How Do I Add a Creditor After I've Filed My Forms?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

What follows is a step by step guide on how to add a creditor after filing bankruptcy. The process for this is often very specific and differs from district to district, but there are some things that are the same across the board. If you're an Upsolve user, you can use the case editor and the self-service amendment feature to update your forms.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated November 10, 2025

Table of Contents

- How Do I Add a Creditor After I've Filed My Forms?

- Step 1: Identify the Type of Debt

- Step 2: Collect the Forms

- Step 3: Write Your Case Information on All the Forms

- Step 4: Fill Out the Rest of the Forms

- Step 5: Create the Creditor Matrix

- Step 6: Fill Out Local Forms (if Required)

- Step 7: File the Amendment Paperwork With the Court

- Let's Summarize...

You’ve filed for bankruptcy and are finally enjoying the peace that inevitably comes when the collection calls stop. Then a debt collector calls you or you receive a bill in the mail and you realize that you somehow missed a creditor in your bankruptcy forms. Don’t panic, this is not the end of the world.

Everyone makes mistakes and this one is relatively easy to fix. Yes, you’ll have to fill out some more forms, and even pay an amendment filing fee of $34, but once you’ve added the creditor you know you will be protected. If you don’t list a creditor or don’t amend your creditor schedules if you realize that you forgot to add someone, the debt you owe to the creditor may not be discharged. Looking at it that way, it’s more than worth it to go through all the necessary steps to add a creditor after filing bankruptcy.

A number of states follow a "no harm, no foul" rule when it comes to accidentally leaving out a creditor. These states generally say that if no funds are being distributed to your creditors (because your case is a no-asset case), the debt is discharged even though the creditor was not listed on the schedules. If you are not sure whether your case is a no-asset case and you can’t afford to spend $34 to pay the court filing fee for the amendment, consider speaking to a lawyer or your bankruptcy court’s self help center.

How Do I Add a Creditor After I've Filed My Forms?

What follows is a step by step guide on how to add a creditor after filing bankruptcy. The process for this is often very specific and differs from district to district. If you need to add one or more creditors after filing bankruptcy, the first thing you should do is check the Court’s website or call the clerk’s office. Chances are good that the Court that is handling your bankruptcy case has already created a how to guide that is specific to how they do things.

If you're an Upsolve user, you can update the information on your bankruptcy forms right in your my.upsolve.org account. For any questions on how to do so, please log into your account and ask our team!

Step 1: Identify the Type of Debt

The type of debt you owe the creditor you are adding determines what form you will need to fill out. There are three main types of debt:

Secured debt

Can the creditor repossess the items you purchased using this loan if you don’t make payments? That is considered a secured debt. Common examples are car loans, motorcycle loans, and mortgages.

