What are the advantages of filing bankruptcy?

5 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

Bankruptcy can do wonderful things for you and while many bankruptcies have some risk, others are so simple that you can file without having to pay for an attorney. Continue reading to learn more about the advantages of filing bankruptcy.

Written by Lawyer John Coble.

Updated July 28, 2023

Table of Contents

Bankruptcy is the most powerful debt relief tool available. Say you have $30,000.00 in credit card debt. In most cases, if you file a Chapter 7 bankruptcy, this debt is eliminated without having to pay or give up anything. It's as though you won $30,000.00 in the lottery and used the proceeds to pay off your debt because the debt in this example is gone forever. By law, you no longer owe the debt. Of course, it isn't this simple, but from your perspective, it will seem that it's that simple, especially if you have a bankruptcy lawyer or a legal aid nonprofit like Upsolve helping you through the process.

For consumers, you have a choice of two types of bankruptcy: Chapter 7 bankruptcy or Chapter 13 bankruptcy. Whichever type of bankruptcy you choose, the instant you file bankruptcy the automatic stay requires that all collection activity against you stop. After filing, there can be no repossessions, wage garnishments, lawsuits, foreclosures or even phone calls from creditors without special permission from the bankruptcy court.

Chapter 7 Bankruptcies

In the real world, very few people lose anything when they file a Chapter 7 bankruptcy. In theory, a Chapter 7 bankruptcy involves a bankruptcy trustee taking and selling certain property to raise money to pay your creditors. Now, if this were what happened, few people would be filing Chapter 7 bankruptcies. The trustee is only interested in property you own free and clear with a value greater than the amount of the available exemption. If you have equity in an asset you don’t owe free and clear - like a car with a car loan - the trustee will only be interested if the amount of your equity is greater than the exemption limit. The exemptions you have available depend upon your state’s law and how long you’ve lived there.

See the example below for how a bankruptcy trustee determines whether to take and sell one of your assets in a Chapter 7 bankruptcy:

Example-1

This example presumes you’re in a state where the exemptions mentioned above are available. In this case, you have $500.00 of non-exempt equity. Will the trustee sell a piece of jewelry to raise this money to pay the unsecured debts? It’s possible, but in most jurisdictions, it’s not likely unless there is some non-exempt cash coming to the trustee in the form of a tax refund. Such low non-exempt equity won’t be worth the trustee’s time, especially since the cost of the sale would come out of the non-exempt equity, not leaving enough for a meaningful distribution to creditors.

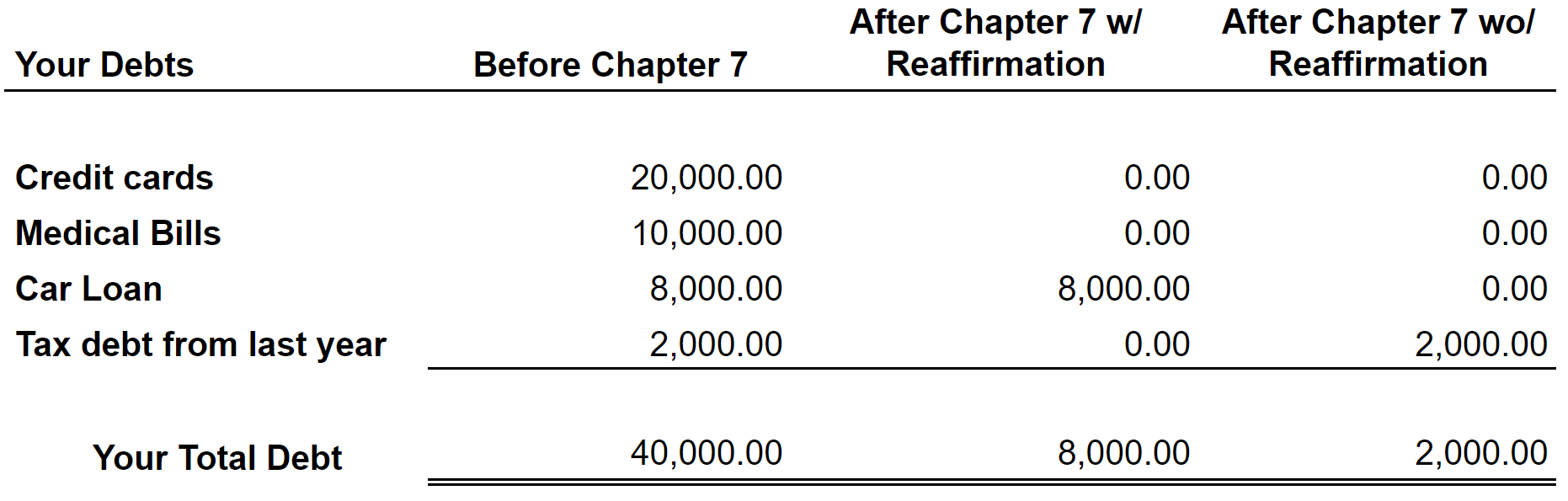

In the same case, say you have the following debts:

Example-2

A reaffirmation is an agreement with a secured creditor to remove your debt to that creditor from the Chapter 7 bankruptcy. Usually, you only want to do a reaffirmation with a secured creditor. If you don’t reaffirm with a secured creditor, you will have to surrender the collateral to them. In the example above, that collateral is your car.

