How To Answer an Arizona Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Responding to a debt lawsuit in Arizona is easier than most people realize. You respond by filling out a court-provided answer form, filing it with the court, and delivering a copy to the person suing you. The answer form is your opportunity to admit, deny, or say you don’t know about the claims against you. These claims are written out in the complaint form, which you’ll receive with a court summons that tells you you’re being sued and how long you have to respond to the case.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated September 16, 2025

Table of Contents

How Do Debt Collection Lawsuits in Arizona Work?

If you get sued for a debt in Arizona, your case will likely be in a Justice of the Peace Court. These courts are more commonly referred to as justice courts. If the claim against you is $3,500 or less, your case may be heard in the small claims division of the justice court. More likely, your case will be heard in a regular justice court. These courts hear cases with claims of up to $10,000, and they allow both parties to have a lawyer present without prior permission, which is needed in small claims.

Debt collectors can’t sue you without notice. They may properly deliver formal court papers called a summons and complaint to initiate a lawsuit against you.

Note: The following information applies primarily to debt lawsuits in regular justice courts. The process is similar in small claims court, but the forms and rules may vary somewhat. You can find the small claims summons, complaint, and answer forms on the court’s website. Each form includes additional information and instructions specific to the small claims process.

What Is a Summons?

An Arizona civil summons is a multipage document that tells you important information, such as:

Case information, including the court name and contact information and your court case number

The name and contact information of the person/company suing you (and their lawyer’s information, if they’ve hired one)

Instructions on how to respond to the summons

The timeline you have to respond to the summons (20 days)

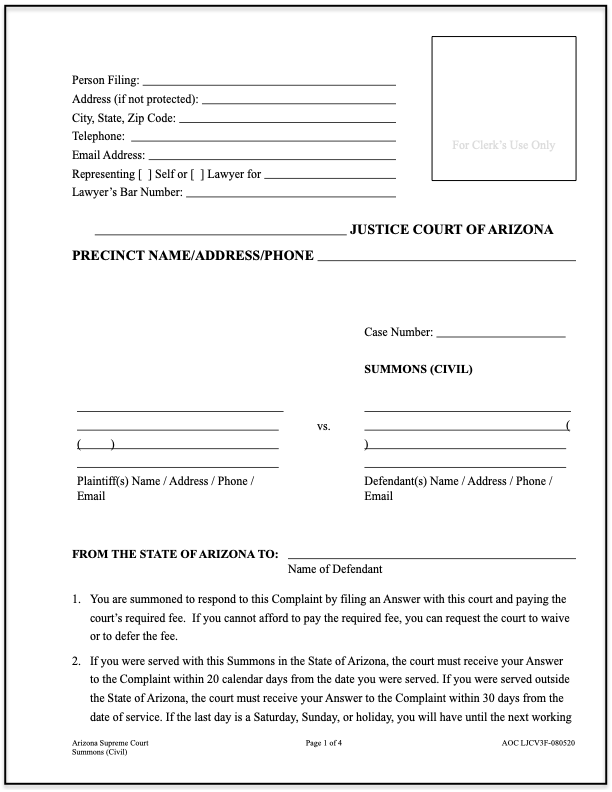

The first page of the summons looks like this:

The Arizona civil summons form also includes a Notice to the Defendant, which you should look at carefully. This usually starts on page three of the summons packet.

What Is a Complaint?

The complaint is an official legal document that accompanies a summons and outlines the claims against you. In other words, it tells you why you’re being sued and how much you’re being sued for.

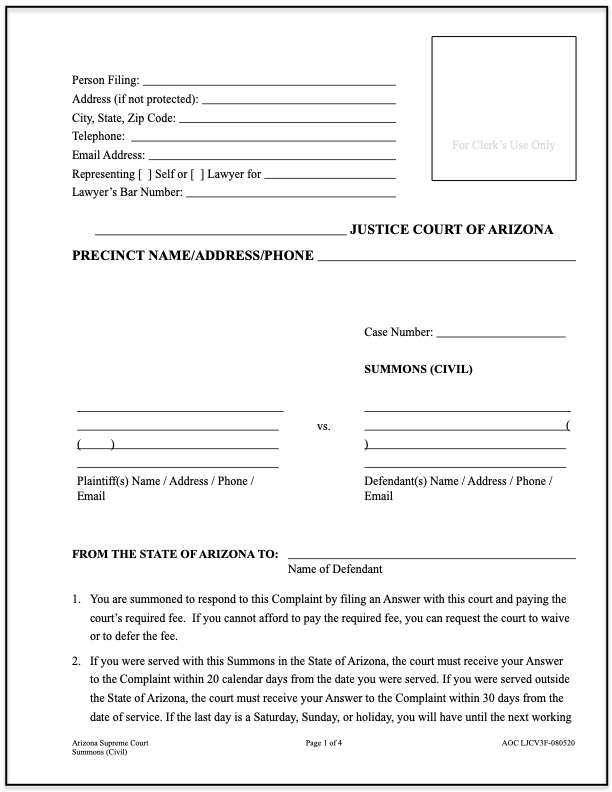

The first page of the complaint form looks like this:

In Arizona, complaints are usually multipage documents. Like the summons, one of the pages in the complaint document includes instructions and important information. Read it carefully and hang on to this paperwork.