Form to add a creditor you owe a secured debt: Official Form 106D, Schedule D

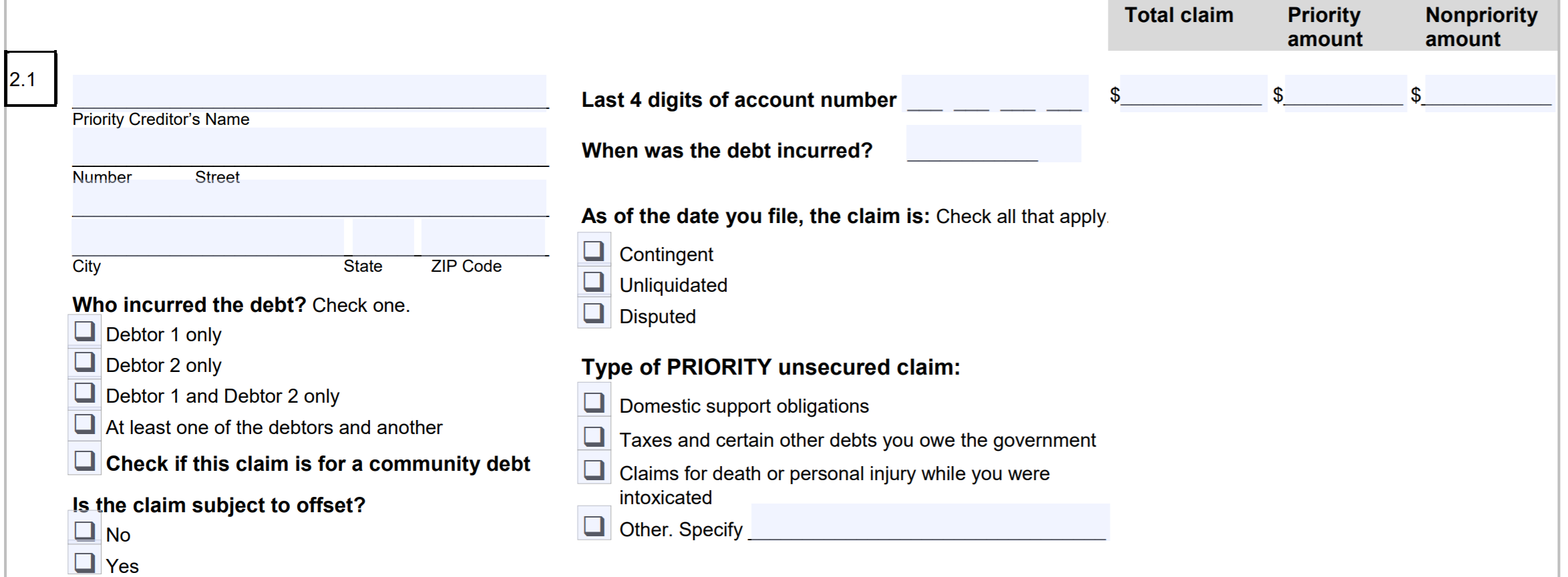

Priority debt

Is the creditor the government (federal, state, municipal) or your former spouse/partner? If so, the debt you owe them is most likely a priority debt. Common examples of priority debts are taxes, child support, and alimony.

Form to add a creditor you owe a priority debt: Official Form 106E/F, Schedule E/F - PART 1

