How To Win Against Northstar Location Services

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Northstar Location Services is a debt collection agency. If they reach out to you, you need to take action. Start by validating the debt they claim you owe. If the debt is accurate and you agree you owe it, consider negotiating a debt settlement to pay only a portion of the full amount. If Northstar sues you, respond immediately by filing an answer form. You don’t have to hire a lawyer to respond to the lawsuit.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated October 13, 2025

Table of Contents

- Why Is Northstar Location Services Contacting Me?

- Do I Have To Pay Northstar Location Services?

- How To Negotiate a Debt Settlement With Northstar Location Services in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Northstar Location Services in a Debt Lawsuit

- Let’s Summarize…

Why Is Northstar Location Services Contacting Me?

Northstar Location Services is probably contacting you because they’re trying to collect a debt they believe you owe.

Northstar is a third-party debt collection agency that buys debt from lenders and creditors and takes over collection efforts. They may be collecting on behalf of banks, credit card companies, or medical providers.

You can learn more about this collection agency by reading How To Deal With Northstar Location Services.

Do I Have To Pay Northstar Location Services?

If Northstar can prove the debt is accurate and belongs to you, you probably need to pay it. If it’s not yours or you think they got the amount wrong, you can dispute the debt.

Ignoring a debt you owe can lead to serious consequences. In addition to collecting phone calls and letters, Northstar may eventually decide to sue you. If they win the lawsuit, they can get an order to garnish your wages or freeze your bank account.

If you’re ignoring the debt because you can’t afford to pay it, here’s some good news: You may be able to settle the account without paying the full amount you owe. Third-party debt collectors frequently negotiate debt settlement agreements so they can close the account and stop spending money trying to get people to pay their debts.

Nervous about attempting a debt settlement? Continuing reading to learn our three-step process for debt settlement negotiations.

How To Negotiate a Debt Settlement With Northstar Location Services in 3 Steps

In order to stay in business, debt collectors need to make money. Since debt collectors buy debts for significantly less than they’re actually worth, they have the ability to negotiate the debt amount with you. You have more power here than you might think.

As with any negotiation, you can expect a few rounds of back and forth. So start lower than where you hope to end up. You might offer as little as 25% of the total debt to start and see how Northstar responds. There’s a good chance they’ll agree to settle the debt for 40%–60% of the original amount.

Sometimes the debt collector will make a settlement offer. If they do, don’t hesitate to make a counteroffer. But know that you can also initiate a settlement yourself.

Let’s go through the steps you can take to complete a successful debt settlement negotiation.

Step 1: Make Sure the Debt Is Valid

Start by validating the debt. The Consumer Financial Protection Bureau (CFPB) requires third-party debt collectors to send a validation letter within five days of first contacting you or before they initially reach out. They also have to give you 30 days to dispute the debt.

The validation letter should help you confirm that:

The debt account belongs to you

Northstar truly owns the debt or has the legal right to collect it

The debt amount is accurate

If the validation letter doesn’t answer all your questions, you can use Upsolve’s Debt Verification Letter template to request more information about the debt.

Step 2: Figure Out What You Can Pay

Once you know the debt is yours, figure out how much of it you can pay by looking at your monthly income and expenses. If you need guidance on creating a budget for the debt settlement, the CFPB has a great budget worksheet and debt worksheet that can help you sort through your monthly expenses.

If the budgeting process is still confusing, you can look into a free consultation with an accredited nonprofit credit counselor. If you’re struggling with lots of debt, a credit counselor can help you understand all your debt-relief options.

Lump Sum vs. Payment Plan: What’s the Best Way To Pay?

The best way to pay is the way that’s doable for you.

That said, it can help to know that debt collectors usually prefer a one-time, lump-sum payment. If you’re able to offer such a payment, they may be willing to settle for a lower amount than if you want to repay with a monthly plan. The question, of course, is where to get the money. If you have a small windfall, like a tax return or work bonus, you could use that. Or you might consider selling household items you’re no longer using.

If a lump-sum payment doesn’t work for your finances, you can negotiate a repayment plan. Suggest a repayment plan with monthly payments that work for your budget and a timeline you feel good about. If you agree to set up an automatic withdrawal from your bank account, Northstar may be more inclined to accept the offer.

Step 3: Make a Settlement Offer to Northstar Location Services

Now it’s time to make an offer! You can use Upsolve’s debt settlement letter template to craft your offer letter.

It’s wise to make offers in writing so there’s a record. Make sure Northstar’s response is in writing as well.

Don’t Just Negotiate the Amount… Negotiate Everything!

Along with the settlement amount, you can negotiate how you repay the debt and how Northstar reports your account to the major credit bureaus. Debt collectors can report debts as “paid in full,” “partial payment” or “settled.”

Request Northstar marks your account as “paid in full” since this is most beneficial for your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Often, yes! However, it’s important to participate in the lawsuit until the case is dismissed or closed, even if you’re planning to negotiate a settlement. Make sure you respond to the lawsuit in a timely manner and follow all court procedures, like court appearances.

