The Florida Consumer Collection Practices Act

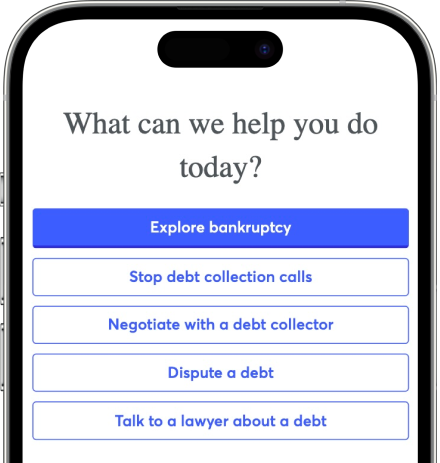

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

In Florida, you have even more protections from unfair collection practices than you would in other states. The Florida Consumer Collection Practices Act (FCCPA) works with the federal Fair Debt Collection Practices Act to help limit phone calls, threatening letters, and other types of unfair actions from collection agencies and other types of debt collectors. It protects Florida consumers and gives them the right to sue debt collectors that have violated the FCCPA. Keep reading to learn more about the Florida Consumer Collection Practices Act and your rights under federal and state consumer protection laws.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated February 9, 2024

Table of Contents

Is a Florida collection agency harassing you? The Fair Debt Collection Practices Act offers broad protections from unfair collection practices, but it may surprise you to learn that in Florida, you have even more protections than you would in other states. The Florida Consumer Collection Practices Act (FCCPA) is a consumer protection law that Florida debt collectors must follow.

This state law works with the federal Fair Debt Collection Practices Act to help limit phone calls, threatening letters, and other types of unfair actions from collection agencies and other types of debt collectors. It protects Florida consumers and gives them the right to sue debt collectors that have violated the FCCPA. Keep reading to learn more about the Florida Consumer Collection Practices Act and your rights under federal and state consumer protection laws.

What Is the Florida Consumer Collection Practices Act, and What’s It For?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that has rules and regulations that debt collectors in every state must follow. The Florida Consumer Collection Practices Act (FCCPA) is a state law that has rules and regulations that specifically cover debt collection in Florida. People who collect debt in Florida must follow the rules under both federal and state laws. That means that borrowers in Florida get added protections from debt collection activity that people in other states may not have. It’s like having two security locks on your door instead of one.

The federal law already prohibits collection agencies from engaging in harassing contact, using abusive and threatening language, and using unfair tactics, but the law doesn’t apply to original creditors. The federal FDCPA only applies to third-party debt collectors, such as a hired outside collector or someone else who bought the debt. But in Florida, the Florida Consumer Collection Practices Act (FCCPA) says the debt collection laws apply to original creditors as well.

So, if you live outside Florida in a state with no extra protection, your original loan creditor doesn’t have to follow the same rules as a collection agency. If you live in Florida, they do. That means fewer phone calls and letters about debt for you!

What the FCCPA Requires of Collection Agencies

The FCCPA requires collection agencies to adhere to the FDCPA rules on timeframes and communications. It also requires agencies collecting debt in Florida to register with the state.

State Registration

Florida debt collection laws require many collection agencies to register with the state if they are going to collect debt in Florida. This helps government agencies to keep track of creditor activities. But not all types of debt collectors are required to register. The following types of debt collectors do not have to register, although many of these are required to register with other licensing agencies:

Original creditors

Florida attorneys

Authorized Florida financial institutions and their subsidiaries and affiliates

Licensed real estate brokers

Licensed insurance companies

Consumer finance companies and their subsidiaries and affiliates

Certain non-Florida debt collectors

FDIC-insured institutions, subsidiaries, and affiliates

Identification and Debt Validation

Under Florida law and federal law, all debt collectors, registered or not, are required to identify themselves, their employer, or the business they are working for when asked by a customer or third party. There are several other laws under the Florida and federal acts that apply to communications. For instance, within five days of the first contact between the debt collector and the consumer (you), the collector must provide debt validation information. This must include the amount of consumer debt, the name of the creditor, and three other legally required statements. Those three statements are as follows:

Unless you, within 30 days after receipt of the notice, dispute the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector.

If you notify the debt collector in writing within the 30-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector.