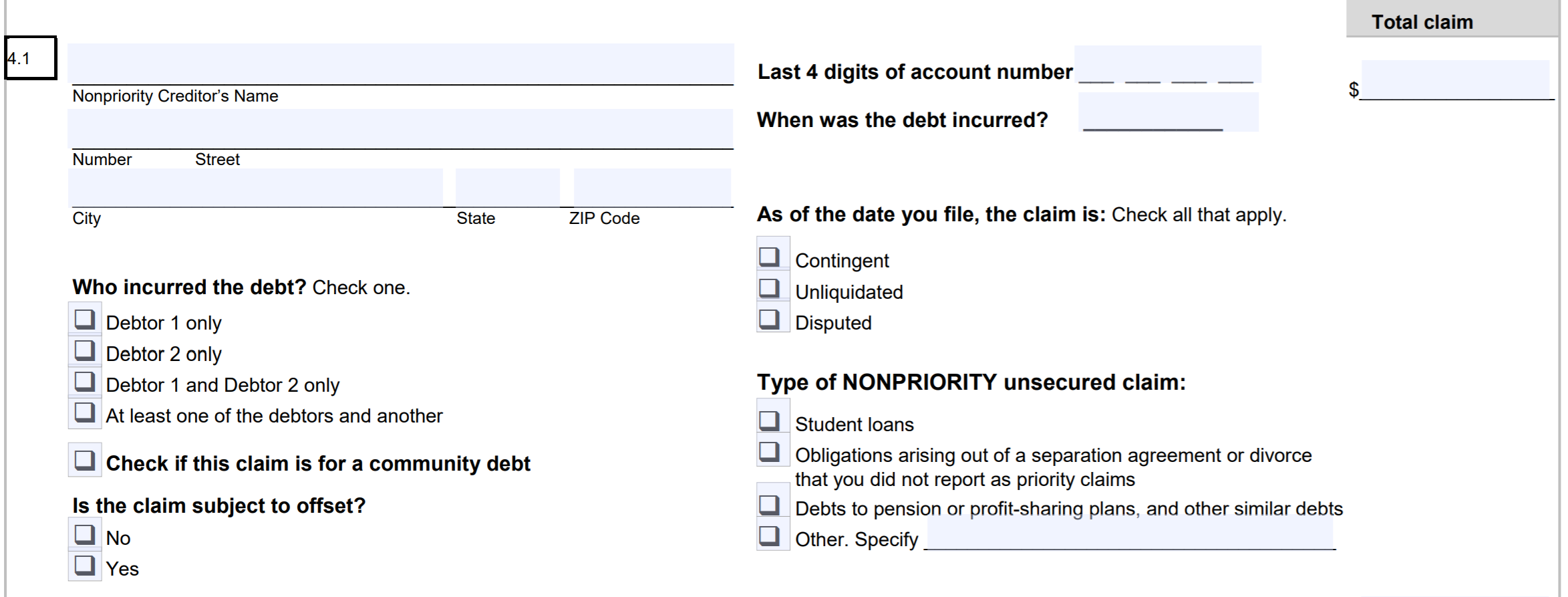

Unsecured nonpriority debt

Common examples of unsecured nonpriority debts are credit cards, student loans, medical bills, payday loans, and personal loans.

Form to add a creditor you owe a priority debt: Official Form 106E/F, Schedule E/F - PART 2

Step 2: Collect the Forms

Download each form you need and save it on your computer. All forms are fillable PDFs which means you can fill them out on your computer without special software.

In addition to Schedule D and/or Schedule E/F above, you also need:

Official Form 106sum, Summary of your Assets and Liabilities

Official Form 106dec, Declaration about an Individual’s Schedules

Any local forms the court may require. (More on that later.)

If you have a co-signer on the debt your adding, you'll also need Official Form 106H, Schedule H.

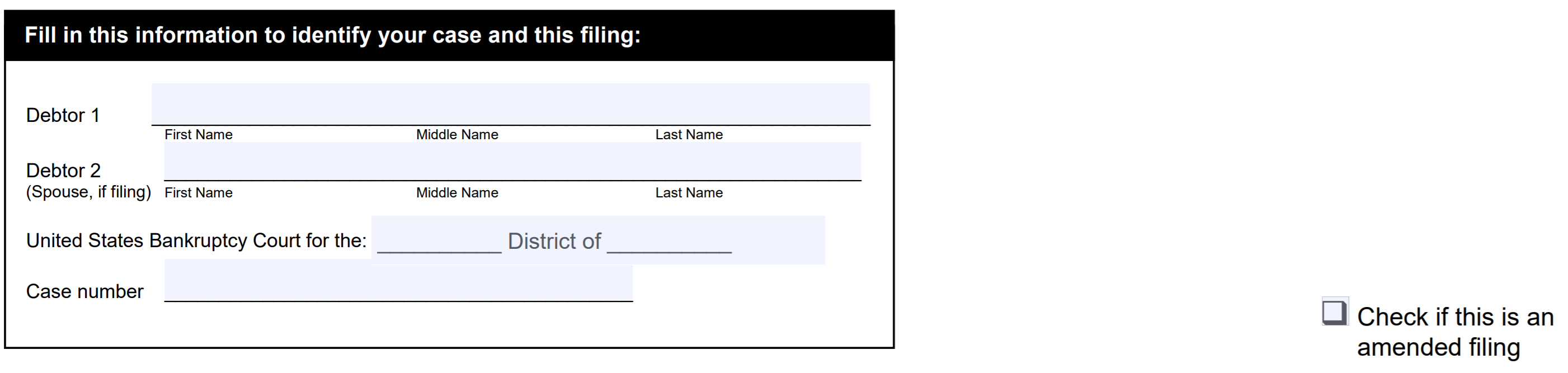

Step 3: Write Your Case Information on All the Forms

Certain information needs to be listed on every single page of each form. The first page of every form has a section that looks like this:

Since you are preparing all of these documents for an amendment, make sure to check the box in the right corner to indicate that this is an amended filing.