If you want help responding to the lawsuit and negotiating the debt, consider working with our partner, SoloSuit. They've helped over 300,000 people respond to debt lawsuits and settle debts, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

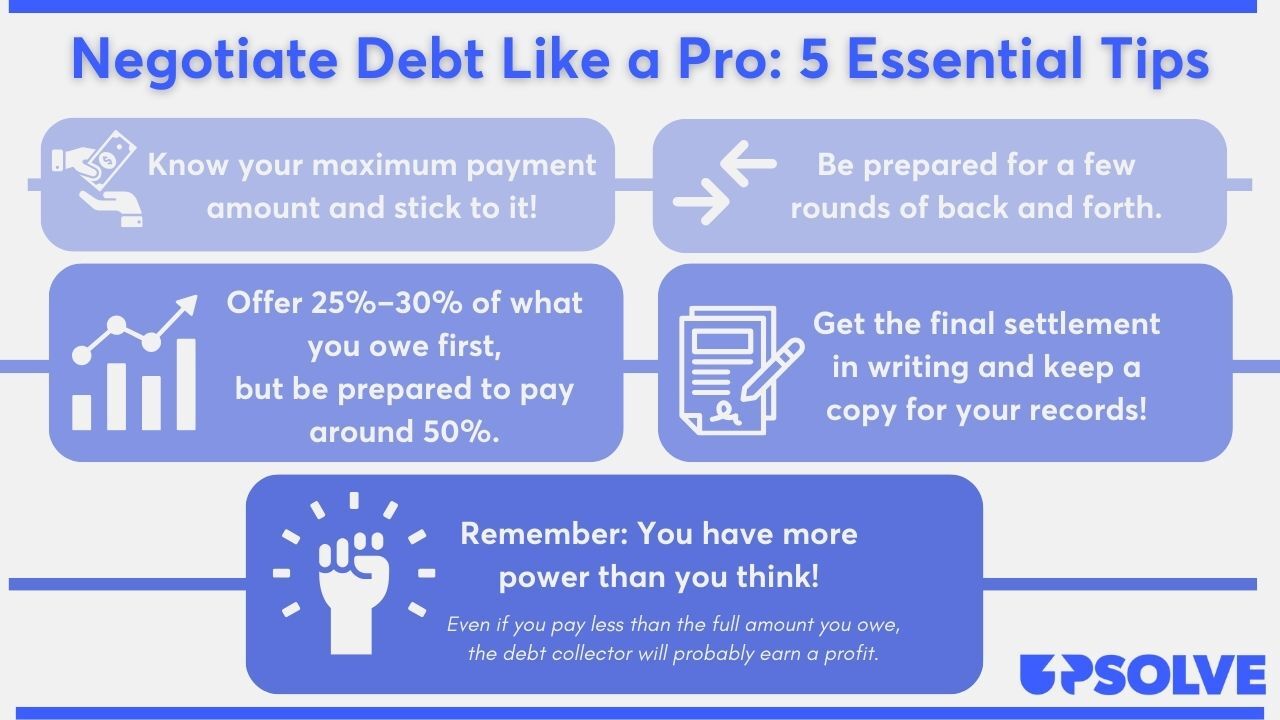

Tips for a Successful Debt Settlement

We know it’s intimidating, but anyone can negotiate with the right tools and mindset. Take a look at our top tips for negotiating like a total pro.

For additional guidance on negotiating, read Upsolve’s 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Northstar Location Services in a Debt Lawsuit

It’s true that debt collectors can sue you. They probably won’t unless you repeatedly ignore their collection efforts.

If you get sued, you’ll receive a summons and a complaint. These are two official court documents that notify you of a lawsuit and explain the details of the case. If you are sent these papers, you need to respond as soon as possible.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit.

Try not to stress! Responding to a lawsuit isn’t as difficult as you might think.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that alerts you to the lawsuit. The format of this official court document varies by court, but the summons should tell you:

The name and address of your court

Information about you (the defendant) and the debt collector (the plaintiff)

The case number

The nature of the lawsuit

The legal consequences of not responding to the lawsuit

Most often, when you receive a summons, you receive a complaint document as well. The complaint lays out all of the claims the plaintiff (Northstar) has made against you, often in numbered paragraphs. This is important to know when you go to fill out and file your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

A lot of courts provide an answer form template for you to use to fill in your responses. You can Google “[court name] + answer form” to check if your court has one. You can also look on your court’s website for a section called “self help” or “court forms.” This may also include useful instructions or other information on how to respond to a lawsuit without a lawyer.

If you need help understanding the answer form, you can ask the court clerk to explain. The clerk can help you with court procedures and documents, but they can’t give legal advice. If you need legal help, you can use the Legal Services Corporation’s online search tool to find low-cost or free legal help in your community.

The answer form gives you an opportunity to explain your side of the lawsuit and defend yourself. There are a few different types of defenses that commonly apply in debt collection lawsuits. You can learn more about them by reading 3 Steps To Take if a Debt Collector Sues You.

Note: Some courts require additional paperwork beyond the answer form, such as a certificate of service, so check your court’s website or talk to your court clerk if you’re unsure.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

Court processes for filing answer forms vary. Most of the time, you can file in person or send the form in the mail. But some courts also let you file online. Read through your court’s website or ask your court clerk if you don’t know where or how to file.

You’re usually also required to deliver a copy of your answer form to Northstar. This is called “serving the plaintiff.” You can likely send their copy through the mail by using the address listed on your summons.

Let’s Summarize…

If Northstar Location Services contacts you about an unpaid debt, you need to validate the debt before anything else. If the debt is correct and you own it, you can start planning your debt settlement negotiation strategy to pay a percentage of the debt in a lump sum or via a payment plan. If Northstar filed a debt collection lawsuit against you, respond to the lawsuit right away by sending an answer form. Taking initiative is the best way to protect your finances!