At your written request within the 30-day period, the debt collector will provide you with the name and address of the original creditor, if different from the current creditor.

Timelines to Honor Your Requests

There are also timelines that debt collectors must follow. If you, the consumer, send the collector a debt verification request letter, then the collector must verify the debt within 30 days and send you a written notification of the results. If you made your request within 30 days of receiving your first debt validation letter, then the creditor must stop contacting you and stop collection activity while the debt is being verified. Also keep in mind that if you inform a collector that you have an attorney, then the collector must contact the attorney instead of you.

Limits on Communication

Debt collectors must also stop most communication with you if you send them a letter telling them to stop contacting you. This does not mean you won’t receive a summons, judgment, or garnishment. Lawsuits can still go forward, and the collectors have other legal options they can pursue. Florida law prohibits collectors from sending fake documents that look like they may be a formal lawsuit or a formal paper from a government agency. Collectors also can’t pretend to be an attorney with fake logos on letters or make their phone calls to sound like they’re calling from an attorney’s office. It’s always best to have an attorney review any legal documents you receive that make threats, mention a lawsuit, or set a date and time to be in court. An attorney can tell you what’s legit and what’s fraud.

How Does the Florida Law Protect Me?

In Florida, debt collectors aren’t always pleasant. Debt collectors can be abusive, harassing, and unfair. The FCCPA and FDCPA were created to stop harmful collection activities. A 2019 consumer law analysis of Federal Trade Commission (FTC) data found that Florida has the highest number of debt collection complaints per capita. The FCCPA provides the following communication-related protections for Florida consumers:

Debt collectors cannot call you after 9:00 p.m. or before 8:00 a.m. unless you give them consent to do so. This is based on your time zone, not the debt collector’s.

They aren’t allowed to keep calling you and hanging up within a short time period.

They aren’t allowed to call you at work after you tell them to not call you at work.

They cannot use profane, vulgar, obscene, or abusive language or behavior toward you or your family.

They cannot threaten you with any type of violence, force, or illegal acts.

They cannot impersonate a lawyer or government official.

They cannot threaten you with arrest or criminal charges.

They cannot sue you after Florida’s state statute of limitations has expired.

If debt collectors do any of these things, they are violating the FDCPA or FCCPA, and you can bring a claim against them for the violations.

Upsolve Member Experiences

2,029+ Members OnlineWhat If I Have a Claim Against a Debt Collector?

You can file an official complaint with a government agency, and you can sue a debt collector if they’ve violated the FCCPA or FDCPA. If you want to sue a debt collector, you’ll want to talk to an attorney. An attorney can help you recognize a valid claim and let you know what challenges you might face. A local attorney admitted to the Florida Bar will have specific knowledge of Florida state statutes. This allows them to recognize state-specific claims in addition to claims under the FDCPA.

Generally, if you win, your attorneys’ fees will be covered. You may also receive an award for actual damages from emotional and physical stress, statutory damages covering up to $1,000, and punitive damages. The amount of your award will vary based on the amount of your debt.

The FTC has a list of banned Florida debt collectors you can search to see if a company that has contacted you is listed. Some companies simply pay a fine or settlement and get ordered to change their practices. The FDCPA covers personal debt and not business debt. A credit card used for household purposes would be covered, but not when used for business debt.

If you’re not interested in a lawsuit and just want to file a complaint, you can file a complaint online with the Florida Office of Financial Regulation. You’ll need to provide a summary of your complaint along with copies of supporting documents. You’ll also have to register for an account. You can also file a complaint with the Consumer Financial Protection Bureau and report fraud with the FTC. Making an official complaint can be a little time-consuming, but it helps stop abusive debt collection activity. Complaints help to identify repeat offenders and prevent others from being harassed.

Let’s Summarize...

Florida’s Consumer Collection Practices Act (FCCPA) provides an extra layer of security for consumers in the state of Florida. Together with the federal Fair Debt Collection Practices Act, it protects you and other Florida consumers from harassing phone calls, illegal threats, and fraudulent debt collection activity. Take time to learn about your rights. With that extra layer of protection, you’ll be able to take control of your time and manage your debt without the stress of abusive and harassing debt collection calls from Florida debt collectors.