You will need your name, the name of the court, and your case number. If you filed jointly with your spouse, make sure you include their name as well.

You can find the name of the court and your case number on Official Form 309A, Notice of Chapter 7 Bankruptcy Case. If you can’t find that form, you can contact your local bankruptcy clerk at the courthouse to get all of your case information.

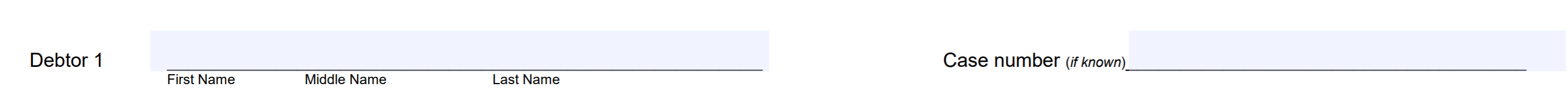

All following pages of each form have this at the very top:

If you’re using the official fillable forms, adding your information on the first page will automatically update this information on all following pages. If you’re filling everything out by hand or using non-fillable forms, you’ll have to make sure to add this information on every page.

Step 4: Fill Out the Rest of the Forms

Again, this steps varies a bit by debt type. Read the relevant section below for the debt you're adding to the amended paperwork.

Adding a Priority Debt on Schedule E/F

Check “yes” in response to Question 1 in Part 1.

Add the creditor in line 2.1

If you ‘re not sure how much of the claim is priority vs. nonpriority, it’s ok to only put a total claim amount.

Check the boxes as applicable.

Adding an Unsecured Nonpriority Debt on Schedule E/F

Check “no” in response to Question 1 in Part 1 and go to Part 2, which starts on page 3

Check “yes” in response to Question 3

Add creditor in line 4.1. It’s important to list the creditor’s correct address and if you have it, the last four digits of the account number.

If you don’t know the account number, it’s ok to put “unknown”

List the amount of the debt under “total claim”.

Check the boxes as applicable.

Update the Total on Schedule E/F

Once you’ve added the debts you’re adding as outlined above, make sure to update the totals in part 4, Question 6. Only include the amounts listed in the amendment you’re filing.

If You Have a Co-signer on the Debt, Update Schedule H

If you are the only one responsible to pay the debt you’re adding, skip this part. Otherwise:

Check “yes” in response to Question 1

Copy response to Question 2 from your original Schedule H you submitted to the Court before

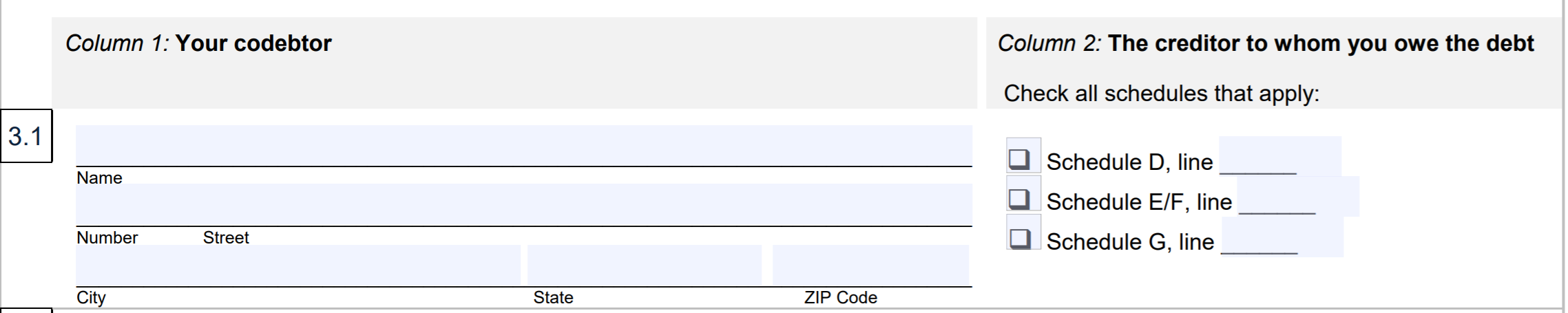

Add the co-debtor’s information in response to Question 3.1.

