What Is Equity?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Your equity in a house or car (the dollar value that belongs to you, not the lender) is the current value of the property minus the amount you still owe on it. When you file bankruptcy, exemptions protect the equity you have in certain assets.

Written by the Upsolve Team. Legally reviewed by Attorney Paige Hooper

Updated September 1, 2025

When you have a loan on a piece of property, you may hear the word “equity” every now and then. This is how much of the property’s dollar value belongs to you rather than the lienholder. To find how much equity you have, take the current value of a piece of property and subtract any outstanding loans you have on it.

Let’s walk through an example to illustrate: Say you own a home with a current market value of $200,000 and the balance on your (only) mortgage is $175,000. In this case, you have $25,000 of equity in your home, calculated as follows:

$200,000 (value of house) – $175,000 (balance left on mortgage) = $25,000 (your equity)

You can even have equity in your car, but this is less common since vehicles usually only decrease in value. Still, the calculation remains the same. If you own a car with a value of $7,000 and you owe $3,100 on the car loan, your equity is $3,900.

Why Does Equity Matter?

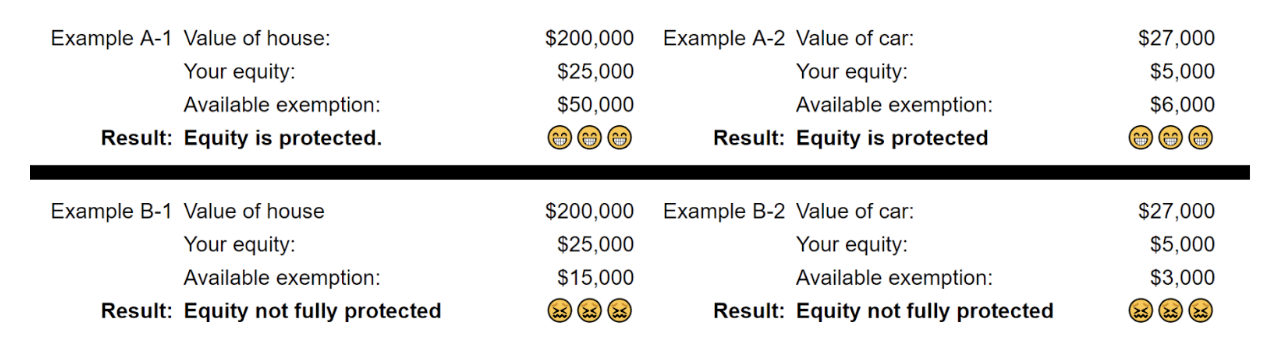

When you file bankruptcy, exemptions protect the equity you have in certain assets. That means your house or car can be 100% protected even though it’s worth a lot more than the available exemption, as long as your equity is less than the exemption amount.

Here are some examples to illustrate how this works:

If your house or car is worth less than what you owe on your mortgage or car loan, you don't have any equity and the trustee won’t be interested in the asset. In Chapter 7 bankruptcy, the trustee can sell your assets and use the sale proceeds to pay some of your debts. If there are any loans against the property that's sold, the trustee must use the sale proceeds to pay those off first. If you don't have any equity in the property — meaning nothing is left over after paying off the loan(s) — then it's not worth the trustee's time and expense to sell that property. The same is true if all or almost all of your equity in the property is protected by exemption laws.