Should You Change Your Student Loan Repayment Plan?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

There are several federal student loan repayment plans, including the Standard Repayment Plan, four income-driven repayment plans, and the Extended (Graduated) Repayment Plan. After graduation, student loan borrowers are automatically placed on the 10-year Standard Repayment Plan, but you can switch to a different plan at any time.

Written by Attorney Tori Bramble.

Updated January 30, 2025

Table of Contents

- What Are My Student Loan Repayment Plan Options?

- What Is the Standard Repayment Plan for Student Loans?

- What Are the Income-Driven Repayment Plan Options for Student Loans?

- Who Do You Contact if You Have Questions About Federal Student Loans?

- Can’t Afford Your Student Loan Payment? These Options Might Help

- Can You Get Rid of Student Loan Debt?

What Are My Student Loan Repayment Plan Options?

There are many different student loan payment plans to consider. To choose the right one for you, you should look at your financial situation (income, expenses, debts) so you know what you can afford to pay.

Then, get familiar with your repayment plan options. Here’s a quick overview of the main federal repayment plans and their pros and cons:

Standard Repayment Plan (SRP): 10-year repayment term. You’ll have higher monthly payments than you would in other plans, but you’ll pay less in interest over time.

Income-driven repayment (IDR) plans: 20–25-year repayment term, depending on which plan (of four options) you choose. Your monthly payment will be more affordable, but you’ll pay more in interest over time.

Graduated Repayment Plan (GRP): 10-year repayment term. Payments start lower and increase every two years. Works well for borrowers who anticipate increasing income over time.

Extended Repayment Plan (ERP): 25-year repayment term. Only borrowers with $30,000 or more in student debt qualify. Works well for borrowers who don’t qualify for an IDR but want a lower payment than in the SRP or GRP.

What Is the Standard Repayment Plan for Student Loans?

After graduation, you're automatically placed on the Standard Repayment Plan. This is a 10-year plan with a fixed monthly payment, which is calculated based on your student loan balance.

Standard Repayment Plan Pros and Cons

The SRP has the shortest repayment period of all federal repayment plans (except the graduated plan, which is also 10 years). Compared to other plans, the upside to the SRP is that you’ll pay off your loans the fastest and with the least interest. The downside is that your monthly payments will be much higher on this plan than on other plans.

When you graduate, if you don't choose another payment plan, you’ll default to the standard plan. Also, if you already changed to an income-driven plan but fail to complete your annual income recertification as required, your loan servicer can put you back on the SRP.

If the Standard Repayment Plan isn’t right for you, don’t worry! Federal student loan borrowers have access to several other types of repayment plans.

What Are the Income-Driven Repayment Plan Options for Student Loans?

