How Does Bankruptcy Affect a Car Lease?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Filing bankruptcy affects a car lease differently than a car loan. A car lease isn’t considered a debt you owe, but you still need to report it in your bankruptcy paperwork. If you’re filing Chapter 7 bankruptcy, you can usually keep the lease if you’re current on payments, or you can give the car back and wipe out any remaining lease-related debt. In Chapter 13, you can typically keep the car and make payments as usual if you’re current, or you can fold past-due payments into your 3–5-year payment plan. Understanding how bankruptcy affects a car lease can help you decide whether to keep the car or walk away.

Written by Attorney Paige Hooper. Legally reviewed by Jonathan Petts

Updated February 17, 2026

Table of Contents

Is a Car Lease Considered a Debt in Bankruptcy?

A car lease isn’t a loan, but it can still involve debt in bankruptcy.

✍️When you lease a car, you sign a contract (called an executory contract) to make monthly payments in exchange for using the vehicle. You don’t own the car, and you didn’t borrow money to buy it.

If you’re behind on payments or owe fees, those unpaid amounts are considered debts and can be included in your bankruptcy case. Even if you’re current, the lease still has to be disclosed in your bankruptcy paperwork. You’ll also need to say whether you plan to keep the lease (assume it) or end it (reject it).

✨ If you use Upsolve’s free filing tool to prepare your Chapter 7 paperwork, it will walk you through the process of reporting your leased vehicle step by step. It only takes two minutes to see if you’re eligible.

Where Do You List a Car Lease on Bankruptcy Forms?

The court and your creditors need to know about all of your financial obligations, including any current leases. Car leases are generally reported on the following bankruptcy forms:

Schedule A/B: Property You Own or Lease

Schedule G: Executory Contracts and Unexpired Leases

Statement of Intentions (Form 108)

Schedule A/B: Property You Own or Lease

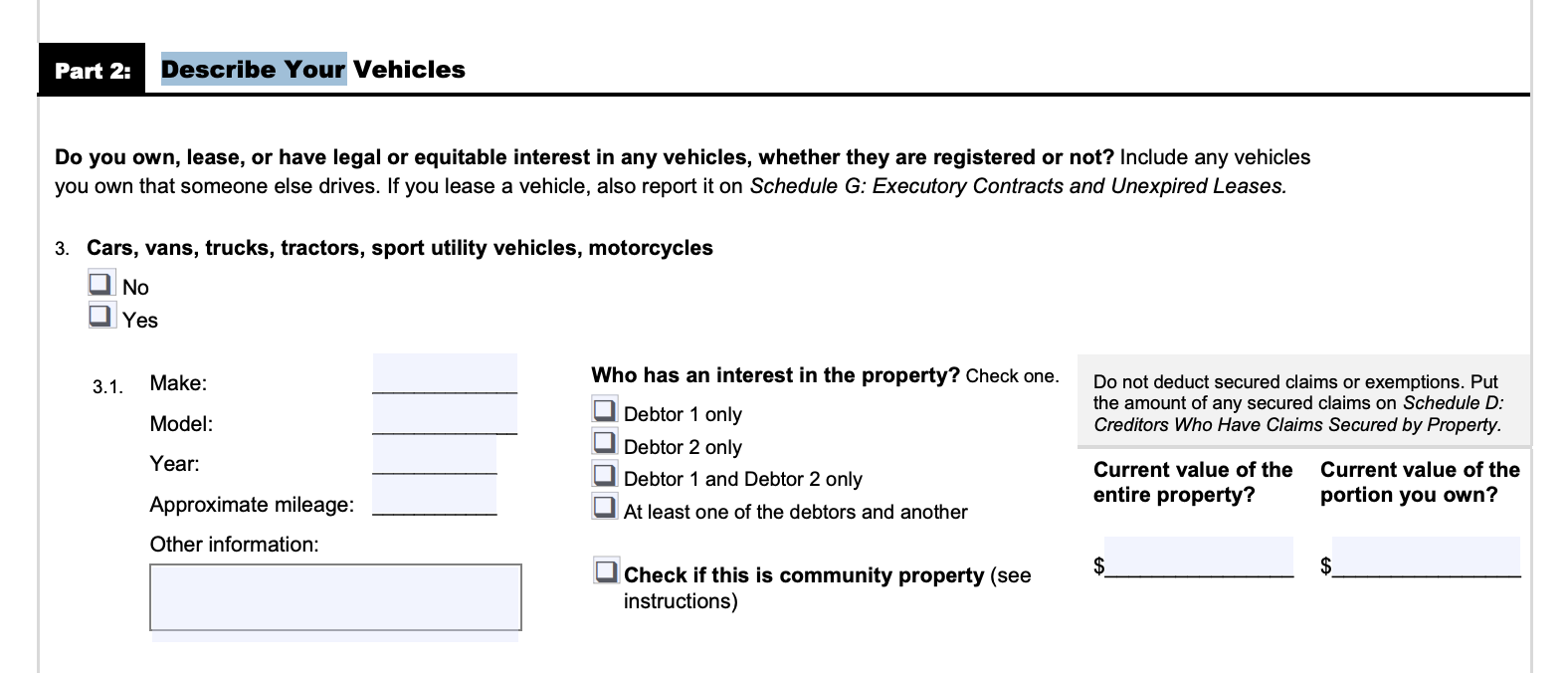

If you lease a car, you’ll list it in Part 2 of Schedule A/B, which covers vehicles.

