement agreement is final and the plaintiff has submitted it to the court.

How To Prepare for Court Appearances

The best thing you can do for your court appearance is show up and be organized. Make sure to make several copies of any documents you bring to present to the court. Be prepared to give a copy to the plaintiff (or their lawyer) and always keep a copy for your own records.

Here are a few additional tips from PALawHelp.org:

Dress neat and professional.

Arrive to court early and know where to go ahead of time.

Listen carefully to all questions asked.

Speak respectfully to the judge and everyone else in the courtroom.

Stay calm and always tell the truth.

What Happens if You Don’t Respond to the Lawsuit?

Whatever you do, don’t ignore the lawsuit! If you do, the judge is likely to issue a default judgment against you. This means you lose the lawsuit automatically.

A default judgment is a court order that allows the person or company suing you to request a court order for a wage garnishment, bank account levy, or property lien.

Debt collectors count on you not showing up to court. If you take action and respond to the lawsuit, you give yourself a fighting chance to win the debt collection lawsuit.

What Do I Do if the Court Already Issued a Default Judgment Against Me?

If a default judgment has already been ordered against you, you can file a motion to vacate the judgment. To vacate means to cancel the judgment ordered.

You can file this motion by submitting an official request with the court you were served from. This process can be difficult to navigate, so seek legal help as needed.

Need Legal Help?

Pennsylvania Legal Aid: Online hub with links to legal aid programs/organizations across the state

PALawHelp.org: Self-help guides and resources online; maintained by PA Legal Aid Network

Legal Aid Services across Pennsylvania: The following legal aid agencies provide free or low-cost legal aid services to help qualifying low-income residents.

Community Legal Services of Philadelphia and Philadelphia Legal Assistance serve Philadelphia (and nearby) residents.

Legal Aid of Southeastern Pennsylvania serves residents of Bucks, Montgomery, Chester, and Delaware counties.

MidPenn Legal Services serves residents of central Pennsylvania.

Neighborhood Legal Services Association serves Pittsburgh-area residents.

North Penn Legal Services serves residents of northern Pennsylvania.

Northwestern Legal Services serves residents of Cameron, Crawford, Elk, Erie, Forest, Mercer, McKean, Potter, Venango, and Warren counties.