In Example-1 above, had the trustee sold the jewelry for $500.00, the $500.00 would only go to pay the past-due taxes. These particular taxes are priority debts. Since priority unsecured debts must be fully paid before any money can be distributed to the general unsecured creditors, the credit card companies and medical bills are paid nothing. All of the general unsecured debts are still discharged and you now owe only $1,500.00 in back taxes after bankruptcy instead of the full $2,000.00. Had the jewelry been sold for a profit of $2,001.00 instead of $500.00, the credit card companies and medical creditors would split $1.00 between them.

In cases where you might lose assets to the trustee or to a secured creditor, you can file a Chapter 13 bankruptcy. In a Chapter 13 bankruptcy, the bankruptcy court combines most of your debts into one monthly payment. These repayment plans last from 36 to 60 months. As a general rule, a Chapter 7 bankruptcy lasts three to four months and there is no repayment plan. Chapter 13 bankruptcies can also be useful to eliminate types of debt that would be nondischargeable in a Chapter 7 bankruptcy. Chapter 13 bankruptcies can change the terms on secured debts such as car loans. If you’re behind on long-term secured debts such as mortgages a Chapter 13 plan can catch up these past-due payments.

There are times when Chapter 13 bankruptcies are the best choice. Be forewarned, that three to five years is a long time. There are techniques that a skilled bankruptcy attorney can use to keep your Chapter 13 on track. It’s a good idea when choosing a bankruptcy lawyer to file a Chapter 13 for you, that you ask what percentage of their cases are actually discharged.

Important Considerations when deciding between Chapter 7 and Chapter 13 bankruptcy

When choosing which chapter of bankruptcy you’re going to file under, your default choice should be a Chapter 7, unless a lawyer can give you a good reason to file a Chapter 13. Each chapter has its own advantages and disadvantages.

With a Chapter 7 bankruptcy, many of your debts are eliminated in as little as 3 - 4 months. Major exceptions include secured debts where the collateral isn’t surrendered, some tax debts, and student loans.

While filing a Chapter 7 bankruptcy will harm your credit score in the short run, in less than two years, most people have a higher credit score than they did the day before they filed. You can’t rebuild your credit when you’re overwhelmed with debt. By eliminating your debt, your financial position improves. This makes it possible for you to improve your credit score.

A Chapter 13 bankruptcy can eliminate debts that a Chapter 7 bankruptcy can’t. In the case of short term secured debts such as high-interest car loans, a Chapter 13 plan can usually reduce the interest rate. In some cases, the loan balance can be reduced by the court.

Upsolve Member Experiences

2,099+ Members OnlineSome Disadvantages of Filing Bankruptcy

There are a few cons to filing bankruptcy. You could be in the rare situation where you have too much nonexempt property you could lose in a Chapter 7 bankruptcy, but insufficient income to make the payments in a Chapter 13 bankruptcy to be able to keep the items. If a Chapter 7 bankruptcy will eliminate all your debts, you may choose to give up your nonexempt property in exchange for a clean slate.

Consider Example-1 and Example-2 above. If you owned the property listed in Example-1 and owed the debts listed in Example-2, plus you own a house that you can fully exempt in your state and there is another car with $5,000.00 of nonexempt equity in it. You would be losing $5,000.00 worth of property in exchange for $32,000.00 of debt elimination and payment in full of your otherwise non-dischargeable tax debt. That’s the equivalent of paying $5.00 to get $32.00 in return. That’s a 640% return on investment. It takes lucky people years to do that well in the stock market but a Chapter 7 bankruptcy can achieve this in just three to four months.

Regardless of the chapter of bankruptcy you choose, by law, the credit reporting agency can put a notation that you have filed bankruptcy for up to ten years. Except for bankruptcies, negative items on a credit report can only remain for seven years. While a Chapter 7 bankruptcy does stay on your credit report for the full ten years, the good news is that all three credit bureaus only keep notation of a Chapter 13 bankruptcy on your credit report for seven years. The idea is that with a Chapter 13 bankruptcy, at least you tried to pay some of the debts. The date the clock starts running is the filing date of your bankruptcy. In a five year Chapter 13 plan, this means the bankruptcy notation will drop from your credit report two years after the bankruptcy discharge. The fact that the notation is on your credit report doesn’t stop your credit score from improving immediately after the initial down-score that accompanies the bankruptcy filing.

Conclusion

Bankruptcy can do wonderful things for you and while many bankruptcies have some risk, others are so simple that you can file without having to pay for an attorney. Upsolve screens cases to determine if you’re eligible to file your own bankruptcy with our help. If so, Upsolve has an online tool to help you prepare your bankruptcy forms for free.