The form asks whether you own, lease, or have a legal interest in any vehicles. To report a leased vehicle, check “Yes” and include the make, model, year, and your lease status.

Schedule G: Executory Contracts and Unexpired Leases

Schedule G is where you list the lease agreement itself.

Include the name and address of the leasing company and a short description of the lease. For example: 2021 Toyota Camry lease, expires June 2026.

Statement of Intention for Individuals Filing Under Chapter 7

The Statement of Intention form is where you officially tell the court and the leasing company whether you want to keep the lease or not. The form asks, “Will the lease be assumed?”

💡Assuming the lease means you plan to keep the car and continue making the monthly payments under the original lease terms.

If you don’t want to assume the lease, you’ll also report it on Schedule F: Creditors Holding Unsecured Nonpriority Claims. In this case, the remaining lease obligations may become an unsecured debt.

What Happens To a Car Lease in Bankruptcy?

What happens to your car lease in bankruptcy depends on:

The type of bankruptcy you file (Chapter 7 or Chapter 13)

Whether you're current on your lease payments

Whether you want to keep the car or give it back

🚗 Generally speaking, if you're filing Chapter 7 and you're current on your payments, you can usually keep the lease and continue making payments like normal.

If you're behind or no longer want the car, you can give it back and wipe out any remaining lease obligations.

In Chapter 13, you may be able to catch up on missed payments and keep the lease through your repayment plan.

How Car Leases Work in Chapter 7 Bankruptcy

If you’re filing Chapter 7 bankruptcy and you’re leasing a car, you’ll need to tell the court what you plan to do with the lease.

You do this by filling out a form called the Statement of Intention. This form gives you two choices:

✅ Assume the lease: This means you want to keep the lease and continue making payments under the original terms.

❌ Reject the lease: This means you’re giving up the car and ending the lease early.

You don’t have to explain why you’re choosing to keep or give up the car, but you do need to make your decision clear.

🗓️ The Statement of Intention is due 30 days after you file your bankruptcy case. That said, many filers submit their Statement of Intention at the same time that they file the rest of their bankruptcy paperwork to avoid delays or problems.

If you don’t file this form on time, the automatic stay protection for your leased car may be lifted. That would allow the lessor (the leasing company) to start repossession or collection efforts.

What Happens if You Assume the Lease in Chapter 7?

Assuming the lease means you want to keep the car and continue making monthly payments under the lease terms.

You’ll stay on the same payment schedule, and the lease agreement will continue as if you hadn’t filed bankruptcy.

You don’t need to sign a reaffirmation agreement to assume a lease. That only applies to loans. However, some leasing companies may send one anyway. You can sign it if you want to avoid confusion, but it’s not legally required for a lease.

What Happens if You Reject the Lease in Chapter 7?

Rejecting the lease means you’re choosing to give up the car and end the lease early. Once you reject it, you’re no longer responsible for future payments.

If the lease has early termination fees or a remaining balance, the leasing company may file a claim for that amount. You can list this as an unsecured debt on Schedule F, and it may be discharged in your bankruptcy.

What if You’re Behind on Lease Payments in Chapter 7?

If you're behind on your lease payments but want to keep the car, you may still be able to assume the lease — but only if you can catch up quickly.

👉 In most cases, your payments need to be current by the time the leasing company receives your Statement of Intention.

Even then, the lessor doesn’t have to agree to continue the lease. Most lease agreements give the lessor the right to take back the car if you’ve fallen behind, even if you're trying to catch up. It depends on the lease terms and how far behind you are when you file.

⌛ If you can’t bring the lease current in time, you likely won’t be able to assume it. In that case, you can return the car and won’t owe anything else on the lease once your bankruptcy case is complete.

If you're behind on payments but still want to keep the vehicle, Chapter 13 bankruptcy may give you more flexibility.

Can You Lease a Car After Bankruptcy?

Yes, many people are able to lease a car after bankruptcy, including after Chapter 7. Depending on your credit score and financial situation, it may take some time.

Leasing companies review your credit history when deciding whether to approve your application. Seeing a recent bankruptcy may mean you face:

Higher security deposits

Higher monthly payments

Stricter approval requirements

Some people are able to lease a car soon after their Chapter 7 case is discharged. Others find it easier to wait 6–12 months while they rebuild their credit.

How Car Leases Work in Chapter 13 Bankruptcy

Chapter 13 gives you more flexibility with a car lease than Chapter 7.

If you're current on your payments and want to keep the car, you can continue making your regular lease payments directly to the leasing company.

If you're behind on payments, Chapter 13’s repayment plan may allow you to catch up over time. You can spread the past-due amount over 3–5-years while continuing your regular lease payments.

⚠️ That said, filing Chapter 13 just to keep a leased car isn't usually the best path forward, especially if the payments are high or the car isn't in great shape.

✨ If you want some personalized advice on whether Chapter 13 is a good fit for you, consider speaking with a bankruptcy attorney. Upsolve can connect you to a local lawyer for a free consultation.

Let's Summarize...

Car leases are treated differently in bankruptcy than car loans. A car loan is a debt tied to something you own, while a car lease is a contract to use a car that still belongs to someone else.

In Chapter 7 bankruptcy, if you're current on your lease payments and want to keep the car, you can usually continue with the lease. If the payments are too high or you're behind, you can give the car back and discharge any lease-related debt. In Chapter 13, you can typically roll any past-due payments into your 3–5-year payment plan.