Add the name and address of your co-signer, or co-debtor, in Column 1 and identify the Schedule and Line the co-debtor is attached to.

If you’re adding only one unsecured creditor, you will check the box for “Schedule E/F” and list the number line the creditor appears on next to the word "line." It’ll look something like this by the time you’re done:

Summary & Signature Pages

The summary sheet will act as a cover sheet for your amended schedules, so the Court gets a complete picture of your updated information.

Start by pulling the original summary sheet you submitted to the Court.

Answer Question 1 by copying information from the original summary.

Complete Part 2 by increasing the amount shown in the original summary based on your amendment.

Example: Your original summary sheet shows a total of $23,450 in response to Question 3 and your amended Schedule E/F adds a new debt of $2,000. Your response to Question 3 in the amended summary will be $25,450 ($23,450 + $2,000)

Answer Questions 4–8 by copying information from the original summary

Answer Question 9 by increasing the amount shown in the original summary based on your amendment.

Finally, don’t forget to complete, print, and sign the signature sheet as that has to be submitted along with your amended Schedule(s).

Step 5: Create the Creditor Matrix

The creditor matrix is the document that lists all of your creditors addresses in the style of a mailing label. It is used by the court to create the documents to mail to all of your creditors whenever they need to be notified about something happening in your case. Since that is done differently in most courts, the court that is handling your bankruptcy case has probably come up with a way to create this list that works best for their system.

In light of that, be sure to check out the court’s website or call the clerk’s office.

Explain that you are trying to find out where to find information about creating and filing a creditor matrix for an amendment to your Schedule E/F. Make sure to follow the instructions carefully. The clerk may not accept your filing if you don’t meet their specific requirements.

If you need to learn how to create a .txt file for the Court, check out this how to guide.

Finally, since the creditor matrix itself isn’t signed, you will also have to prepare a verification of the creditor matrix. You can use the same form that you prepared for this purpose when first filing your bankruptcy case but make sure you add your case number, and either check a box or otherwise indicate that this is for an amendment to your creditor matrix.

Step 6: Fill Out Local Forms (if Required)

Some districts have created a cover sheet, certificate of service, or other supplemental form to be filed with the court when adding a creditor after filing bankruptcy. Check the court’s website or call the clerk’s office to find out what local forms you will need to amend your Schedule E/F.

In some cases it may make sense to complete this step at the courthouse while you’re filing your amendment but the best practice is always to bring all the forms you need. Since this varies from district to district, make sure to follow the instructions from your court.

Step 7: File the Amendment Paperwork With the Court

Go to the courthouse or send your amended schedules in via U.S. mail to file your amendment. There is a $34 filing fee for amending creditor schedules. The fee is the same even if you add more than one creditor.

Not all bankruptcy courts accept cash, so if you plan on using cash to pay the court filing fee, make sure to check whether that’s allowed by calling ahead. If you’re mailing in your amendment, don’t send cash. Instead, include a cashier’s check or money order and be sure to write your name and case number in the memo field.

Let's Summarize...

In short, while you should do your best to make sure that all of your creditors are listed on your Schedules D and E/F and part of the creditors’ matrix before you file for bankruptcy, it’s not a complete disaster if you realize you missed someone. No one is perfect and as long as you take the proper steps to correct the error, everything will be fine. Finally, depending on your district, if your trustee is not distributing funds to your creditors, the unlisted debt may be discharged even though they didn’t get notice of your case.