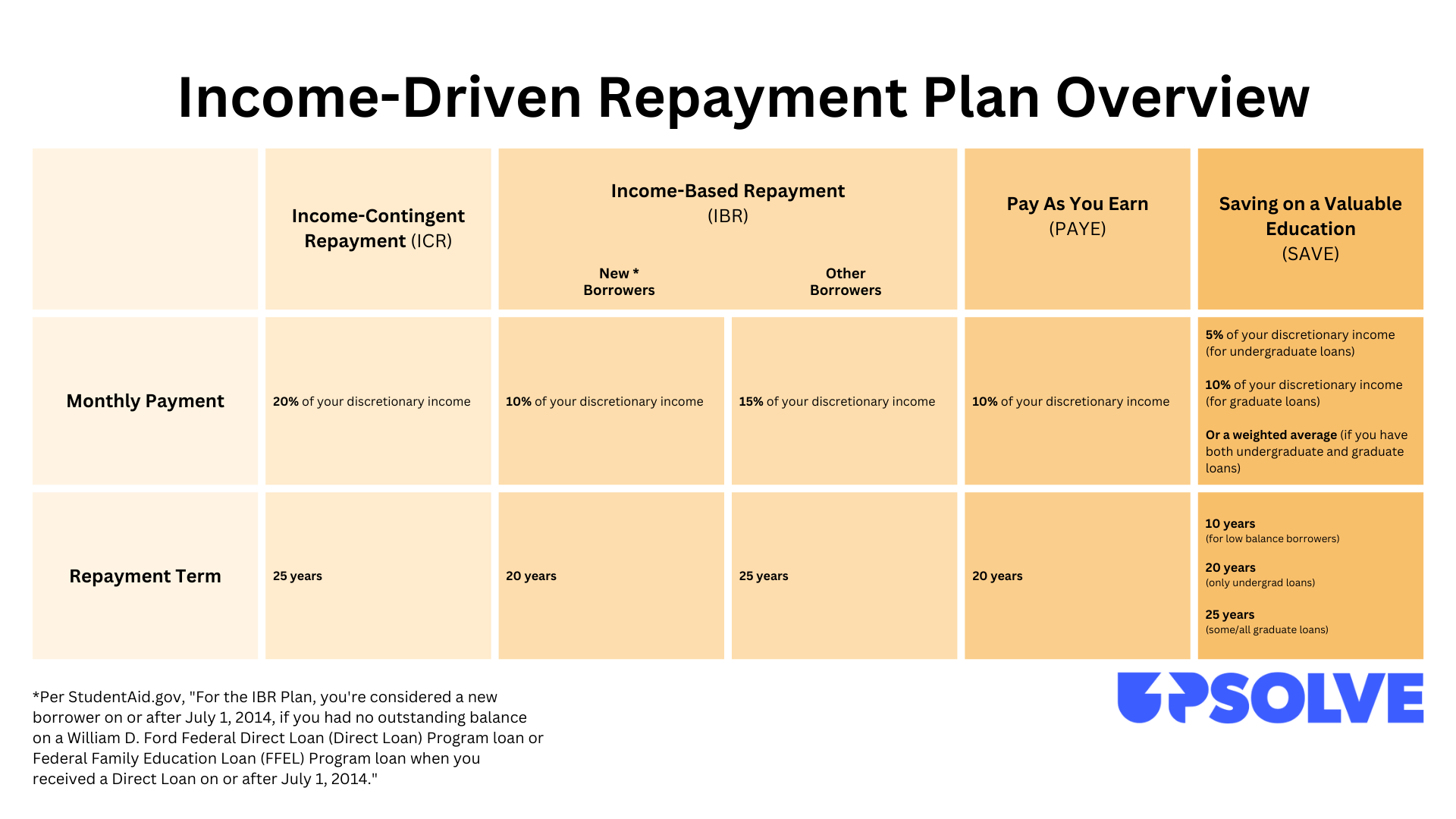

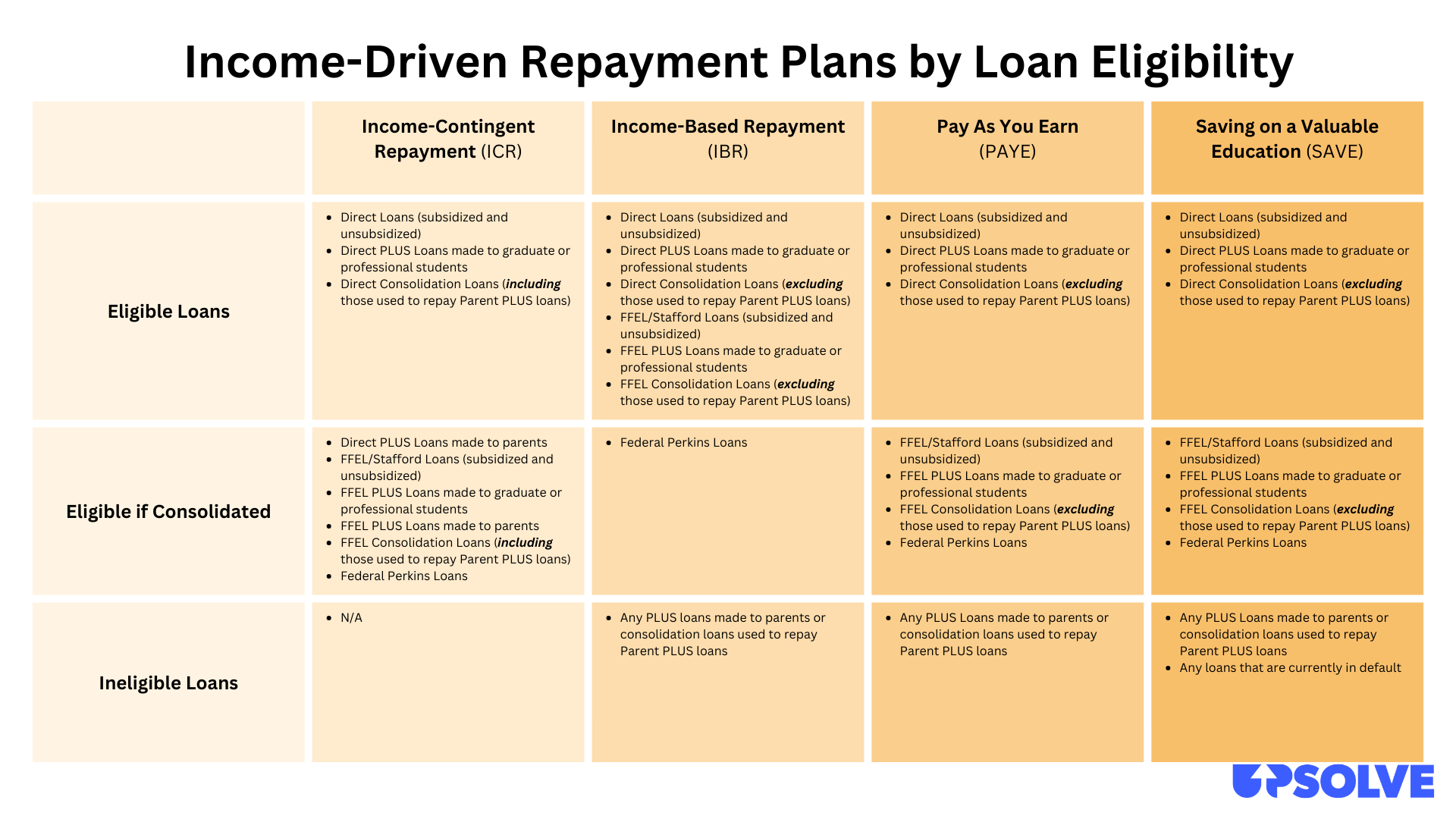

An income-driven repayment plan is a type of repayment plan that considers your discretionary income and family size when setting your monthly payment amount. Discretionary income is the difference between your annual income and 150% of the federal poverty guidelines* for your family size. If you enroll in an IDR plan, you’ll pay 10%–15%* of your discretionary income in monthly student loan payments.

*225% of the poverty line for the Saving on a Valuable Education Plan.

*5%-10% (or a weighted average) for the Saving on a Valuable Education Plan.

If your income or family size changes year-to-year, your monthly payments may change too. This is why you’re required to recertify your income and other information annually.

If you are applying for student loan forgiveness through the Public Service Loan Forgiveness (PSLF) program, you must be on an income-driven plan to qualify.

There Are 4 Types of Income-Driven Repayment (IDR) Plans

The U.S. Department of Education offers four income-driven repayment plan options.

Income-Based Repayment (IBR)

Income-Contingent Repayment (ICR)

Pay As You Earn (PAYE)

Saving on a Valuable Education (SAVE) - Formerly the Revised Pay As You Earn Plan (REPAYE)

These plans vary based on the repayment period. All have a longer repayment period than the 10-year standard plan. They allow borrowers to repay their loans for 20–25 years.

Here’s an overview of these four plans:

You may also hear about the less common Income-Sensitive Repayment Plan. This is only available for borrowers with Federal Family Education Loans (FFEL). These loans are no longer issued by the Department of Education.

Feeling confused about which plan to choose? Check out the Loan Simulator tool from Federal Student Aid. It helps you see your repayment options and what your monthly payment will be under different plans.

What Is a Graduated Repayment Plan?

If you choose the Graduated Repayment Plan and make all payments on time, you'll pay off your loan in 10 years. On this plan, you'll begin with low student loan payments that increase every two years.

Assuming your annual income increases, these loan payments will become easier to handle. If you think your income will increase over time, this plan could be a great option for you. If not, a different plan — such as the Extended Repayment Plan — could be a safer option.

What Is an Extended Repayment Plan?

The Extended Repayment Plan is available to borrowers who owe more than $30,000 in student loans. It may be an attractive option if you aren’t eligible for an income-based repayment plan.

The extended plan offers smaller monthly payments than the standard plan and gives you a 25-year repayment period. You can choose a fixed or graduated amount for your monthly payments.