How Do You Respond to an Arizona Court Summons for Debt Collection?

While it can feel intimidating to receive official court papers, it’s important to take a deep breath and make a plan to respond by the deadline. It’s easier than you might think, and you don’t have to hire a lawyer to successfully file an answer form with the court.

To respond you need to:

Download or ask the court for a blank answer form.

Respond to each of the numbered claims in the complaint.

Briefly explain your responses and raise any defenses you have.

File your answer with the court and deliver a copy to the person suing you (or their lawyer, if they have one).

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

How Do You Fill Out an Answer Form?

To start, you need to get a blank copy of the court’s official answer form. You can download it from the court website or go to the court in person and ask for a copy. You can also use the court’s e-filing system to fill out your form, but there is an additional charge to print the completed form.

The answer form is three pages; the first page looks like this:

Step 1: Fill Out Your Case Information

First, make sure you have the summons and complaint handy. These documents contain all the case information you’ll need to provide at the top of the answer form. Fill out your name and information on the top left-hand portion of the form. If you’re representing yourself, check the “Self” box. You can write “N/A” under “Lawyer’s Bar Number” if you’re representing yourself.

Then fill out the court name and information, the case number, and the plaintiff’s (the person suing you) and defendant’s (you) information. Again, all of this information should be on the summons and complaint forms.

Step 2: Respond to Each Item on the Answer Form

The Arizona answer form is relatively easy to follow. It’s often helpful to read the entire form (and these instructions) and look at the complaint again before you start responding. Then take it question by question.

Question 1

This asks for your answer to the complaint. You can use this line to summarize what you’ve written in the rest of the form. For example, if you deny all the claims against you, you would write that here. If you admit some claims but deny others, you can write that here and include a statement for the judge to see more details in the numbered items below.

Question 2

This asks whether you admit or deny that the court has jurisdiction over the case. Jurisdiction is a legal term. It simply means that the court has the legal right to handle a certain case. When it comes to debt lawsuits in Arizona, you’ll usually be sued in the county where you work or live. If for some reason you weren’t sued in one of these courts or if you believe your case was filed in the wrong court, you can check the “deny” box here and explain your reasoning. If you believe the current court is the right court to hear your case, you can check “admit.”

Questions 3–5

This is where you indicate which claims in the complaint you admit to (question 3) and which you deny (question 4). You can also tell the court you don’t have enough information to admit or deny (question 5). To make things easier, the claims in the complaint should be in numbered paragraphs. You can refer to each claim by the numbered paragraph as you respond to it in the answer form.

Question 6

The sixth question reads: “I am asking the court to deny Plaintiff’s claim. The Plaintiff is not entitled to judgment because.” This is where you can raise your affirmative defenses.

Step 3: Raise Your Defenses

Question 6 is where you can point out any incorrect or missing information in the complaint. It’s also where you can tell the court about any affirmative defenses. An affirmative defense is a reason the plaintiff should lose the case, even if everything in the complaint is true.

Some of the most common affirmative defenses in debt lawsuits are:

The debt is past the statute of limitations, so the debt collector can’t sue you for it.

You already paid the debt.

You were wrongly identified as the owner of the debt.

You were a victim of identity theft and the debt isn’t yours.

The debt was discharged in bankruptcy.

There are other affirmative defenses as well, so do your research and read the complaint carefully. To learn more, read How Do You Answer a Summons for Debt Without an Attorney?

Be prepared to provide evidence for your affirmative defenses. This may include bank statements, credit card statements or agreements, receipts, written correspondence with a creditor or debt collector, police reports (for identity theft), and more.