The main benefit of this plan is that it offers lower monthly payments than the Standard Repayment Plan. Many borrowers find these payments more manageable. The downside is that you will pay more in interest on the loan over time.

Who Do You Contact if You Have Questions About Federal Student Loans?

Start with your lender! Or more accurately, your loan servicer. Your loan servicer is the company that is managing your student loan repayment. You can find out who your servicer is by visiting your account on StudentAid.gov. You can also run an NSLDS report to get comprehensive information on all your student loans, including your loan balance, lender, loan servicer, interest rate, type of loan, and loan term(s).

You can also contact your student loan servicer to ask about your repayment options and get help figuring out what your monthly payment would be under different plans. Student loan servicers are often busy. If so, a good alternative is to use the FSA’s Loan Simulator tool to compare loan repayment options.

Can’t Afford Your Student Loan Payment? These Options Might Help

Federal loan borrowers may be eligible to temporarily pause their student loan repayments through deferment or forbearance.

This can provide relief to borrowers who are financially stressed, but note that your loan balance may increase if you don't pay the interest on your loans while in deferment or forbearance. This will depend on which program you use and whether you have subsidized or unsubsidized loans.

You may also want to look into consolidating your loans. Getting a Direct Consolidation Loan can make your monthly payments more manageable.

If you have a good credit score and feel confident you’ll be able to repay your loan balance, you can also look into refinancing your student loans. It’s usually only wise to do this if you can get a lower interest rate, and you should weigh the pros and cons. Once you refinance your federal student loans, they become private loans, and you lose a lot of federal benefits.

Can You Get Rid of Student Loan Debt?

If you’ve tried everything to make your student loan payment manageable, but you just can’t keep up, know that you’re not alone. The U.S. Department of Education data shows that at least 10% of borrowers have defaulted on their loans. This comes as no surprise since many people are facing financial difficulties in our current economy.

There is an option you may not have considered yet that could turn your life around: filing bankruptcy. A lot of people do not realize that filing bankruptcy to discharge your student loans is a safe and reliable way to give yourself a deserved financial fresh start.

You must meet certain eligibility requirements to get your student debt erased. You can use Upsolve’s free screener to see if we can help you file bankruptcy and get rid of your federal student loans. Take the screener now and be one step closer to financial freedom!