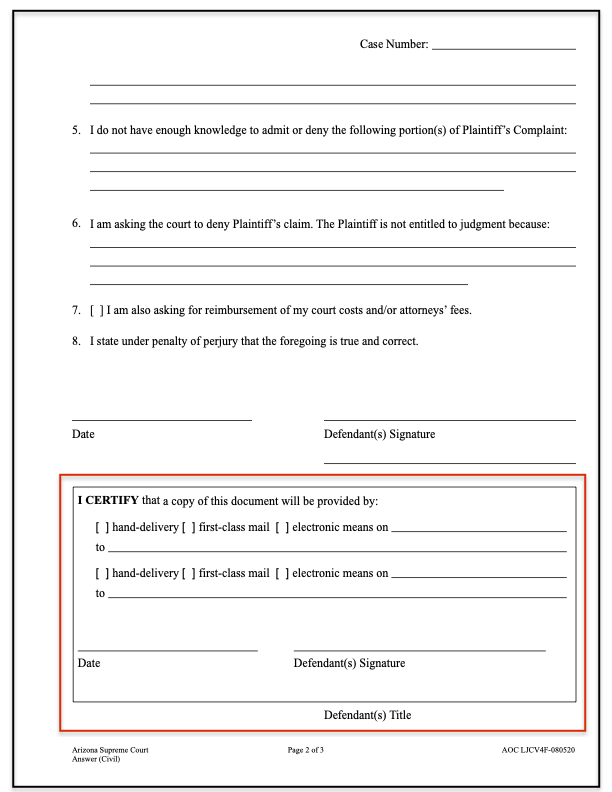

Step 4: Complete the Certificate of Service & Send a Copy of Your Answer to the Plaintiff

By law, you’re required to send a copy of your answer form to the person suing you. If they have a lawyer, send the answer to the lawyer. Their name and address will be listed on the complaint.

Once you finish your answer form, make at least two copies. You’ll file the original with the court, keep one for your records, and send one to the plaintiff.

The answer form requires you to certify how you delivered (or plan to deliver) and when you delivered (or plan to deliver) the form to the plaintiff. You can hand-deliver it, send it via first-class mail, or deliver it electronically.

The certification is on page three of the answer form. It’s outlined in red below:

Step 5: File Your Forms With the Court Clerk Within 20 Days

Finally, be sure to file your answer form with the court clerk before the 20-day time limit is up. It’s important to respond by the deadline or you could lose the case by default. (More on this below.) You can file your forms in person at the courthouse. You may be able to file electronically or by mail, but you should verify this with the clerk first.

You can do steps 4 and 5 in whichever order is convenient for you, but both must happen within 20 days of receiving the summons.

What Happens After You Respond to the Lawsuit?

After you file your answer form, you should first take a deep breath and congratulate yourself. This is a big deal! Many people don’t take this step to assert their rights, but you did it.

Next, wait to hear more information from the court. Your case may go to trial before a judge, or you may be invited to participate in a pre-trial settlement conference or mediation session to address the issue outside the courtroom.

Again, read all notices you get from the court carefully. Don’t hesitate to contact the court clerk if you have questions about how the process works or what the rules are. The clerk can’t give you legal advice, but it’s their job to help people navigate the court system and paperwork.

How To Prepare for Court Appearances

If you do have to go to trial, it’s good to spend some time getting prepared. This means gathering any evidence or documentation that supports your side of the story and the defenses you raised. It may also mean getting familiar with the court or hearing location (some are held remotely).

On the day of your hearing, dress professionally, show up early, and speak respectfully to everyone in the courtroom. It can boost your confidence to remember that the plaintiff is the person tasked with proving their case. In other words, they have to prove to the judge that you really owe the debt and the amount they claim. Don’t hesitate to ask for these details from the plaintiff or to present information you have that may help get the case dismissed.

What Happens if You Don’t Respond to the Lawsuit?

Taking people to court is an ugly but often-used tactic. Debt collectors do this because it’s often the easiest way for them to get paid. Why? Because the majority of people don’t respond to the lawsuit and lose by default.

Not responding to a lawsuit doesn’t make it go away. Most frequently, it leads to a default judgment. This is a court order that allows the debt collector to pursue serious collection measures like wage garnishment or a bank account levy. You have a better chance than you probably think to win the debt collection lawsuit, but to do so, you have to respond and fight it.

If you already have a default judgment against you, you may be able to file a motion with the court to vacate the judgment. Vacate means cancel. Filing a motion means you submit more formal paperwork to the court. This is often more difficult to do without legal help than filing a simple answer form. If you need legal advice or assistance but can’t afford a lawyer, look into the resources in the next section.

Need Legal Help?

The Arizona Court’s Self-Help Center provides a lot of guidance for Arizonans who are representing themselves in court. But if you still have questions or want to meet with someone in person, an Arizona legal aid organization can assist you if you can't afford an attorney.

SoloSuit is an online service that can help you respond to a debt lawsuit for a small fee.